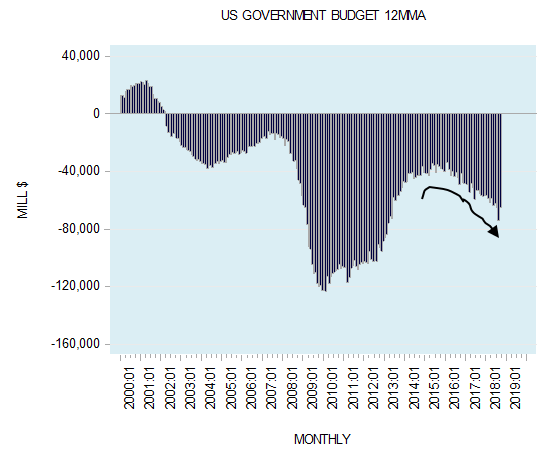

Accordingly, to the United States Department of the Treasury data released October 15, 2018, the federal budget deficit increased in the fiscal year of 2018 by 17% to $779 billion.

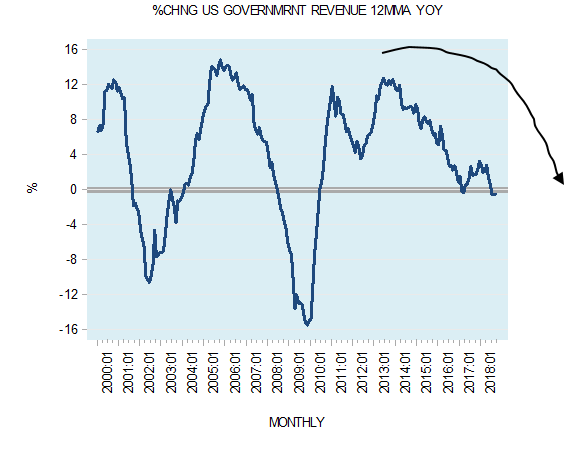

The US lowered its corporate tax rate from 35 percent to 21 percent and reduced the income tax from 39.6 percent to 33 percent. These tax cuts took effect in January of 2018. Experts see these tax cuts as a reason for the increase in the deficit. The 12-month moving average of the deficit is $64.9 billion in September of 2018 versus $55.5 billion a year ago, and the chart below shows how the budget deficit widens.

The increase in the budget deficit during times of economic growth can be terrible news once the recession appears. Experts claim that tax cuts will lower the budget deficit because it will boost economic growth, which will lead to better government revenues.

The issue should be the size of the government and its outlays. How are we going to lower taxes while we have a big government which is not willing to reduce its outlays? The government is not generating prosperity and wealth. It needs to tax the private sector to fund its activities. The government can only pay its employees by taking resources from the wealth-generating private sector. Through excessive taxation of businesses and employees, the government undermines genuine economic growth.

The private sector has to fund every government plan or any investment, and by doing it, the real wealth is allocated to government activities. If the private sector infrastructure is not able to handle too many governments actions, then it puts too much pressure on the pool of real wealth. It leads to the weakening of economic growth.

The solution to support economic growth is to have lower taxes accompanied by the lowering of government outlays. The US government lowered its corporate tax rate and reduced the income tax? The ideal solution is to abolish the income tax altogether and to make the government small.

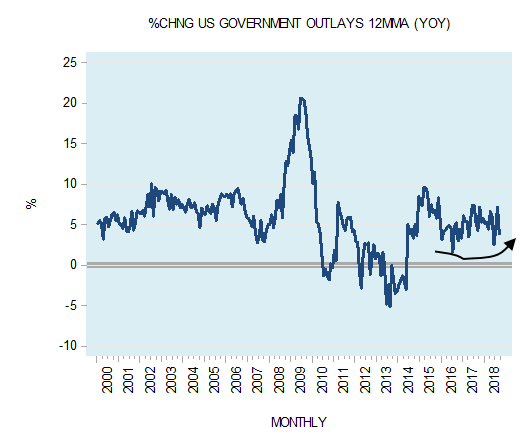

We will see the impact of tax cuts in 2019 as Americans in 2018 were filing tax returns for 2017. The chart below is not indicating that the Trump administration plans to curb government spending. A deficit means that the State promises to tax in the future. The government spending expansion acts like a black hole which sucks in wealth and prosperity.