Elliot Wave

)

)

At times the cryptocurrency market will take big swings up and down so its definitely not for the weak hearted. You will see the market go up just as fast as it goes down, but you have to remember the big picture. This is an investment that will benefit society and its in its beginning stages. Its normal to have this volatility because its still only a small percentage of investors that can influence heavily. The first time I experienced a euphoric feeling with crypto I thought I was going to be wealthy beyond my dreams. I had woken up to my account and I had tripled what I had invested into it. I imagined the possibilities of becoming a billionaire and I was already thinking of ways to diversify my money into other streams of income, but real life came at me like a 90 mile and hour baseball hitting me flat on my face.

I was losing money so fast too rapidly that I had no idea how to react. I kept thinking the market would stabilize, but the money was going down so fast that I literally froze. My head was trying to capture why the market was dropping, my stomach kept churning every time it dropped a new low, and my heart kept telling me to hold. I was completely useless because I failed to have an exit strategy. It taught me one of the biggest life lessons to this day. Emotions lead to irrational decisions all the time!

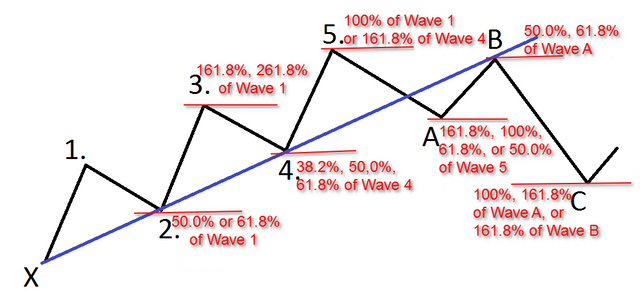

If I looked at the big picture I would have known my entry points and exit points. I researched a bit on how the market tends to move with different waves and I stumbled upon the Elliot Wave Theory. The Elliott Wave Principle is a form of technical analysis that traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s.

The Elliott Wave Theory is interpreted as follows: Every action is followed by a reaction. Five waves move in the direction of the main trend followed by three corrective waves (a 5-3 move). A 5-3 move completes a cycle.The stock or currency will be steady at one point, investors at this point are just holding the coin in hopes that big news will cause it to go up. Usually the first wave will be the smallest wave, this will cause the coin to have some visibility and start having some "hope" for the coin. This would be the first impulse wave.

After the first wave when the currency starts to drop in value the bulk of investors will have already have the feeling of hope and start putting into that coin at a very fast rate when it reaches a good entry point, this financial frenzy then becomes what all investors want, euphoria. This is the second wave and perhaps the most exciting because it will give the biggest profit margins. This wave is where people tend to become so excited that they might forget or not plan out exit points, but you have to remember that big increases are followed by big falls. When you start to experience this feeling it is when most investors will sell because the people who have a sound judgement will take their profits and leave. This would be impulse wave 3.

Some investors put in money at its highest point and are now panicking to recover their money so it leads to a third wave. The third wave will usually come back up really quickly, but most of the time it will not come back up to its 24 hour high. This is perhaps the best indicator if your using this principle to leave before its too late. This is impulse wave 5.

After third wave the currency will continue to drop in value, it will hold in certain points on the way down but most people will be selling off slowly. This is where I lost most of my money, it was until the currency finally stabilized on the 1 day graph that it finally starting to regain confidence again. This would be 8 wave cycle trend down until it stabilizes.

earning this principle has helped me make better decisions and its something that I think is very useful in stocks or currencies. Human emotions are part of the market and its beneficial to you and your investments to think about how other investors feel at certain times in critical moments. At times big news will have a huge influence and will either make investors panic or become very greedy. So remember, use sound judgement and do not let your emotions get to you, you should know at all times the moments to sell and moments to buy.