Good morning to all people here in the crypto space. This is your Mr. Decentralized again giving you my insights about the latest happenings in the cryptocurrency and blockchain world.

It doesn't matter what year you have started into cryptocurrency. What matters is how you learn quickly, adapt what did you learn, and execute all the things you have learned to strive to be the best in yourself as a crypto enthusiast. In the year 2017, we all got pumped up by the ICO mania. We hear Bitcoin all over the world and all altcoins get pumps up. It is an era of knowing the unknown and all those people who don't know what they are doing suddenly go into the wave as well then there is January of 2018 where the bear market emerged. Most people get out and got wrecked on their portfolio because they bought at the top of the Euphoria.

Moving fast-forward this year of 2020. I do know that most people who got into crypto from the year 2012 onward do know the importance of the HODL strategy and it does still works. Even I do still HODLs coins. With the recent pandemic that

crippled the entire world whether it be recreational activities, employment, entertainment and financial sectors including banks STOPPED. They all stopped. Being most of the people are in their households, especially blockchain developers and programmers like me, that is the best time to think and deploy the best ideas in disseminating the blockchain revolution. Why? Because it is the "cashless" way to transmit money from one person to another because of the COVID-19 scare!

This is when the DeFi or 'Decentralized Finance' era begin. This is the true time wherein what we call as 'time' for the blockchain and cryptocurrencies to emerge against Fiat. This is the true essence of the blockchain.

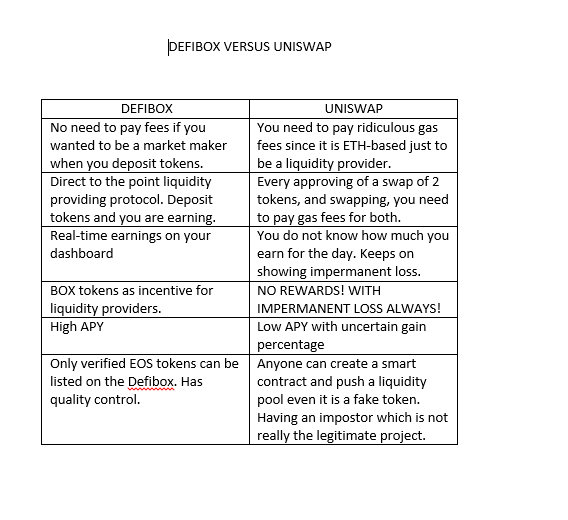

If you would ask me if I do Defi? Yes I do. I saw different protocols running on the Ethereum blockchain and I do have tokens in there as well as liquidity. But I am disappointed because in these past days, the Ethereum blockchain has too much congestion that you need to pay ridiculously high gas fees just for your transactions to go through! Which is not fair in my opinion. Because in real life, first come, first serve. Whatever the status you are in life, nothing is better than to 'Fall in line' and you will be served accordingly. With that said, it is the main core value of the blockchain. To be not picky who to serve. That is the true meaning of decentralization for me. It seems even though ETH blockchain is well-known, it seems their development and code restructuring is so poor. Who pays for a transaction fee higher than the amount to be sold or sent? That is insane!

That is why even I saw new projects coming in Ethereum blockchains, I did not turn an eye to them. Instead, I find other blockchains that do care really for the people and built for the people. Here is where I saw EOS.

I got interested in EOS blockchain especially their EOS Defi protocols. What made me jump into EOS is Defibox. I am proud to say that during this present time I am using EOS blockchain as my staking platform for Defi and I am still a learner and learning about EOS and its technology as days passes by. Lately, I found one of the most promising projects in the EOS Defi space named Defibox. It is founded by the Defibox foundation and is supported by the Newdex exchange and funded it as well. To those who are new, Newdex is the decentralized exchange of EOS platform. It is supported by the community of developers and EOS community. This is where the real deal for Defi is all about which I will talk with you in just a bit.

Defibox

What is Defibox?

----> Defibox, as its name implies, is a decentralized exchange and a decentralized application wherein it offers different tools for the user or person to execute trades non-custodial, swap different EOS tokens on the main net with super-low fees to almost insignificant low fees, staking, DAO or decentralized autonomous organization on blockchain and enterprise-grade blockchain dapps. It is a Dapp that is many times greater with an order of magnitude against other blockchain platforms around. Defibox is the one wherein an all-in-one platform which is perfect for the Defi chad when it comes to earning, staking, and trading plus providing liquidity to the entire EOS ecosystem.

Do you know when was Defibox launched? It was launched just this July 21, 2020. An infant when it comes to the launching date but a King already when it comes to Decentralized finance because of its features. Defibox has several other features wherein I will talk about today.

Features of DEFIBOX and its competitive advantages

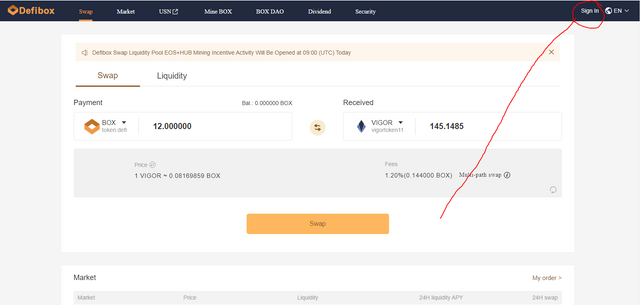

- DEFIBOX SWAP--> This is the first feature of Defibox wherein you could swap/trade your EOS coin to other EOS-built tokens or swap/trade your EOS-built token to another EOS-built token and vice versa. The beauty of this Defibox swap is that it is non-custodial guys! When we say Non-custodial, you own your private keys, you own your coins and tokens, you own your pace of trading and swapping! Because in this DEX, There is always enough supply of tokens to get swapped to. A lot of big-time traders are on EOS blockchain as well. Meaning, there is always an instant swapping of tokens that you need that matches your trading needs.

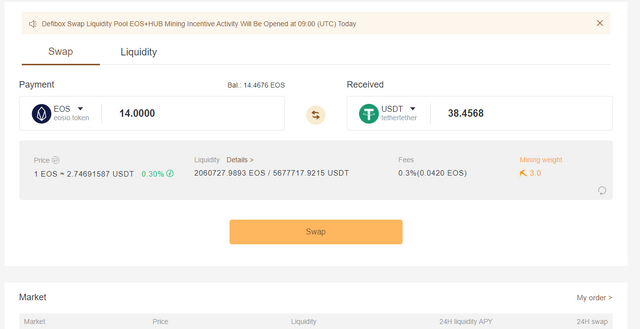

Here is a screenshot of the DEFIBOX SWAP from my account:

As you can see here, I have a balance of about 14 EOS and if I wanted to swap it with USDT, I will be able to get 38.4568 USDT instantly! In Defibox Swap, no more buy walls or sell walls to mix and match just to facilitate the transaction. This is instant and the fees are so low and it will be earned by the liquidity providers to the EOS platform so basically the money revolves around EOS and everyone is getting the opportunity to earn! The algorithm of price setting is that EOS has their own oracles to always match the market's price to the liquidity pool price.

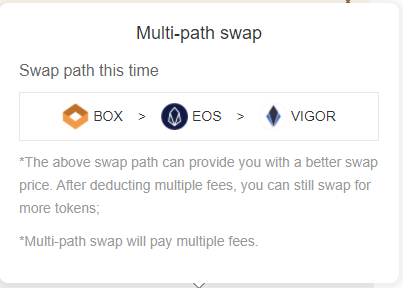

Multi-Path Swap--> This happens algorithmically by the Defibox to seek the best swapping price with the tokens/coins you want to swap. It is for your own good as well. Take a look at this screenshot from my end.

Earning as a DEFIBOX Swap liquidity provider

---> Now here is the exciting part for me which I know for you too. If you are into Defi, we know that as a liquidity provider, we earn fees right? Same here in Defibox but with more added functionality, higher APY and earning opportunities!

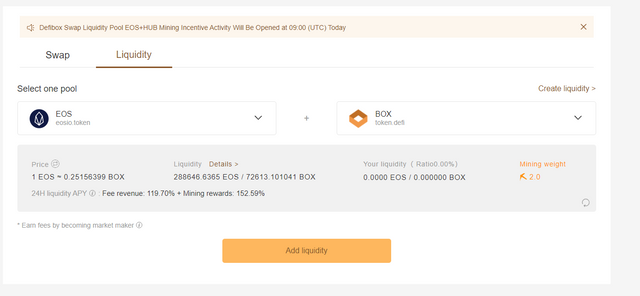

With being a liquidity provider on Defibox, you will earn a certain percentage of the revenue fees which is described on each EOS token pools that you would wish to add liquidity based on the tokens you hold on your wallet. So for example you wanted to provide liquidity for certain pairs of EOS tokens like EOS coin and BOX tokens.

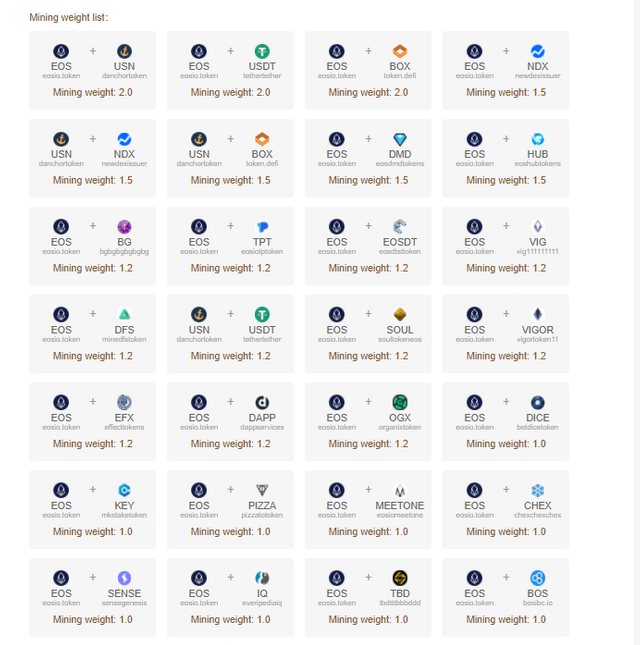

As you can see here, there is a detailed description as to how many EOS is equivalent to 1 BOX and vice versa. Next one is the liquidity pool of this EOS-BOX pair. It also shows the mining weight of the pair. When we say mining weight, it is the partake of a specific pool in the mining of BOX tokens while it is being unlocked per second. The rate as of this moment is 0.0896 BOX per second for liquidity mining. So, if you are going to be a liquidity provider, a tip is to choose a pair that has the greatest mining weight to factor out which token pair are you going to put liquidity into.

Here is the mining weight as seen here: https://defibox.io/mining

Not only the mining weight that needs to be a factor in when you are providing liquidity but also check the 'Fee revenue' and the 'Liquidity mining rewards' percentages. As always in APY, the higher the better.

The 'fee revenue' percentage refers to the APY in general liquidity pool that all liquidity providers at the present time is earning. Of course it will change depending on how many people are into the pool and how much are being provided in the liquidity pool.

The 'Mining rewards' percentage is the amount wherein the certain pool will be able to mine the BOX tokens as the

reward for providing liquidity. The higher the better. No matter how much you hold if you are already on the liquidity pool and you saw what you saw on those percentages, you are expected to earn a certain percentage that is being shown in the computation.

So in the liquidity pool and swapping not only make you earn thru fees and trading but also you are getting a piece of the pie of the BOX tokens that are being generated per second for the Defibox users!

I created a table wherein how Defibox Swap is better than Uniswap and other types of swap protocols around. But let us focus on Defibox swap vs. Uniswap since Uniswap is the widely known around.

The moment I realized the difference, I switched to EOS already.

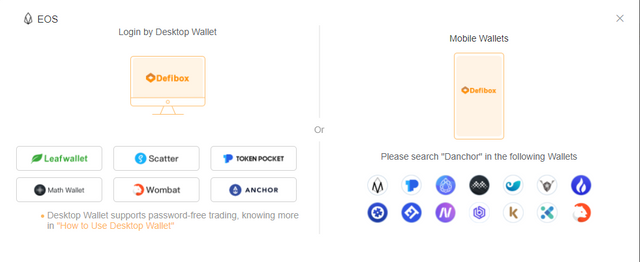

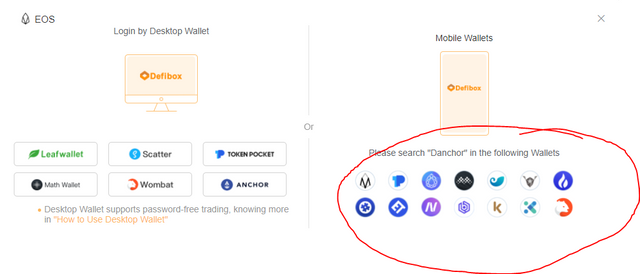

About the swapping and liquidity guys, you need to have one of the EOS wallets that is recommended to be used for the EOS Defibox space. Here are the wallets available for EOS ecosystem. I personally use Wombat because I am always on my laptop and it is the one that is best for me in my opinion. But there are a ton of choices here!

Look at here for Desktop wallet. It will surely link you to the mobile wallets as well.

https://support.newdex.net/hc/en-us/articles/360028370252-Desktop-Wallet-Tutorial

If you wanted to sign-in using Mobile and want to download mobile app wallets, go first to https://defibox.io/

Then click sign-in

Then on your mobile, it will show this one. Just choose the wallet app that you wanted to use out and download it on your phone. Always remember to keep the private key and no one else knows it because if they have your private key, they can get your funds!

2. USN

---> Defibox is from the EOS platform and funded by Newdex. It has the same programming codes and the functionalities with in terms of Defi applications. What makes this more exciting is that Defibox can be used for the generation of the USN Stable coin

First, let us talk about what a stablecoin is. A stable coin is a type of cryptocurrency that is being pegged to 1 US dollar always. Well, stable coins are still being traded with one another as well. It is the protocol of the stablecoin to always reach the 1 U.S Dollar.

Now, we got USN. It is the stablecoin of EOS platform. It is formerly known as Danchor. It is called that because in my opinion, it is anchored always to the price of 1 USD as what the stablecoin is all about.

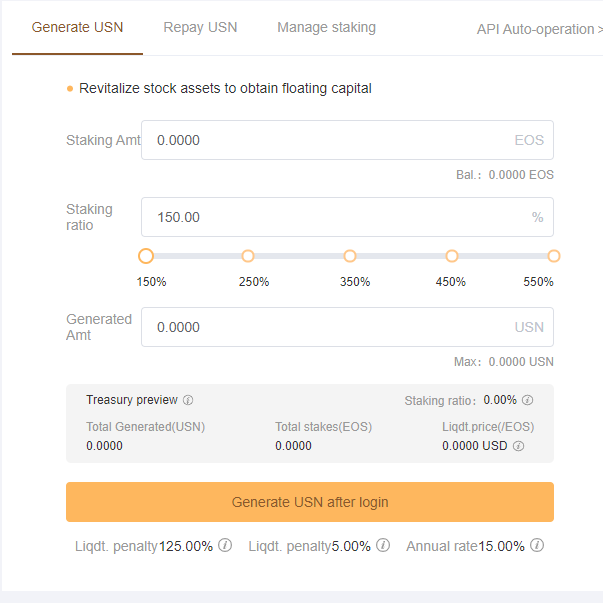

The USN can be generated with the use of EOS coin by going to this process:

a. Go to https://danchor.io/generate

b. You may want to fill out the details needed in the form for generating USN

c. Click the 'Generate USN' button to mint new USN based on your EOS token to be deposited as the asset backing up the minting of USN.

The advantage of this is that since you have USN, you could use it to go yield farm or use it as a way to buy other tokens without selling or trading your EOS tokens in the smart contract of Defibox and USN platform.

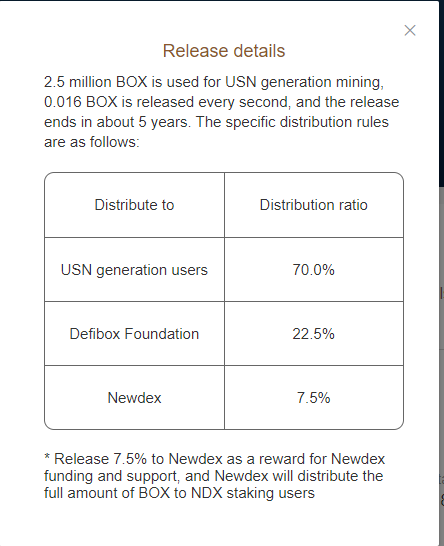

The good news in here is that while you are finding other ways to yield farm on Defi, the Defibox foundation sets aside 2.5 million BOX tokens to be mined when you generate USN. Yes you heard that right! The total BOX tokens for USN generation will last for the next 5 years. Here is a screenshot from the Defibox for the details of mining BOX for generating the stablecoin USN

Source: https://defibox.io/mining

3. NDX Staking to mine BOX

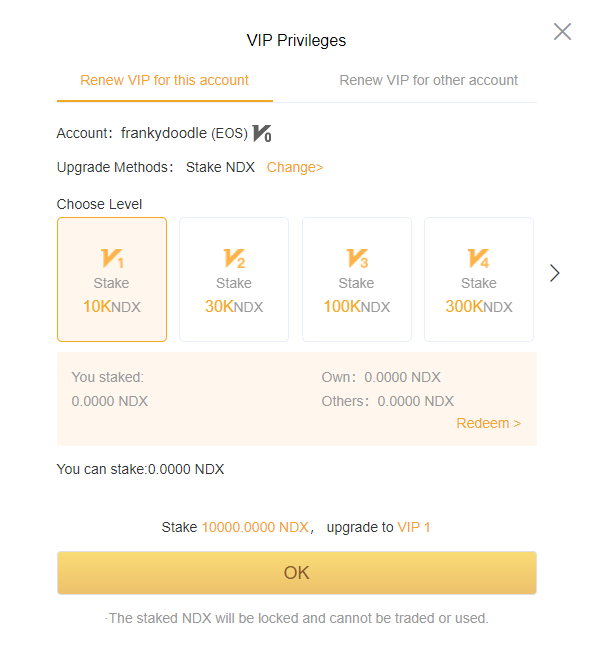

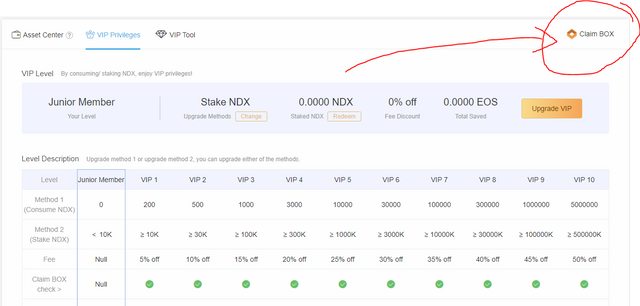

You may also want to stack some NDX to be staked using the VIP membership of the Newdex platform. Because if you do, you may claim BOX tokens hourly as well! The steps below can be followed to be able to mine BOX using NDX staking on the platform.

At the time of this writing, 10,000 NDX which is needed to be able to upgrade from regular member to VIP level 1 is only 13.3 US Dollars. The more NDX you own and you stake, the higher will be your BOX rewards as well hourly.

Take a look at this from my EOS account

1st step: Go to https://newdex.vip/member

2nd step: Stake your 10k NDX or more after you bought it from the Newdex exchange which is a great DEX as well.

3rd step: Just click the Claim box button once you have staked and just click it from time to time if you wanted to claim it hourly and just let it be and do its work then claim it once it is bigger.

4. DEFIBOX DAO Governance and Dividend sharing

Source image: https://cryptooa.com/decentralized-autonomous-organization-dao/

For the last but not the least part of our discussion with Defibox, it is the DAO or the Defibox Decentralized Autonomous Organization on EOS blockchain.

What is a DAO?

--> Here is my personal explanation and quick brief about it. DAOs are organizations built on the blockchain wherein these people who are collaborating and voting on how the blockchain project's direction will go to since they are holding a big chunk of the market share of the certain coin. But that's not all. Even a small participant can join as long as they are holding or owning in their wallet any amount of coins of the said project in this example Defibox.

The more Defibox you hold and the more you stake it on the DAO, the more voting power you have as a market shareholder of the coin. You 'OWN' a percentage of the coin whatever how small or big it may be but better if it is bigger as you have more voting power of the project. You are the believer of the project and holds it that is why you have more voting power to vote into.

The DAO could be used to vote for adjustments whether it be on how the rewards are being distributed, how long, what percentage will be for the staking for this and that etc.

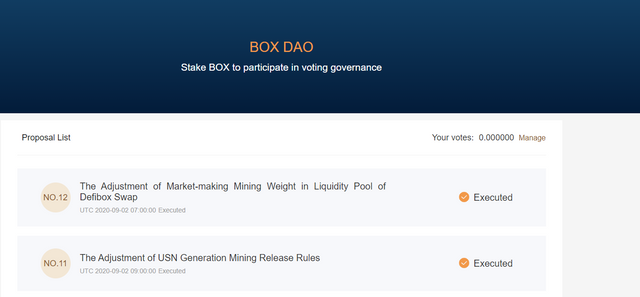

If you wanted to see the Defibox proposals and how voting works, check it here: https://defibox.io/proposal.

Here is the sample screenshot from their DAO's accomplished voting rounds.

At the early stages of the Defibox project, it is of course under the management of the Defibox foundation. But as time goes by, those Defibox holders who hardworkingly stacked BOX tokens from staking and other means like trading will be the one to maneuver the future of the Defibox platform. Defibox foundation knows that The community is always the best one to decide on how the journey of Defibox goes through this Defi adventure.

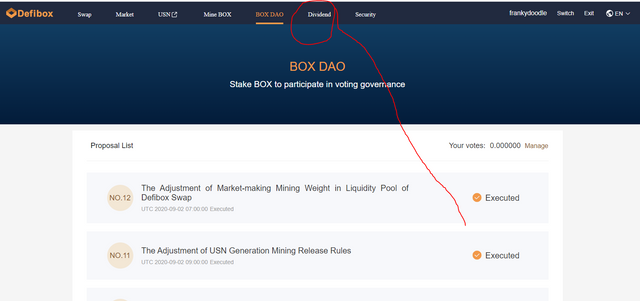

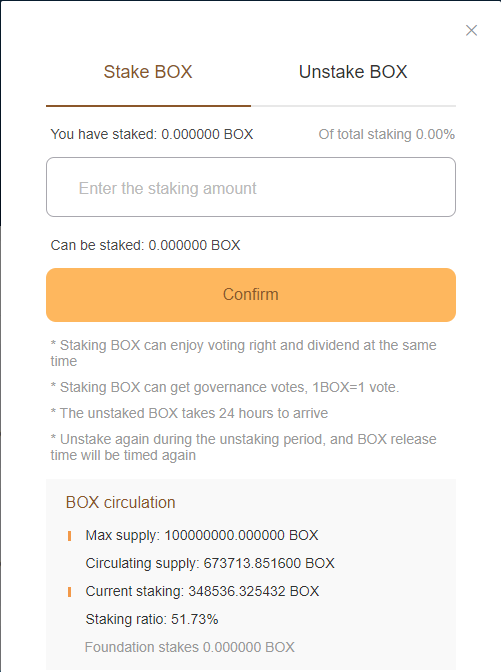

Dividend sharing from staking BOX

If we could stake EOS to earn BOX, we can also stake BOX to earn EOS! That is the logic in the Defi world. Now, to earn EOS hourly as well, here are the steps:

1st step: Go to https://defibox.io/

2nd step: Click the Dividend

3rd step: Enter the amount you wanted to stake and click the 'Confirm' button and you are good to go staking!

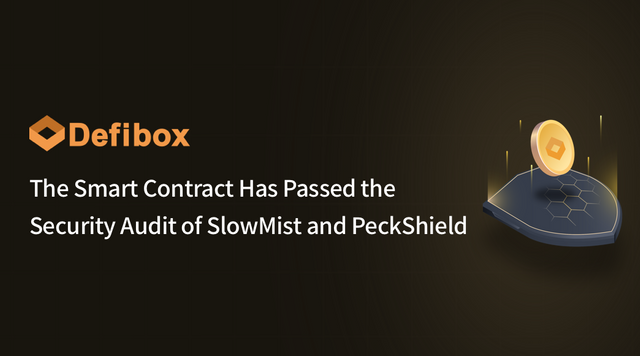

5. Security

If I am investing in the blockchain, I wanted my funds to be secured and safe in the smart contracts whatever the blockchain it may be. That is the top priority of the EOS blockchain developers and community which made me very impressed with their work and dedication to making Defi on EOS in easy, hassle-free, and peace of mind that you know your funds are in good hands in the hands of the smart contract creators are competent and secure.

That is why Defibox had their smart contract get checked and audit by the top security auditing firms/companies like Slowmist and Peckshield.

A security audit report from Peckshield: https://support.newdex.net/hc/en-us/articles/360048886631

A security audit report from Slowmist: https://support.newdex.net/hc/en-us/articles/360048886891

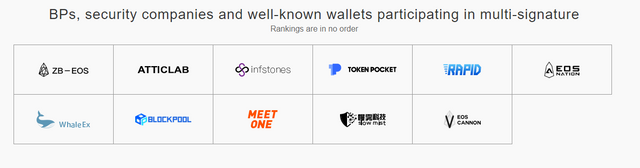

Defibox employs Multi-signature smart contract

--> When we say Multi-signature smart contracts, in layman's term means that any modification or new version of the smart contract before it can be deployed for use is that it needs the majority of the node operators from different parts of the world and have a consensus of the vote. So there is no way that if someone wanted to change the code, it won't happen without the consent of the major community from EOS and security companies which are:

A summary of the Defibox ecosystem and the features to come

So for a quick summary of the features, here is what I learned from Defibox.

Defibox Swap: You can earn BOX tokens every time you swap pairs of tokens in the Defibox platform.

Defibox Liquidity pool: Aside from earning trading fees depending on your pooled tokens from the whole 0.2% trading fees earned of the Defibox, you will earn BOX tokens as an incentive.

USN/Stablecoin generation: You will earn BOX tokens by minting USN using your EOS coins.

NDX staking: You can earn hourly BOX tokens when you stake or upgrade to VIP with 10K NDX and above (13.3 US dollars per 10k NDX tokens at the time of this writing).

Staking BOX to earn EOS: By staking BOX on Defibox, you could earn a drip of EOS from time to time.

Security: Top-notch smart contract developers and audited smart contracts for secured transactions

More to come DEFI features to talk for Defibox

a. Decentralized lending--> Defibox on their white paper said that they will have decentralized lending and borrowing wherein BOX tokens again will be the incentive on top of interests! Which is about 10 million.

b. Synthetic assets mining--> 10 Million BOX tokens for this one again. Not far from now, we will see boxUSD, boxUSDC, etc.

c. Other mining--> There are 50 Million BOX tokens being set aside for this and could be by that time, we are big holders of the EOS platform already. See you soon BOX whales!

Thank you to the EOS community and crypto community for reading my content for today. Defibox will really be the one to improve not just the global circulation of assets and money but the Newdex and Defibox foundation will uplift a billion lives through this opportunity. Thank you again!

For visualization of the words I expressed here, you may check these videos on how to navigate and use Defibox for the future of Defi and your financial future success!

Exchanges on where to buy Defibox

A. Biki

https://www.biki.cc/en_US/trade/BOX_USDT

B. Gate.io

https://www.gate.io/trade/box_usdt

C. Dragonex

https://dragonex.io/en-us/trade/index/box-usdt

D. Newdex

https://newdex.io/trade/BOX_EOS

E. Hoo

https://hoo.com/spot/box-usdt

https://hoo.com/spot/box-eos

If you wanted to know more details about Defibox, EOS and the whole information and ecosystem, you may check and visit their website and social media channels which I will post below:

Website: https://defibox.io/

White paper: https://support.newdex.net/hc/en-us/articles/360046066792-Defibox

Twitter: https://twitter.com/Defiboxofficial

Telegram: https://t.me/Defibox

Newdex: https://newdex.io/

Proof of authorship

About the author--> EOS account: frankydoodle

‘This article is for the Defibox article contest’