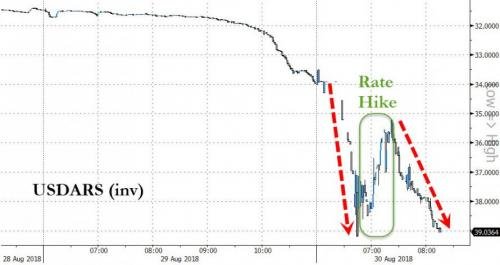

- Argentine Peso Crashes Back To Record Low – Emergency 1500bp Rate-Hike Fails

by Tyler Durden, https://www.zerohedge.com/

Update 2: Well that’s not supposed to happen!! The peso has just collapsed back to its record lows…

–

Update 1: Having met pre-market, it appears the Argentina Central Bank (CBRA) decided that if things got worse they would ’emergency hike’ rates. And as the peso collapsed to 39/USD, they have just raised the key 7-day leliq rate to 60% (a 1500bp hike)! The rate was last hiked from 40% to 45% on Aug 13th. They also confirmed there will no rate cuts until December.

–

read more.

– - Rand Tumbles As Government Warns Of “Catastrophe” Unless ‘Land Reform’ Allowed

In a barrage of headlines that sparked chaos in FX algo markets, The South African government proclaimed proudly that it is opposed to illegal land grabs (sparking a rally in the rand) before humans realized that this is mere statement of fact and that the entire reason for this process is to ‘legalize’ land grabs through reform.

–

read more.

– - Lira Plummets After Turkish Central Bank Deputy Governor Quits

It was already an ugly day for the Turkish Lira, which earlier in the day accelerated its drop for the 4th consecutive session, sending the USDTRY to the highest level since August 14 when the currency crashed over the weekend to the lowest level on record.

–

Today’s drop was initially precipitated after Erdogan said on Thursday that Turkey “is not without alternatives” and warning that it won’t “back down over threats.”

–

In his latest attack on the US, Erdogan said that “some do not hesitate openly stating the fact that they are trying to drive us into a corner through the economy. There are surely structural issues in the Turkish economy. We know these issues and are working to fix them.”

–

Alas, as we noted earlier, judging by the plunge in the lira, the market did not seem convinced by Erdogan’s latest rant, and proceeded to slide further after closing last night down 3.0% at 6.469 which was weaker than where it was on the Friday 3 weeks ago (6.4323) when the panic spread across the market. The only softer closing level was on the following Monday (6.884) but that actually included a big intra-day rally back from the Asian wides. Yesterday was the third day in a row the Lira has weakened (post domestic holidays) while Turkey’s 5yr CDS was also +14.4bps wider and touched 500bps again (recent high was 535.0 on Aug 13).

–

read more.

– - Brazil Central Bank Intervenes As Real Crashes Near Record Lows

The bloodbath in Argentina and Turkey is evident in Brazil also where Bloomberg reports that the central bank just intervened for the first time since June 22.

–

BCB reportedly intervened at 4.20 “to provide liquidity” adding that intervention intensity and frequency will depend on the market. The BCB also attempted to provide some confidence by reaffirming that monetary policy is not directly linked to recent market shocks.

–

read more.

end

https://socioecohistory.wordpress.com/2018/08/31/emerging-markets-currencies-bloodbath-continues/

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit