Content adapted from this Zerohedge.com article : Source

Is the United States economy slowing?

Many statistics still point to an accelerating economy. One barometer, the yield curve, is showing something else.

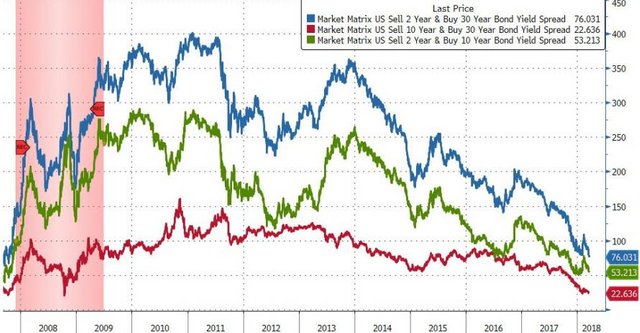

Of late, the curve is flattening out. This happens when long-term rates falls while short-term rates gain. Many use this as an indicator of the economy in general. When the yield curve is steepening, the economy is accelerating and the opposite is true when the cruve flattens out.

This is a problem for many industries because it is said to reflect the sentiment of bond holders. A drop in long-term interest rates means that investors are less bullish about outlook of the economy. Threats of receession and inflation can enter into the minds of these investors.

As a historic indicator, the yield curve tends to "predict" recessions. It also rarely gives a false flag. The time from warning to recession can take years so the value is in the prediction, not the timing.

Authored by John Rubino via DollarCollapse.com,

For a while there it looked like the blow-off top of this expansion was somewhere in the future. Now it's starting to look like 2017 was as good as it's going to get – with serious implications for stocks, bonds and real estate.

At least that's what interest rates now seem to imply. From today's Wall Street Journal:

A bond market barometer that briefly suggested growth was perking up has reversed course.

The so-called yield curve, typically calculated by measuring the differential between short- and long-term Treasury yields, has been flattening in the last few weeks. Long-term yields have fallen in response to tempered expectations for growth and inflation, even as short-term rates extend their months-long rise.

The differential between the two-year yield and 10-year yield on Thursday shrank to 0.54 percentage point, the smallest since Jan. 26, coincidentally the day of the S&P 500′s last record high, Tradeweb data show. That was near its January low, which had been the lowest in a decade.

>

The yield curve flattened this week as long-term yields fell after a slew of lackluster economic data. Retail sales slipped 0.1% in February, their third straight monthly decline, data showed Wednesday. And data on consumer and business prices showed inflation pressures remain modest.

Investors watch the yield curve because it can signal that the economy is speeding up when it steepens. It can show the opposite when it flattens. And when short-term Treasurys yield more than their long-term counterparts, it signals that a recession is coming.

The yield curve also influences portions of the stock market — lifting banks and financial firms when it steepens and pushing up utilities when it flattens. On Wednesday as the curve flattened, the S&P 500 utilities sectors outperformed the benchmark, while the financial sector underperformed.

Rising yields this year had made the yield curve steeper throughout parts of the winter, but recent economic data has dampened those expectations. At the beginning of this month, the Federal Reserve Bank of Atlanta's real-time GDP tracker projected the U.S. growing at a 3.5% annual pace in the first three months of the year, but by Wednesday, it had fallen to 1.9%.

Though some have recently questioned the curve's forecasting power, many say it still offers a reliable signal. "Periods with an inverted yield curve are reliably followed by economic slowdowns and almost always by a recession," said Federal Reserve Bank of San Francisco economists, in a research note earlier this month.

Definitively an ominous trend, this, and one that's consistent with a long-in-the-tooth expansion like today's. But nothing in this hyper-complicated world is ever simple, so before assuming that a recession is neigh, be sure to note that US home prices jumped 9% in February, import prices rose more than expected, and labor markets continue to tighten. And who knows what the nascent trade war will evolve into.

The take-away? There are even more than the usual number of moving parts to consider this time around. Which means _the party can end suddenly via some kind of discreet inflation/geopolitics/stock crash event or very slowly via an accumulation of Fed rate hikes, moderating growth, and rising trade barriers. _Either way, "messy" is likely to be 2018's dominant theme.

Non-adapted content found at zerohedge.com: Source

The yield curve in my view is showing the true state of the economy. The flattening curve needs no further elaboration with long-term yields falling in response to tempered expectations for growth and inflation, even as short-term rates extend their months-long rise. This flattening curve should be cause for fear of a curve inversion. At the moment their are slow growth expectations, the monetary policies are tighter.. This surely is a sign of an economic recession in the future. We shall be soon witnessing a slow economic growth if the Federal reserve doesn't get cautious about raising the policy rate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for the updates

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The weakening dollar may well push Treasury yields higher. That means higher interest rates. The Feds also recently mentioned they will take measures to avoid yield curve inversion, I say good luck. Here comes another QE. Yes, the yield curve is in trouble as well. The yield curve is now the flattest since late 2007, with the flattenig accelerating. The problems usually begin after the yield curve inverts, but we're not there yet. Inverted yield curve, means a pilot fish for stagnation. Some say it may happen as early as this March or April of 2018. I personally think we will have to wait for collapse another two years or so, but we shell see. Sure, inversion could be on the way. However, I dont need that to tell myself which way the wind is blowing, or should I say, which way the hurricane is heading.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes it is sure the more steemit becomes known to people more popularity it gains because it self-employs everyone. I think this year of 2018 this steemit will gain more than million users.it is really cool here ,you post about what you like and people with same interest keep in touch with you ....a persons gets a lot of knowledge..

Yup sure i will add up @zer0hedge in steemauto ...i already registered there....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Man I never even heard of Ben Swann before this video, probably because when I was getting really into cryptocurrencies he had already gone dark. But this was an awesome video from him and I need to follow his work now!! I loved how he kept things so short and simple. Most cryptocurrency related videos that are decent enough are like 20-30 minutes long and you don't always have the time to watch them. But Ben looks just like the guy we need on a busy schedule!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Trump and this tariff thing makes investors uneasy and so that will scare some of them. And Theresa May trying to start a war with Russia would not be great for business. Be scared when others are greedy and be greedy when others are scared. The fundamentals of the economy are still good.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

a wonderful project. You are doing a great work. This project is really great.

Its always good to know that someone is trying hard to make Steemit a better & beautiful place.

I will upvote & resteem this post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is awesome I love that new popular Youtubers coming on the platform are getting such great support. I'm worried though that this will overshadow talented people already on the platform that have been here and helping build the community on this platform.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

well economy information i like this keep it up.... thanks for shareing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Looking only for this indicator and this graphs it doesn't look right, but it means what it means, not much actually, mere speculation, I must say.

We need to watch and consider the global context and what is happening with all the economies around the world, because globalization made this planet much "smaller" and it means that if there is a recession to come it will affect the entire world, so if the US´s economy is slowing down it doesn't mean all the world will slowdown, probably they will try to compensate...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit