“It is futile to approach social facts with the attitude of a censor who approves or disapproves from the point of view of quite arbitrary standards and subjective It is quite common for the people stumbling upon complicated issues to set hopes on a central authority to resolve them rather than proposing an algorithm for the individuals to preserve their fundamental right to economic choice and settle problems on peer-to-peer basis.

The complicated problem of social costs, of negative externalities, collateral damages[1], especially related to environmental issues, remains in the focus of economic science for over 100 years and has become critically important in relation to climate change in particular. While Pigovian approach remains dominant, advance of economic thought and technologies allows for implementation of the decentralized peer-to-peer model based on delimitation of property rights, on values and choices of free individuals. Ludwig von Mises, 1881–1973, the brightest mind of the Austrian School of Economics, precisely defined the core problem: “Carried through consistently, the right of property would entitle the proprietor to claim all the advantages which the good’s employment may generate on the one hand and would burden him with all the disadvantages resulting from its employment on the other hand”[2]. F. A. Hayek, 1899 –1992, another bright representative of the Austrian Economics, 1974 Nobel Prize Winner, alternatively stated that certain harmful effects of deforestation, of some methods of farming, or of the smoke and noise of factories, cannot be confined to the owner of the property in question, or to those willing to submit to the damage for an agreed compensation. F.A. Hayek suggested that in such instances we must find some substitute for the regulation by the price mechanism, and resort to the substitution of direct regulation by authority.[3]

Ronald Coase, 1910–2013, a British economist, Nobel Prize Winner in Economic Sciences in 1991, proposed a general market-approach to the problem of social cost and a solution based on clearly defined property rights. The approach introduced the concept of clear delimitation of rights to perform activities harmful to third party and provided the basis for the market-based distribution of limited resources as a production factor and for a peer-to-peer settlement of reciprocal damage of part A (the manufacturer) and part B (the third party). “The real question that has to be decided is: should A be allowed to harm B or should B be allowed to harm A? The problem is to avoid the more serious harm”[4]. The focus is on the aspect, which still is mostly ignored: limiting or banning harmful activities of the polluter, party A, harms him just as his activities harm the people, the third party, party B.[5] They either have to choose, which side of damage is less costly to compensate or to bargain and settle.

One of the solutions is strict delimitation of right to execute harmful activities[6] though the process of allocating these rights is costly and bears significant error or corruption risks.

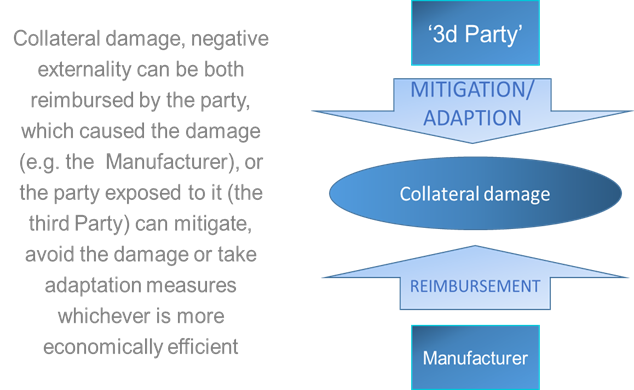

Figure 1 — Reciprocal approach to the problem of social cost[7]

[1] In the original sense not a military euphemism

[2] Human action: a treatise on economics / by Ludwig von Mises, 4th rev. ed., San-Francisco, 1996, p. 657

[3] Hayek, Friedrich August (1994). The Road to Serfdom. University of Chicago Press. ISBN 978–0–226–32061–8, p.44

[4] Ronald H. Coase, “The Problem of Social Cost”, The Journal of Law & Economics, Vol. III, 1960, p. 2

[5] “What has to be decided is whether the gain from preventing the harm is greater than the loss which would be suffered elsewhere as a result of stopping the action which produces the harm”, Coase, op. cit.., p. 27

“[6]If factors of production are thought of as rights, it becomes easier to understand that the right to do something which has a harmful effect (such as the creation of smoke, noise, smells, etc.) is also a factor of production. Just as we may use a piece of land in such a way as to prevent someone else from crossing it, or parking his car, or building his house upon it, so we may use it in such a way as to deny him a view or quiet or unpolluted air. The cost of exercising a right (of using a factor of production) is always the loss which is suffered elsewhere in consequence of the exercise of that right-the inability to cross land, to park a car, to build a house, to enjoy a view, to have peace and quiet or to breathe clean air’, Coase, p. 44

Figure 1 — Reciprocal approach to the problem of social cost[1]

[1] “It is necessary to know whether the damaging business is liable or not for damage caused since without the establishment of this initial delimitation of rights there can be no market transactions to transfer and recombine them. “But the ultimate result (which maximises the value of production) is independent of the legal position if the pricing system is assumed to work without cost.” (R. Coase, p. 8)

For example, the manufacturer produces gasoline with huge damage to the environment, natural resources, i.e. to future generations, and to the people’s health, security and quality of life. If the manufacturer would have to reimburse all of the damage, prevent pollution, restore natural resources and environment, cover all related medical expenses, etc., the costs would increase dramatically, and he might even have to stop the production of goods demanded by people. However, if the third party, i.e. those who are aggrieved by the damage, take “adaptation measures” or measures to offset, mitigate the damage, costs might be even greater. Both of the solutions are equal and differ only by the level of costs.

The Austrian economists probably would not agree to such delimitation arguing that the property rights, the ownership should be clearly defined from the very beginning. But in some cases, for instance for newly discovered resource it is just not possible. Take radio frequencies, the resource, which was unlimited and worthless for some historical period and became especially valuable and scarce with the development of cellular communications. Same applies to GHG emissions. For a long time emissions of carbon dioxide were not considered harmful as the gas is a natural component of the atmosphere. Now they are regulated or limited by taxes or under emission trading schemes globally and the rights to emit GHG became a limited resource.

Under the circumstances, it would be just natural and logical for the business to formulate fair method of allocation of this limited resource. The starting point, the baseline could be natural rights of ownership of the resource, which now has to be limited and formally distributed. For emissions markets the principle is known as “grandfathering”. It is consistent with liberal economic principle of allocation, one of famous historical examples of the application of which is Homestead Act in 1862 in the United States.

In accordance with such Homestead Principle, the resource is distributed on the grounds of claims, though in limited quantity, and assignment of its share to particular owner is subject to efficient and careful exploitation.

Smart contracts to perform such allocation of rights (quotas or allowances) are ready in DAO IPCI.

Thus, it is the company itself, who is interested to claim a certain portion of the resource, to claim specified amount of annual greenhouse emission rights, and to justify the claim by efficient exploitation of the resource.

With transfer of the entitlement for these rights, “the burden of the disadvantages”, i.e. responsibility for negative externalities is transferred to the buyer. The seller should inform the buyer of the risks and consequences associated with the goods transferred. Nevertheless, once the transaction is executed liability lies with the one who has acquired property rights.

The manufacturers argue that they supply goods and services in demand, which at least means that the buyer of the goods and services (the second Party) is equally liable. From the economic point of view, it is neither the installation, physical objects nor physical processes, nor the ownership that causes damage. It is actually the transaction, the deal, the trade, which causes the damage, the negative externality.[1]

There seems to be no such thing as a balance in economic development, there is no seamless process of ‘dynamic balancing’. Similarly to quantum mechanics, individual trade acts as ‘quantum’ of economic activities.

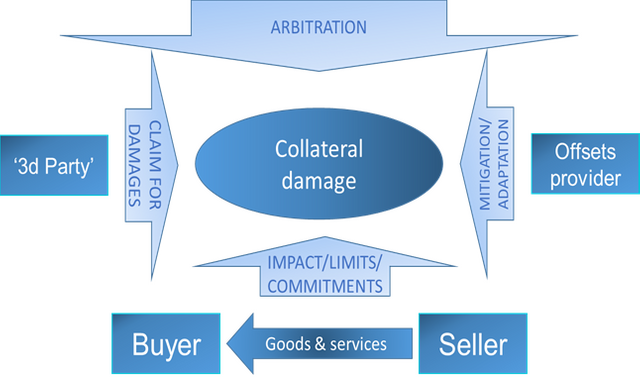

Furthermore, if the parties agree on reimbursement from the manufacturer, the latter can reimburse negative externality (collateral damage) against the claim of the third party in monetary form, or the settlement may imply that either of the parties or professional supplier of offsets (the forth Party) provides for compensation (offsetting) or mitigation ‘in-kind’.

[1] See A. Galenovich, “Quantization” of the environmental impact resource: “ transaction-based model “ of settlement of the social cost of carbon issue, https://goo.gl/tN16Wj

Figure 2 — Comprehensive peer-to-peer social cost problem solution

Traditionally, such complicated interactions of the four parties are regulated by the governments, which take possession of the arbitration, assign taxes and fees, quantitative limits and commitments.

In the example with gasoline, the damage is partially controlled by the government, which applies licenses, taxes, fees, penalties, and technical regulations. As a result, the government awards the manufacturer with indulgentia, and the latter transfers the liability to the car owner. The third party, those who are aggrieved by the damage, may try to seek reimbursement, which would be difficult as the manufacture has already acquired legitimate clearance from the government, address claim for damages to the government, or take measures to offset, mitigate the damage, or adapt to it, or take no measures at all (which is the less evil than the interference of the government).[1]

Experience shows that government “corrective” interventions often do not resolve but aggravate problems while blocking alternative ways for optimal settlement. This leads to the need to “correct corrective interventions” and governmental activity starts to circle without positive results with great transaction costs for society.[2]

In fact, solution may be found if there is no government or any “superior authority” action[3], only if the parties interact on decentralized peer-to peer basis.[4]

The goal is to arrange for or create low transaction cost institutions to promote settlement between the parties via smart contracts without government interventions. F.A. Hayek noted that “compared with this method of solving the economic problem — by decentralization plus automatic coordination through the price system — the method of central direction is incredibly clumsy, primitive, and limited in scope”.[5]

The advance of public and programmable blockchain technology, Turing-complete systems, and triple-entry accounting allows for decentralized arbitration and truly peer-to-peer settlement, and thus allows for further development of the Coase paradigm embracing all of the four parties involved excluding superior authority or allowing the parties to choose the medium.

Blockchain technology can be applied to mitigate the collateral socioeconomic damage caused by economic activities; it requires market-based infrastructure that supports decentralized peer-to-peer interactions, the public network evaluation of negative impacts, the distribution of liability, and settlement by means of mitigation outcomes.[6]

The design objective is to provide any person, program, corporation, association or jurisdiction, with common space, common space fabric, common tools and ecosystem that is universal, reliable, transparent and that allows diverse stakeholders, including businesses and even individuals to: register their quantified impacts and mitigation pledges; invest in mitigation projects; offset carbon footprints and other damages; acquire and trade mitigation instruments; and join existing programs or launch new programs.

As a blockchain ecosystem focused on mitigating negative societal externalities, programmable blockchain is a digital environment built on smart contracts designed to minimize transaction costs and to make the issuance and transfer of mitigation instruments — including internationally transferred mitigation outcomes — highly reliable, transparent and protected from interventions and manipulation by any centralized power.

There should be no technical restrictions as to who may launch an autonomous mitigation program in public and programmable blockchain. Existing mandatory or voluntary, large and small programs of diverse scopes of activities and jurisdictions, as well as businesses, NGOs and even individuals should be able to create independent decentralized autonomous organizations (DAO) to implement specific programs and projects and perform transactions. Independent mitigation programs within specific blockchain or even different systems should interlace and form a web of DAOs that share selected modules and protocols with their peers.

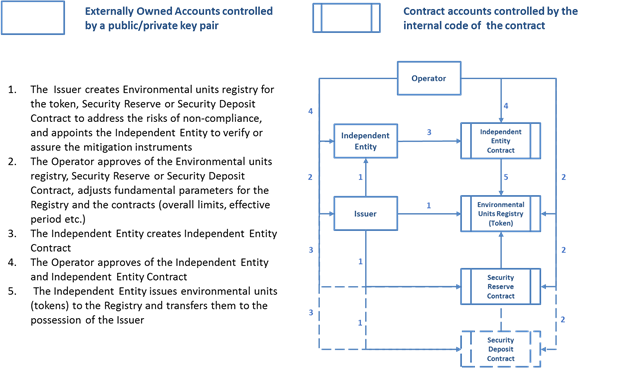

Diverse mitigation instruments in blockchain should be represented by specific tokens issued via coordinated actions of the Operator of the DAO, the Issuer and the Independent Entity. Only if these actions are in coordination and in compliance with the logic of the open-source smart contracts may the tokens be issued to the possession of the Issuer.[7]

[1] “There is, of course, a further alternative, which is to do nothing about the problem at all. And given that the costs involved in solving the problem by regulations issued by the governmental administrative machine will often be heavy (particularly if the costs are interpreted to include all the consequences which follow from the Government engaging in this kind of activity), it will no doubt be commonly the case that the gain which would come from regulating the actions which give rise to the harmful effects will be less than the costs involved in Government regulation”, Coase, p.18

[2] “The kind of situation which economists are prone to consider as requiring corrective Government action is, in fact, often the result of Government action. Such action is not necessarily unwise. But there is a real danger that extensive Government intervention in the economic system may lead to the protection of those responsible for harmful effects being carried too far”, Coase, p. 28

[3] “That is to say, compensation would be paid in the absence of Government action. The only circumstances in which compensation would not be paid would be those in which there had been Government action”, Coase, p. 31

[4] “Who can seriously doubt that the power which a millionaire, who may be my employer, has over me is very much less than that which the smallest bureaucrat possesses who wields the coercive power of the state and on whose discretion it depends how I am allowed to live and work?”, Hayek, 1994, p.41

[5] Hayek, 1994, p.59

[6] There is already one practical example that allows participants in greenhouse gas (GHG) credit-based or quota-based emissions trading schemes to account for claims made towards these targets. (see http://ipci.io )

[7] Up to the moment, two of the manufacturers (KhimProm and Swiss Krono) and one trader (Aera Group) have issued tokens based on the GHG emission reductions assured and verified by reputable auditors. Pilot transaction to register transfer of tokens took place in March 2017. First market transaction has been executed in April 2018.

Figure 3 — Issuance of the tokens representing mitigation instruments (environmental units)

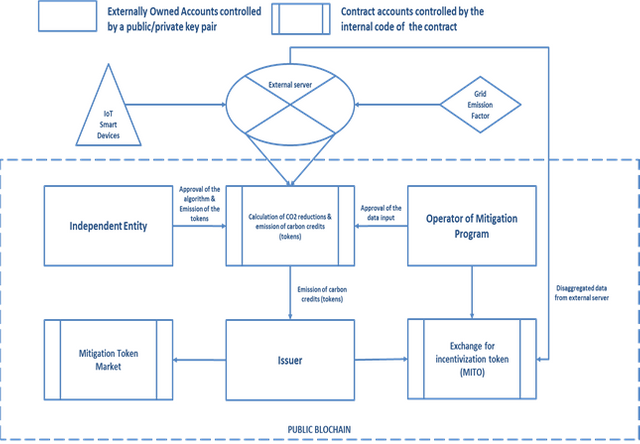

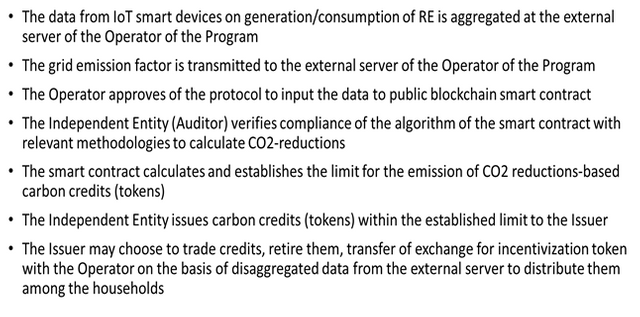

Independent Entities play a crucial arbitration role in the procedure. To reduce transaction costs and convert arbitration to truly decentralized smart contracts based model, IoT smart devices and Network verification has to be introduced and developed to gradually substitute expensive “manual verification”.

Figure 4 — IoT smart devices based verification of renewable energy based credits (Prototype)

IoT devices and Artificial Intelligence and their economic interaction, ‘Robonomics’, are the future.[1] The interesting question is how exactly artificial devices would participate in human-to-machine deals, transactions, which need a common algorithm for market price. An algorithm based on ‘marginal cost’ concept may be introduced for machines, while human individuals would still and ever use subjective values to determine prices and costs. There seems to be no alternative to creation of a specific market for IoT or robot services.

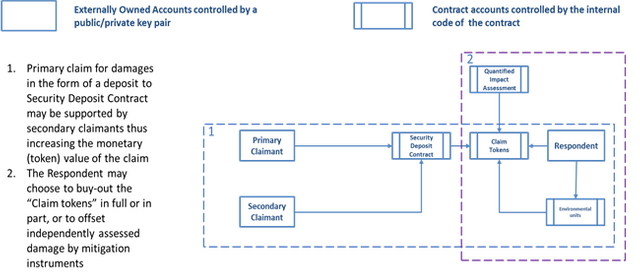

Regular demand for tokens representing mitigation instruments is on the side of the participants of commercial deals that cause collateral damage, manufacturers, suppliers and consumers, sellers and buyers of goods and services. However, monetary claims for damages of ‘the third Party’ is also a potential source of demand, which can be satisfied either in monetary form or by ’in-kind’ offsetting. Smart contracts should allow for initiating claim for damages in blockchain along with filing actual case, supporting it by secondary claimants, and settling either by reimbursement or offsetting the damage.[2]

[1] See Robonomics platform by Airalab at https://github.com/airalab

[2] There are notorious examples of public protest in Russia against air pollution from landfills. Little can be done as all the permissions from the government are in place. Enlisting a claim against landfill owners or/and relevant authorities in blockchain is an alternative peer-to-peer way to seek settlement. Primary individual claim secured by payment token deposit might be supported by secondary claims increasing the value of the claim. Furthermore, objective IoT devices may quantify and verify negative impact. The Respondent may choose to ignore the claim, reimburse damage by buying out “the claim tokens” or to compensate the damage with the verified results of mitigation measures if there are any.

Figure 5–3d Party Claim for Damages

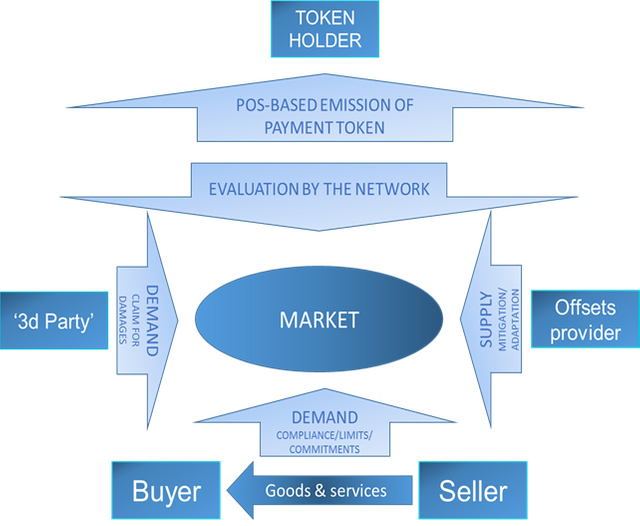

Other than tokens representing mitigation instruments type of token, represents digital currency for internal markets of independent programs, essentially a payment token. Operators of independent programs, DAOs, may issue this type of tokens arbitrarily.[1]

Fundamental concept for issuance of independent currencies is that artificial state monopoly for money emission suppressing other currencies is harmful in respect of inflation, social conflicts, unrestrained budget expenditures, economic nationalism. Government monopoly for money should be abolished. From the very beginning blockchain technology and its first manifestation, Bitcoin, brought to life a simple though disruptive concept: that anyone can issue his own global money with minimum transaction costs. Actually, monopoly for money by the governments has already ended, and denationalization of money[2] has begun. Suppression by the governments of currencies issued by entities, persons or even machines, is hopeless, does not make sense and will eventually stop. At the end of the day, it is up to person himself to choose which of the currencies to use for each specific exchange or to store values. On the other hand, it is up to the Issuer to choose the scheme of issuance of “his money”. However, “one-time” sale of the token representing the currency is not the only option. Proof-of-Work algorithms to issue currency with all the benefits, unfortunately, are not a market feature. Proof-of Stake also do not fully reflect market demand for the token. Alternatively, a mechanism based on market demand for the token may be created. For this purpose initial crowd-offering should be targeted at understanding the initial demand and initial level of price acceptable for different buyers however unpredictable those might be. A permanent emission mechanism can be launched on this basis. For example, a contract that offers issuance of new tokens at the Ceiling price. When there is enough data from the smart-contract accumulated, Artificial Neural Network may take over setting the contract price for the token issuance. This way the Issuer provides options to the Buyers whether to use the token on the Market to buy goods, to buy more tokens, to store for the future or to go to an external exchange in search for the Floor price.

Market is the core element of any independent program, DAO, within the blockchain ecosystem. Other elements like issuance or retirement of mitigation instruments provide for the quality of market goods and traceability of transactions, compliance with the program requirements. The goods traded at these markets are not for direct consumption but are goods of a higher order, factors of further production; essentially, they represent rights for further economic activity harmful to a third party.

Payment token functional role is to provide for seamless market operations, fungibility of mitigation instruments, and its’ value is determined by the demand for the token. To provide for market operations with minimum transaction costs and for growth of value of the market further emission of payment token would seem necessary. However, payment token emission algorithm has to be compliant with inherent properties of public blockchain.

“The state of the market at any instant is the price structure, i.e., the totality of the exchange ratios as established by the interaction of those eager to buy and those eager to sell.”[3] Evaluation of the state of the market might be performed by verification nodes of the programmable blockchain Network or by artificial neural network (ANN). Alternatively, market evaluation of the token should be introduced.

[1] The Genesis Operator, the Operator of the Russian Carbon Fund Integrated Standard for Climate Initiatives (RCF ISCI Operator) has issued Mitigation Token (MITO) in total amount of 9,068,185.45, including 109,987.25 tokens, which have been actually sold or distributed, and are in the possession of private holders. No further emission of this token is technically possible. MITO is the payment token for RCF Standard MITO Market.

[2] See Friedrich Hayek, Denationalization of Money, Institute of Economic Affairs, 1976

[3] Human action: a treatise on economics / by Ludwig von Mises, 4th rev. ed., San-Francisco, 1996, p. 258

Figure 6 — The Market and Issuance of Payment Token

There is a dominant economic idea that the supply and demand and turnover determine the value of the market and are to be used to determine the amount of the currency needed. However, the fundamental parameter still is the market demand for the token, the currency whether it is used to exchange for goods (mitigation instruments) available at the market or to store value on the balance.

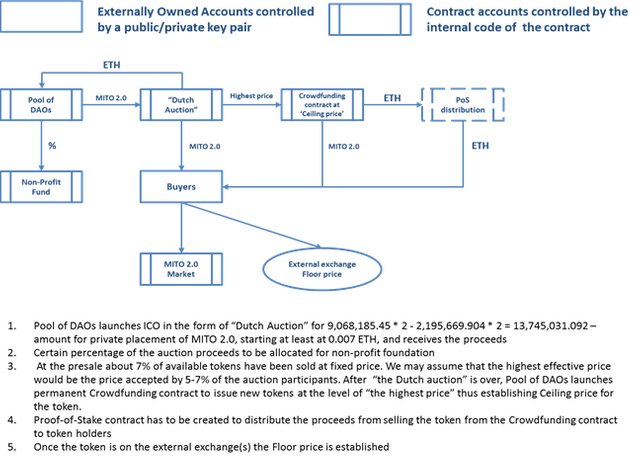

As an example current Mitigation Token (MITO) has been issued by the Genesis DAO Operator in DAO IPCI, and further emission based on the demand for the token is technically impossible. Under the circumstances, it would be reasonable to design and execute the issuance and distribution of “MITO 2.0”. It should be performed by “the Pool of DAOs”. MITO 1.0 should be exchanged to MITO 2.0 at the rate of 1:2 to fulfil our commitments to presale buyers. To ensure the exchange “Alembic” or “Distillation” smart contract should work long enough to preserve the rights of MITO 1.0 presale buyers.

Number of MITO 2.0 decimals should be increased to the level sufficient to support future hypothetical transaction fees, i.e. to the order of Ether decimals (10–18), and an emission mechanism designed. The ultimate target of the emission model is to provide for the growth of value of MITO Market and of MITO.

There should not be a monopolist, a predesigned market maker.

The main question for MITO 2.0 is whether to issue fixed amount or design a self-executing token emission contract. If there is further emission linked to market demand for token or to supply of mitigation instruments (currently more than 1,6 million verified carbon credits available), and newly issued tokens are distributed based on POS, than what would be the legal implications?

The following scheme has been proposed for discussion.

Figure 7 — Emission of MITO 2.0

As newly issued tokens yield proceeds to the possession of existing token holders interested in the value of the market and the token, there would be an incentive to increase the value of the market and the demand for the token and no incentive to falsify trades in order to increase emission.

Most of the elements to implement the model in principle are in place. Yet, some of them are still under development, what is far more important the concept in general still needs comprehension by the “climate” and “blockchain” communities. The concept that there is no governance or central authority, which prescribes solutions, restricts or allows actions is still making its way even in public blockchain projects.