.jpg)

(image source: Sec. Tre Hargett Youtube Channel)

This is the first installment in a series of articles aimed at highlighting the importance of maintaining diligent voting practices for Block Producers on the EOS.IO network. The Block Producers that we choose to represent us will have an effect equal to if not greater than any code proposal or dApp introduction. Whether you are a speculator, developer, long-term token holder, or simply interested in the governance of EOS.IO then please read carefully and consider the influence we wield as token holders and the subsequent responsibility to use said influence to channel positive change back into the network through voting and other means.

There are rampant speculation and near unregulated trading practices occurring in the cryptocurrency space every day. So it's important to understand how the EOS.IO software is specifically designed to insulate itself from token price volatility that can occur. We will omit technical details such as: the fractional reserve model of network resource allocation, parallel chain scaling, and real-time usage, the separation of CPU and network bandwidth, etc. in order to keep it simple for non-technical readers to understand. For reference, when we say “network resources” we mean “bandwidth, storage, and computing power”.

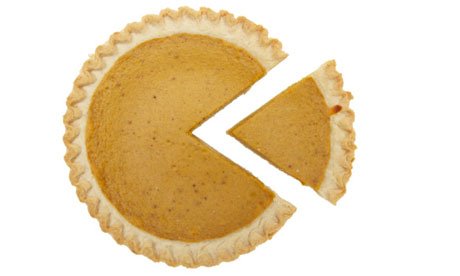

The core utility of the EOS token is not moving a monetary value from point A to point B. While it is an extremely important aspect of the token, the core utility of the EOS token is guaranteeing access to the EOS.io network resources. In other words, if you imagine the EOS.io network as a pie, it’s guaranteeing you get a slice.

The sum of network resources you have access to is directly dependant on the number of tokens you hold (amongst other variables). If we continue with our pie example, the EOS network pie is divided into the same number of parts as the number of tokens that exist. If there are 100 tokens, there are 100 slices of network pie (this can be further subdivided into decimals but assume round numbers for simplicity’s sake).

Now, let’s assume our token price increases by 300%. The network capacity pie is still the same size and there are still 100 tokens that exist. Your access to the network is unaffected, you still have your slice.

Basically, once you own tokens, you’re access to network resources is unaffected by any future change in the token price.

But what if you don’t own tokens and want to secure network resources for your new dApp? In our example, the price has tripled now for the same amount of resources you would have received before. This is why Block Producer (BP) voting is so important and should be the responsibility of every token holder. The responsible Block Producer must manage the relationship between the token price and the network resources afforded by one token. If the price of the token tripled the resources afforded per token must increase in kind. The network pie must become larger and the BP must invest in their own capacity to bring the cost per unit of network resource back to a reasonable range in order to attract a new token-holder to the network. In other words, the ability for the network to grow is heavily dependent on BP commitment to network expansion

How do they fund this expansion? Through their block rewards. BPs are not middlemen, they are network custodians. A BP's existence depends on their ability to properly manage the network and make it usable for all, or they will be voted out (we hope). If a BP allows the price per unit of network resource afforded by a single token to rise above an acceptable range then the network becomes less attractive to prospective token holders and there is a net decrease in value of the EOS platform.

It’s worth noting that what this “acceptable range” benchmark is not yet known. Initial BPs must make a concerted effort to research the marketplace of centralized network resource providers and ensure EOS.IO is competitive.

EOS New York is working to understand and plan for these economic effects and will develop practices to dynamically monitor and respond to market forces to ensure a usable and accessible network.

Have questions? Join us in the telegram channels or e-mail us at [email protected]

Disclaimer: As with any ongoing project, what is current now may become obsolete in a future update. This article is written based on Dawn 2.0 and the published EOS.IO whitepaper.

PLEASE NOTE: EOS TOKENS REFERRED TO IN THIS ARTICLE REFER TO TOKENS ON A LAUNCHED BLOCKCHAIN THAT ADOPTS THE EOS.IO SOFTWARE. THEY DO NOT REFER TO THE ERC-20 COMPATIBLE TOKENS BEING DISTRIBUTED ON THE ETHEREUM BLOCKCHAIN IN CONNECTION WITH THE EOS TOKEN DISTRIBUTION.

Contributing Editors:

Eric Bjork: A contributing member of the EOS launch community and a main driver of the EOS community test net. You can learn more about his Block Producer candidate organization at (www.eosio.se) or on Steemit @xebb

David Packham: One of the founding members of the EOS London meetup group (https://www.meetup.com/EOSLONDON/)

.png)

https://www.eosnewyork.io/

https://twitter.com/eosnewyork

https://medium.com/@eosnewyork

https://steemit.com/@eosnewyork

https://www.meetup.com/EOS-New-York/

Excellent example of taking a complex idea and breaking it down into simple terms. I'm liking this series already.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very well written and informative article. The pie analogy is a great touch. Nice work!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This idea of volatility that could effect adaption must be thought through, thank you. Is this achieved by having an inventory reserve of tokens with the block producers to manage fluctuations?

Its a great thing for a block producer to have this in mind. I didn't think that a BP would take from his pocket to promote network adaption. I came to know now that EOS is different from currencies that only transfer value.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Some percentage of block rewards that the BP receives should be allocated into the expansion of the network capacity that the BP offers. Even if the token price doesn't rise the BP should be investing back into the network to make EOS even more attractive to the token-holder.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post. Thanks :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@eosnewyork is a shoe in for BP.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I continue to be impressed with EOS NY.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your support!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good points. Looking forward to your proposals on addressing the issues raised.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good point. Thank you.

EOS BP is similar to cloud services like AWS to Dapp developers. Most important thing is how BP establishs and manages "network resources". In order to build an enormous ecosystem, I believe the ideal BP is considered as an IT company. This is because a huge amount of manpower is required, such as IDC & IPLC contracts, building all equipments up and managing them. If all BPs have built EOS.IO software on AWS without their own IT infra, we should think that it is a worldwide decentralized ecosystem or just a board game on AWS. I would like to know how EOSnewyork will build your IT infra.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Our IT infrastructure will be open and known. We will publish our plan once we have more input from B1. They are releasing their minimum spec report for a BP this month.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, this helps to understand the function of the BP's.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Happy to help!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

the ability for the network to grow is heavily dependent on BP commitment to network expansion - What are the BP's options to do this?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit