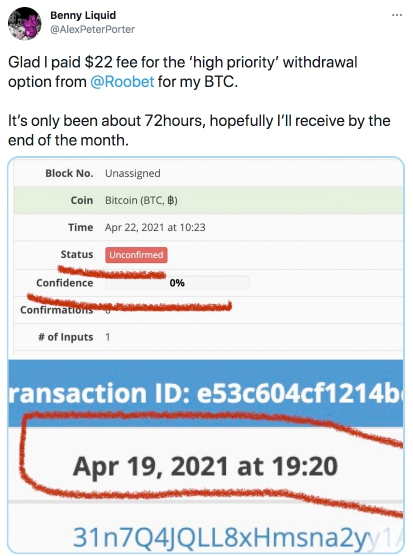

Bitcoin transaction fees totaled $62 at the end of April, setting up a new record in history. In early April, the cost of one transaction reached $15- $16, while the previous fee maximum of ~$55 per transaction was observed only in December 2017.

Since the bitcoin network uses a proof of work algorithm, bitcoin users need to pay commissions to miners to confirm transactions. The higher the commission, the faster miners are interested in processing your transaction and including it in a block.

The user is faced with a problem, whether to pay a small fee and wait for the operation to be carried out within a few hours, or even days, or pay a high fee (sometimes exceeding the transfer amount) so that the miners can process it faster.

What is Proof of Work for?

When Satoshi Nakamoto created Bitcoin, he needed to find a way to confirm transactions without resorting to third-party in order to maintain decentralization. Proof of work turned out to be the model thanks to which the blockchain can reach consensus, only valid transactions are confirmed, and fraudulent activity is excluded, such as spending the same funds twice.

However, when using PoW, the system needs a significant amount of electricity, while there is a limit on the number of transactions that it can process simultaneously. When you send a transaction with bitcoins, it takes the network from 10 minutes (up to several days during the high workload) to confirm it. Only about 7 transactions can be processed per second.

For example, if you transferred funds in the amount of $20 this month, then the fee that had to be paid to miners additionally would be from $15 to $62, depending on the network workload. Not everyone can afford to pay commissions from 75% of the transfer amount.

Is there an alternative?

The decentralized EDC Blockchain platform uses another consensus mechanism – delegated proof of stake. PoS solves the scalability problem. Because each block is confirmed without the need for large electricity amounts, growing computing power and other resources, all transactions are executed quickly at every stage of the network evolution, without paying expensive fees.

How it’s occured in EDC Blockchain:

Block confirmation speed: ~2.5 seconds

Transaction sending/receiving speed: up to 5 seconds

Fee: up to 0,75%, upon reaching Rank 3, the commission is 0%

That is, if you made a transfer in the amount of $20 in EDC coins to a friend, the fee would be only 15 cents, which is significantly lower than in the Bitcoin network. Since there are no miners in the EDC Blockchain PoS network that process transactions in turn, depending on the commission, you can be sure that your friend receives funds within ~5 seconds regardless of the fee and network workload.

In PoS networks, the function of processing transactions is performed by validators. You can read about how to become an EDC Blockchain validator and earn additional rewards in this article.

Why PoS?

The idea behind using the Proof of Stake mechanism in the EDC Blockchain system is that validators maintain security by playing by the rules. If the validator breaks the rules, for example, tries to hack the network or process questionable transactions, they will lose their reward and will be excluded from the Witness Account Committee.

In the EDC Blockchain PoS system, every user who does not have expensive powerful equipment can participate in the consensus and receive a reward. You can contribute to the maintenance of the network by staking your coins and receiving a reward proportional to the amount you sent. In PoW systems, only those who purchase powerful hardware equipment like the Asic are more likely to receive mining rewards.

With a PoS solution, you don't have to pay large amounts of electricity to confirm transactions. You can install your node on a computer that does not consume a lot of electricity, compared to mining equipment.

PoS is more resistant to the well-known 51% attack. To carry out a 51% attack on the EDC Blockchain system, a hacker would need at least 51% of the total volume of coins in circulation. If a hacker buys this amount, the value of the coin will increase significantly, and as a result, they will spend more money on the purchase than they will receive from the attack. If a breach was found, they would also lose all of their earned rewards.

Since the threshold for entry is very low (only 300 EDC coins), any user with this amount or more on their balance can participate in staking, receiving rewards every day.

If you are new to the EDC Blockchain community, you can set up the free EDC Wallet here. For all questions, please contact our technical support specialists here or write to us in the Telegram chat.

via HTTP://BLOCKCHAIN.MN

Our Official channels and groups:

Facebook | Twitter | Telegram | Instagram | LinkedIn | YouTube

#edcblockchain #cryptocurrency #global_platform #graphene #lpos #coin_constructor #masternode #leasing #edc #edccoin #edcmining