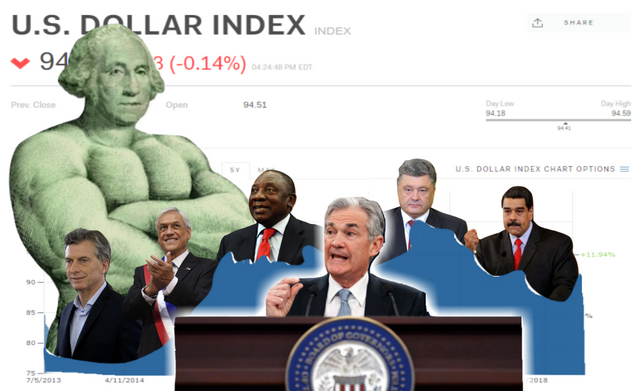

A new EM debt crisis has already started. The U.S. looks like the most desirable destination for hot money right now because of interest rate differentials. And that is having far-reaching consequences on EM economies. The dollar is up 12.5% in the past four years on the Fed’s index, and that’s bad news for emerging-markets (EM) debtors who borrowed in dollars and now have to dig into dwindling foreign exchange reserves to pay back debts that are much more onerous because of the dollar’s strength.

To find out more about the meltdown in Emerging Markets watch the full video below: