https://www.shorouknews.com/news/view.aspx?cdate=16102017&id=4b0eb5bf-b9f1-4638-85c0-71a9e920ee70

Trade finance has been a part of the finance business since the inception of trade. Complicated banking processes and complex supply chains restrict innovations in trade finance. Current manual and the paper-based systems are prone to fraud and errors. Blockchain has opened different avenues to handle trade finance operations in innovative ways. In this article, we shall talk about current issues with trade finance and what are the benefits of implementing blockchain in trade finance.

Blockchain technology is making the waves in every part of the world. In digital transformation, blockchain is considered as one of the most important elements. Technological advancement with blockchain will bring a multitude of benefits and opportunities within the trade finance industry. Trade finance is a significant entity in the global commerce and if blockchain is added to its wings, critical issues related to fraud, scam and wasted time can be resolved. The advent of blockchain technology has made it clear that it is a crucial part of the digital transformation and cannot be ignored.

Before selecting the technology, we need to see if it solves a real world problem or not. If the technical transformation does not provide any business value, it is better to avoid it. Similar is the case with blockchain technology; the transformation of business functionalities to blockchain should be analyzed properly before implementing it.

Current Problems

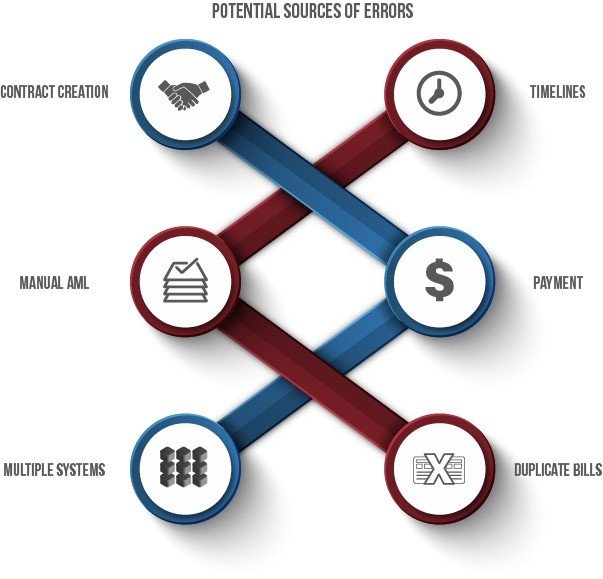

Contract Creation: Borrower’s bank manually checks financials before sending it to the exporter’s bank.

Timelines: Due to multiple hops and intermediary checks, the overall process takes time

Payment: All parties must audit and verify their funds before approving the amount. This process ultimately delays the payment to the exporter

Manual AML: AML and financial checks are happening manually at each of the importer’s and exporter’s bank side.

Multiple Systems: Multiple systems and platforms in global e-commerce also delay the overall trade settlement.

Duplicate Bills: Due to manual paperwork, all intermediaries are issuing duplicate bills in an attempt to verify authenticity.

Blockchain as a Solution

Blockchain technology is capable enough to handle all the above-stated issues. It will remove the manual paperwork and increase transparency, security and trust. End to end solutions such as Envoy are able to handle trade settlement for corporations and banks. These new advancements will increase the efficiency of the entire trade network. Looking at Envoy, it will provide innovative solutions and a robust marketplace to facilitate trade finance businesses, such as direct transactions, data protection, interoperability between different systems and scalability.

Automation and an open infrastructure will enable an efficient trade finance solution, which is the new goal for the current businesses. By applying blockchain technologies produced by the companies such as Envoy, it will reduce complexity and increase efficiency within trade finance.

Permissioned interactions and B2B networks are revolutionizing the trade finance operation with help from blockchain technologies. It will take time for the technology to mature and become fully adopted into real world systems but new companies such as Envoy have already begun down this new and innovative path.