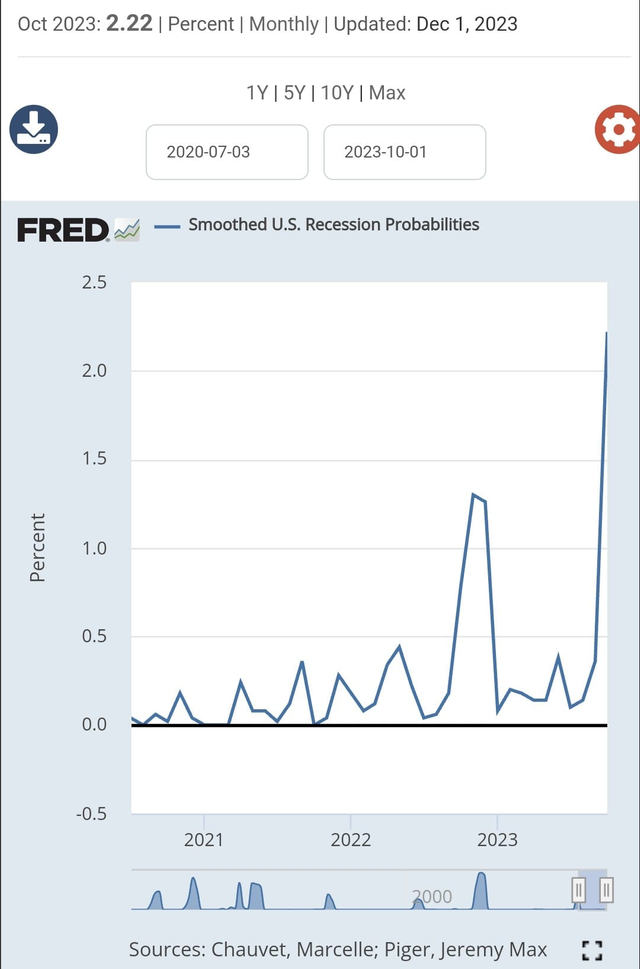

The probability we were in a recession in October was 2.22%. Highest point in recent months, though far below what would generally precede a recession historically.

This model has a fairly decent track record. Generally speaking after three months of a probability of 80+% a recession has started. It doesn't really have a high false positive rate once the probability gets above ~10%. We haven't gotten close to that at any point in the last year.

This model specifically creates a probability we are in a recession using four monthly coincident economic indicators: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. These are four of the six indicators that the NBER uses to determine if we are in a recession. They've generally been pretty good which is why this probability is so low.