What is ESG Investing?

ESG is an abbreviation that means Environment, Society, Governance. ESG investing combiles these non-financial factors are now becoming a trend, and investors analyze these factors as a part of their research process to identify the right investment products aimed to transform the world into a better place. Moreover, today’s investors choose to avoid investing in alcohol companies, tobacco manufacturers, coal mining and weapon manufacturing companies, and others who may be or is involved in environmentally-unfriendly industries or in bribery, corruption, money laundering.

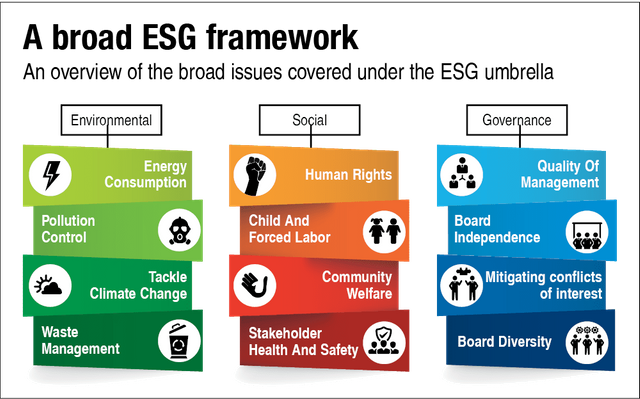

Human rights, child or forced labor, air and water pollution control, carbon emissions and energy consumption are also a part of research to identify ESG investment products. ESG Investing is also known as Sustainable investing and Socially-Responsible Investing.

ESG Key Factors are included in the infographics:

ESG Investing becomes a trend

Covid-19 pandemic has significantly accelerated ESG transformation of global corporations and top-tier financial institutions, including wealth management companies, mutual funds, banks, electronics manufacturers and even cryptocurrency mining companies. Most of key industry players already provide ESG investment products as they are highly demanded by retail and institutional investors. The idea of investing in a better world becomes more important than performance or growth potential, and wise investors put the future of next generations on the first place. The world changes and so do investors’ objectives and motivations.

The appetite to ESG Funds is growing from all age groups, especially from millennials, who are mostly looking to choose the investment products that provide additional value to returns. Moreover, ESG investing factors are becoming increasingly critical for portfolio managers and offshore investment funds.

Read more: https://einvestment.com/esg-funds/