Foreword: Everyone knows that Augur is a forecasting market agreement built on the Ethernet workshop, but from the user's point of view, how does it work? This article has a detailed introduction, of course, to understand more in-depth, no better than practice. The author is Paul Fletcher-Hill. The original article is entitled "Augur's Guide to Market Economics", translated by "Li Xihe" of the Blue Fox Notebook community.

New Veil users often ask us how predicted payments on Veil and Agur work. In this article, we will introduce these key concepts to new traders in detail. We will introduce Augur's market structure, result share, dual market repayment, pure market repayment, and how to trade them on Veil.

Before we formally start, we will briefly introduce that Augur is a forecasting market agreement based on ETF. Veil则是Augur上的一个交易平台。 Veil has its own market order book and uses Augur to represent the market and settle accounts.

Augur Market and Result Share

Augur supports a variety of markets, but today we mainly introduce two kinds: binary market and pure market. Then we will talk about their differences. First, let's look at how the market is implemented on the Augur protocol. Augur has two important primitives: market and result share.

Every Augur market has a problem (for example, will GRIN/USD be included in CoinMarketCap? Or will Rome win the 91st Oscar for Best Picture? And the due date. Each forecasting market is implemented as its own ETF smart contract, which holds Ether as collateral for the market.

There are also two results shares in the market, representing clear answers to market questions in the form of ERC-20 tokens (e.g., bullish or bearish). "Bullish" and "bearish" are common. They can refer to a lot of things based on the market, but you can usually see this as follows:

· Rising: refers to the appreciation of "positive" or underlying assets

· Empty: denying "negative" or depreciation of underlying assets

Complete share of results

The first rule to keep in mind is that the value of any complete share is 1 eth (that is to say, one unit is bullish and one unit is bearish in the market). Anyone can (1) create a complete share by mortgage an ether, or (2) sell a complete share in the Augur market to get the equivalent of an ether's money.

The result share has this attribute because a complete share represents a neutral portfolio in the market - regardless of the final outcome, the value of a complete share will eventually be equal to 1 ETH.

Market Resolution and Payment

When the predicted market expires, the value of the two result shares will be liquidated. Market-designated reporters first set the final settlement by Augur's predictor system, but in this article we will skip the resolution process. Importantly, all funds managed in market contracts are allocated between the two share of results. Nevertheless, any complete result share average is an ether. But the proportion of 1 ETH per share of results is determined by the market.

Two yuan market

Dual markets, sometimes referred to as "yes/no" markets, are the easiest to understand because they are very similar to betting. Here are two examples of binary markets: will GRIN/USD be included in Coin MarketCap on March 16, 2019? Or will Coinbase offload the ETC at the end of 2019? Every dualistic market has a share of bullish (or yes) outcomes and a share of bearish (or no) outcomes.

The duality of these markets derives from the "winner-take-all" rule of the game - either the bull takes all the money or the bearer takes all the money. So if GRIN / USD is listed on the CoinMarketCap website on March 16, every bullish share will be worth an ether, and every bearish share will be worth zero.

When you are ready to bet on a dualistic market (or buy a bullish or bearish share), you should consider the probability of the event. If you think that the probability that GRIN/USD will be included in CoinMarketCap is 50% - or that the bullish share will be worth an ether, then you probably shouldn't spend more than 0.5 ethers to buy a bullish share. Because your expectation for a bullish share is 0.5 ether (that is to say, 50% of the probability of getting 1 eth of repayment funds, and 50% of the probability of getting 0 eth at the same time).

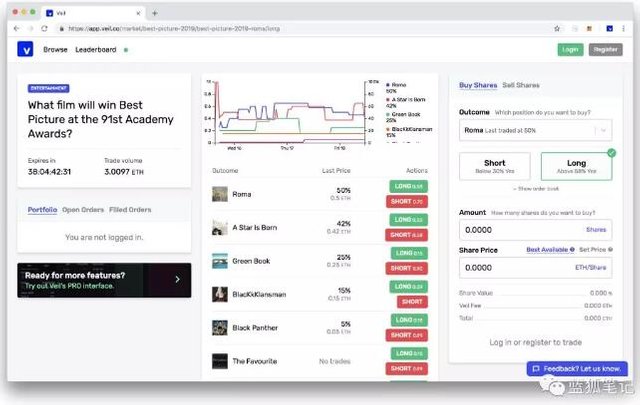

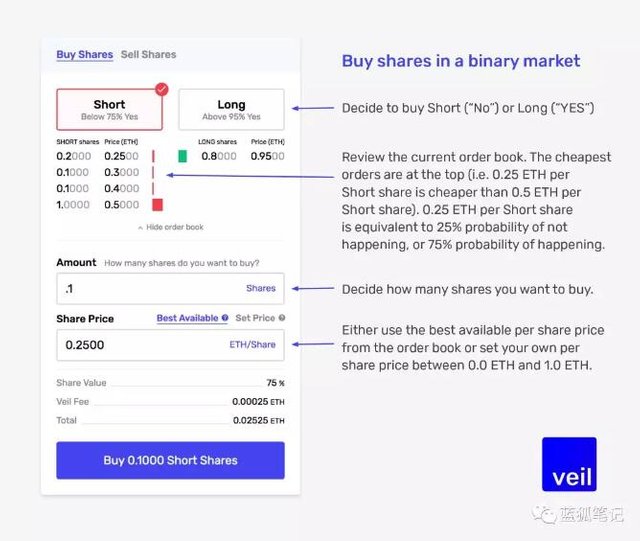

In retrospect, the price of the result share in a binary market is probability dependent. A "bullish" or "yes" share sold at a price of 0.25 is equivalent to a 3:1 odds, or the probability of this happening is 25%.The following picture is a binary market list on Veil.

Scalar Market

Similar to the dualistic market, the pure market also has two result shares -- "bullish" and "bearish" -- although the final liquidation is not the winner-take-all rule. A share of "bullish" and "bearish" always pays an ether, but the allocation can be any value between 0 and 1.

If you want to trade in a certain direction or don't want to face the high risk of "winner-take-all", then the pure market is a good choice. Examples include the price of REP at the weekend, the weather tomorrow, how many three-point shots were scored by Warriors'Curie this season, or when the government reopened. For these examples, we can create markets for multiple outcomes (for proportional weather, 70-72 degrees F, 73-75 degrees F, etc.), but this approach has three drawbacks. First, we lose accuracy, that is to say, 71 degrees F is the same as 72 degrees F. Second, we do not reward traders who are closer to the facts. If the weather turns out to be 70 degrees F, the 73 degrees F bet is as bad as the 50 degrees F bet. Third, the more results, the higher the cost of providing liquidity. And the pure market solves all these problems --- they are accurate, rewarding close answers, and efficient.

Pure market needs more than two data points to define: upper limit and lower limit. These boundaries are the boundaries of the final decision value (e.g. REP price, weather Fahrenheit, number of three-point balls, date, etc.). In a pure market, you can trade within the range of predefined market decisions.

To illustrate, we use ZRX (assuming the current price is $0.3) as an example of encrypted assets and design a pure market that should allow us to bet on prices in 30 days. We call this market "ZRX/USD-30d" and set boundaries between the upper and lower limits -- $0 is the lower limit and $0.6 is the upper limit. Like other AUGUR markets, our market has both a "bullish" result share and a "bearish" result share.

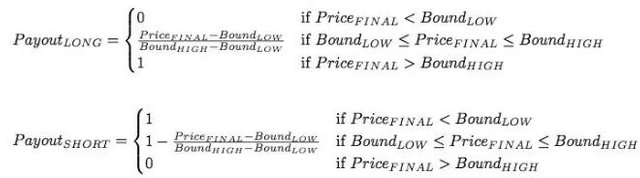

But unlike representing a non-black-and-white outcome, bullish and bearish shares represent directions that tend towards different boundaries. If the price is closer to the upper limit of $0.6 after 30 days, the share of the bullish result will be paid; if the lower limit is more than $0 after 30 days, the share of the bullish result will be paid. If the price is US$0.3, the share of the two sides is decided to be 0.5 ETH without loss or loss. Specifically, it can be expressed by the formula in the following figure:

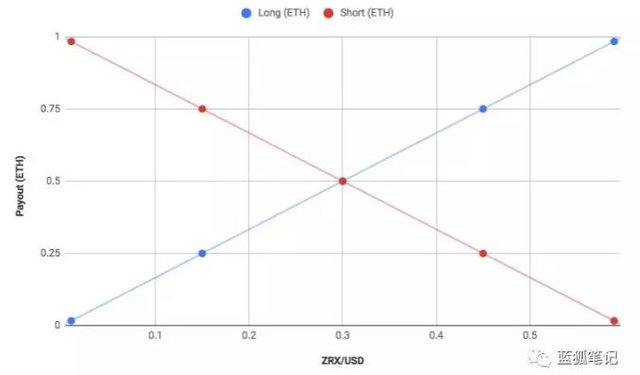

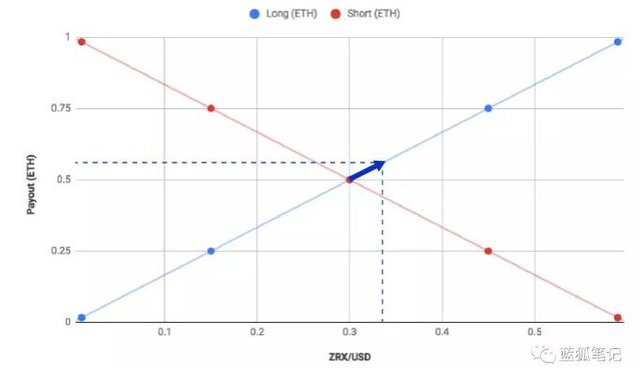

The figure below represents the changes in payments for "long" and "short" shares from $0 to $0.6.

It should be noted that the same ether rule still applies: "bearish" and "bullish" shares always add up to one ether until they expire. But as the resolution price approaches 0.6, that is, the upper boundary, the value of the "bullish" share increases linearly and the value of the "bearish" share decreases linearly, and vice versa, because the resolution price tends to be $0.0.

It should be noted that the same ether rule still applies: "bearish" and "bullish" shares always add up to one ether until they expire. But as the resolution price approaches 0.6, that is, the upper boundary, the value of the "bullish" share increases linearly and the value of the "bearish" share decreases linearly, and vice versa, because the resolution price tends to be $0.0.

Now let's talk about share pricing in the pure market. Unlike the price of each share in a binary market, the price of each share in a pure market can be understood as the execution price of the underlying asset, or any price predicted.

Case 1: Buy-up

If a bullish trader thinks that ZRX/USD will reach more than $0.3 when it expires. She checked the market lists, and it seemed that she could buy a "bullish" share at a price of 0.5 ether. Using the same formula as above, we can think of Ether 0.5 as $0.3, because $0.3 is in the middle of the upper and lower boundaries. So bullish traders bought a bullish share at a price of 0.5 ether and waited for it to expire.

On the day the market expired, ZRX/USD rose 10% to $0.33. This means that market decision bullish TRADERS'"bullish" share can be redeemed by 0.55 ether, because $0.33 is 55% of 0 to 0.6. Bullish traders have a 10% return on their investments, which is the same as her direct investment in ZRX.

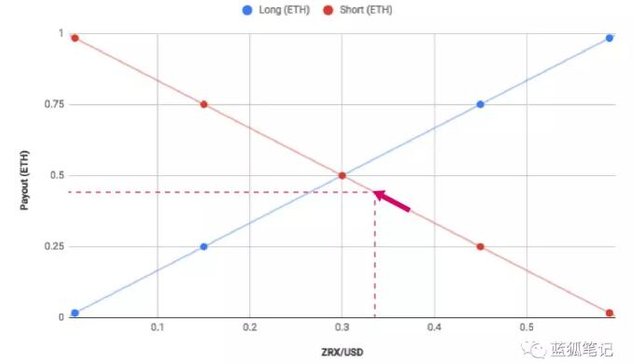

Case 2: Buy short

Bullish traders still believe that ZRX/USD prices will rise, but she does not believe that the increase will exceed 10% of $0.3. So she looked at the trading lists on Veil and found that the community was more optimistic than she was because she could buy a "bearish" share with 0.4 ether (or 0.6 ether for a "bullish" share). Therefore, the community set the future ZRX/USD price at $0.36, higher than her expectation of $0.33. Although the bull trader thought ZRX/USD would rise by 10%, she decided to buy more "bearish" shares at a price of 0.4 ether, which meant that she thought the price would be less than $0.36. On the day of market expiration, prices rose 10% to $0.33, and each "bullish" share was 0.55 ether, while each "bearish" share was 0.45 ether. This means that the bull trader invested 0.4 ether and received 0.45 ether, earning 12.5%. We can review the chart in Case 2 to see how this works.

On the day of market expiration, prices rose 10% to $0.33, and each "bullish" share was 0.55 ether, while each "bearish" share was 0.45 ether. This means that the bull trader invested 0.4 ether and received 0.45 ether, earning 12.5%. We can review the chart in Case 2 to see how this works.

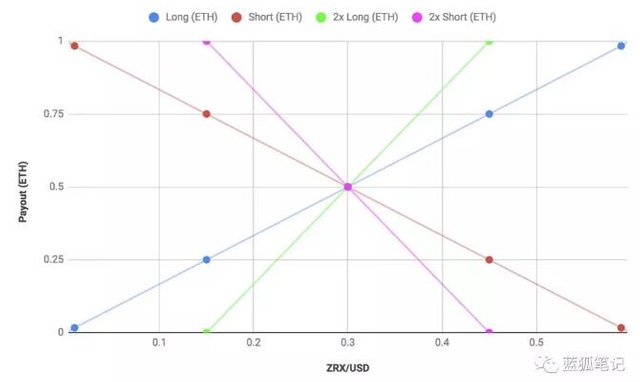

Case 3: Leverage

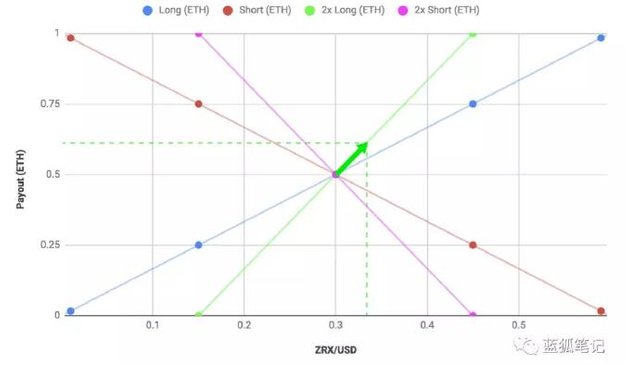

In this last case, we will tighten the upper and lower boundaries of the market to $0.45 (upper limit) and $0.15 (lower limit), respectively. We can see this as leveraging the market, because rising prices now have a stronger impact on both bullish and bearish shares. As shown in the following figure: In the figure above, if ZRX/USD rises from $0.3 to $0.45, the "bullish" share will rise from 0.5 ether to 0.75 ether, but the "double bullish" share will rise from 0.5 ether to 1 ether. Price changes in underlying assets have been magnified by tightening borders.

In the figure above, if ZRX/USD rises from $0.3 to $0.45, the "bullish" share will rise from 0.5 ether to 0.75 ether, but the "double bullish" share will rise from 0.5 ether to 1 ether. Price changes in underlying assets have been magnified by tightening borders.

Suppose a bullish trader can buy a "bullish" share in a new market (double leverage) at a price of 0.5 ether or $0.3. And if ZRX/USD rises by 10% to $0.33, bullish traders will receive 0.6 ether (60% of 0.15 to 0.45 at $0.33). That's 20% of the return, twice the return on direct purchase and holding of ZRX! ___________

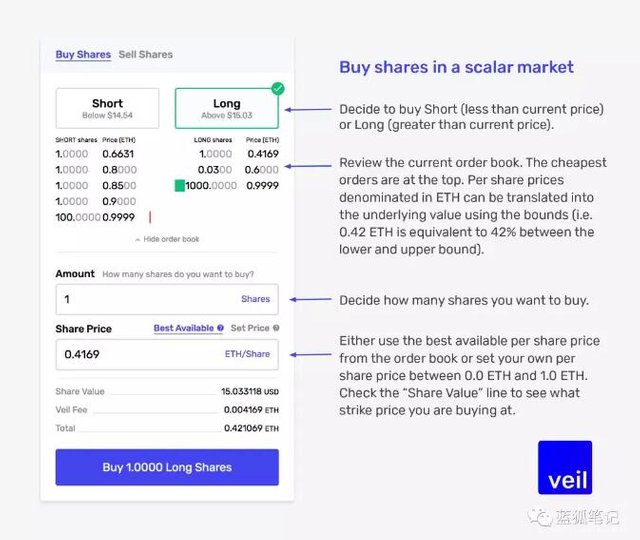

Back to Veil, let's take a look at the list of the pure market in Veil:

conclusion

We have only touched on the fur of a series of possibilities that Augur and Veil have opened up, but I hope you now have a better understanding of the structure of Augur's market and share, as well as the pricing and decision-making of dual and pure markets. The pure market is a very powerful building block, and we will continue to use it to build exciting products.