The new EOS token that Jeff Berwick is promoting as an Etherum Killer, appears to be not a good investment.

Here are some possible problems with EOS:

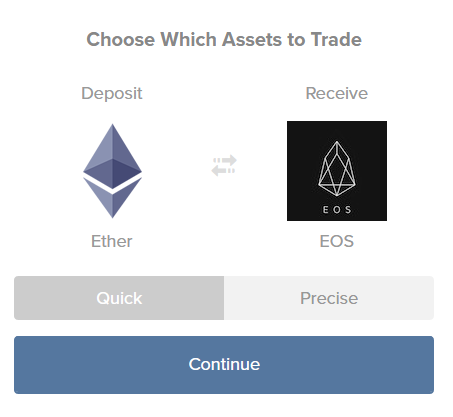

1. This EOS token is just an Ethereum sub-token

That in itself is not a direct indicator of no value, as there are many sub-token coins being put out that do have a backing in value. For those unfamiliar with how Ethereum sub-tokens/coins are made, they are just made using the Ethereum contract mechanism ( a contract is a simple program) , most likely using code written in the Solidity language. The 1 billion EOS tokens that were created could have been made simply like this, using Solidity code: eos_tokens=1000000000; In fact, there is an example program on how to make your own Ethereum sub-coin token right on the Ethereum website, so feel free to give it a try and make your own: https://www.ethereum.org/token You can use the online Solidity program editor: https://remix.ethereum.org/#version=soljson-v0.4.13+commit.fb4cb1a.js That's all it would take, no mining needed. And now they are selling these things at a rate of about 125 EOS to 1 ETH... because they want ETH, ETH has the value, at least right now.

2. This Ethereum ERC20 EOS token is not in any way connected to any future EOS platform tokens that will run on any future blockchains

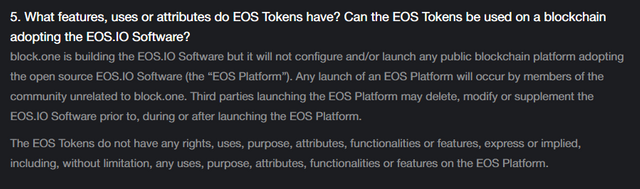

The http://eos.io/faq.html says that the tokens you buy now may be included in any future block chains that use the EOS platform, but that would be based on the people who start any of the future blockchains. The tokens, themselves don't have any rights, uses, purpose, attributes, etc., etc. ... (read more in the attached image from their website):

3. There can be multiple EOS blockchains created, and block.one, the company issuing these Ethereum ERC20 EOS tokens will not configure or launch or have control over any of them

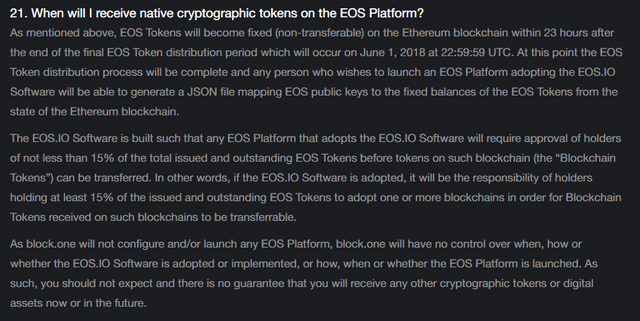

This doesn't seem so bad, as it requires 15% of EOS ERC20 token holders to approve of transfer to one or more blockchains. But what if there are 10 blockchains or even worse, the software doesn't work as promised and there are no blockchains? The company getting your ETH, block.one, won't have any control over it, and there is no guarantee that you will receive any other cryptographic or digital assets, now or in the future; and if people are trading in those future real EOS platfrom tokens, how much will your Ethereum EOS ERC20 token be worth then? They make sure to state this again in a bold printed note on the white paper, that you are not getting any of the not-yet-in-existence EOS blockchain tokens, as those blockchains don't exist:

4. The Technical White Paper has a huge disclaimer at the top.

The white paper sounds awesome, as it has amazing features, if they can pull it off. However, the disclaimer at the top of the white paper says that they don't guarantee any of it working or that any of it is even accurate... maybe the lawyers at block.one don't trust Dan? With that disclaimer at the top, this becomes more of a Brown Paper:

5. More Power = Easier To Hack

The more power a programming language has, the easier it is for million dollar mistakes to slip through, just like the flaw in the Parity contract last week, where a few companies had over $32 million dollars of ETH stolen from them. This was just a minor misunderstanding in the coding of the Parity contract, and as Dan has mentioned, the language that Ethereum contacts in, Solidity, is not a very powerful language. If EOS has a far more powerful language, it will be able to have far bigger mistakes made.

In conclusion: Comparing this to other Ethereum sub-tokens like TenX, EOS appears to fall way way short. They promise nothing, they tell you up front it is worthless (except what you can sell it to someone else for), and they don't even stand behind their own white paper. I know Dan was saying he didn't want to jump the gun on releasing the software, but I think they jumped the gun on collecting money for it. Comparing to TenX again, TenX had a product BEFORE they did their fund collecting; and at least they are very transparent about what they are doing, posting YouTube videos daily on progress, and hiring and the like, slack channels, etc... where has the $232 million gone that EOS has raised? Plus, TenX has a clear statement on how their token holders will make money. EOS says they don't owe anyone anything right in their Faq, so where is the incentive to complete this, since they have all the money already? I would love to hear all of your thoughts on this. Personally, I'm going to hold off on this EOS ERC20 subtoken, and wait for the real ones, if they ever come into existence. If they do come into existence, they may not be called EOS, they may be called multiple other things, just like many coins have used the Bitcoin software to make their own coins; and who is to say that Bitcoin and Ethereum couldn't just use any knowledge gained here to improve those existing blockchains? Thanks for reading!

Hi! I am a robot. I just upvoted you! Readers might be interested in similar content by the same author:

https://steemit.com/crypto/@steemir/is-the-new-usd232-million-ethereum-eos-token-mostly-hype

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your follower :), and i like your posts. i see you also vote up ? @ronaldmcatee

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit