Australian housing bubble continues to power forward with valuations at ungodly levels and net yields in real terms going negative. I see 2018, as the time that Gold / Silver break out of the wedge formations ( see chart below) and really outperform the debt bubble in housing and all other financial assets.

First, let's explore why is the housing market in a bubble.

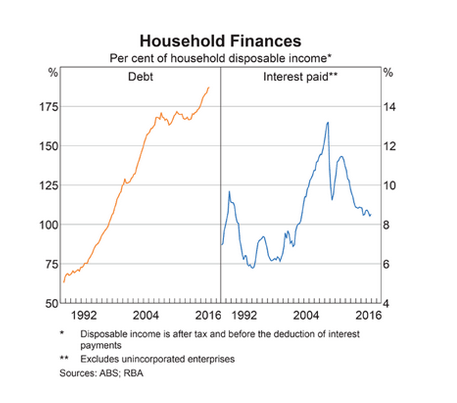

Rising interest rates out of the US will pressure Australian banks, who finance 35% of their loans from offshore funding. As rates rise internationally, Australian banks will have to pass it on to the debt serf. The Australian serfs hold approx 189% household debt to GDP. The Only way they have been able to sustain the chains is via lower interest rates and the willingness for the banks to keep lending. Literally keeping it all together, meanwhile delaying and growing the problem.

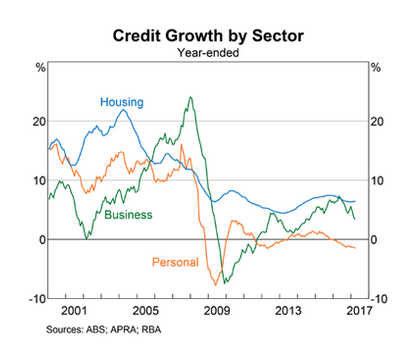

Oversupply. The cure for high prices is high prices!. This means demand will be fulfilled due to the crazy money that builders and all parties involved are making. The synthetic demand which is driven by loose lending has allowed such creation of massive oversupply. Melbourne alone is sitting on 100k+ empty homes stock and rising. Syndey figures aren't too far behind either. That is what is accounted for. Other estimates are far greater.

Slowing credit growth in the business sector will put a strain on the economic activity whilst pressuring wages and rising unemployment. Below chart showing clear signs of deflationary pressures building as credit expansion now contracts.

House prices are now 13 years x average yearly salary in Sydney and near 11.5 x in Melbourne, only second to Hong Kong, a Chinese tax haven. Wages have moved a measly 11% nominal in 7 years while prices depending on the area, houses are up 200-400%. Wages are most likely gone negative in real terms as core CPI is flawed. Doesn't include food nor energy!

Note: USA only had 6.6years x salary when it popped 50-70%.

The bubble is clear and a crashing is coming, the question is when? Like a game of musical chairs, the bears are waiting for the music to stop, whilst the serfs drown in debt thinking 'this is Australia, it is different'.

In my opinion, cashing out and holding worthless Australian Dollars will no grow your wealth. Australian Banks are exposed to new G20 laws and deposits are now only covered up to 250kAUD from any bail in. Holding USD in this scenario would be okay, but has its own risks. Hence I prefer to play the House vs precious Metals.

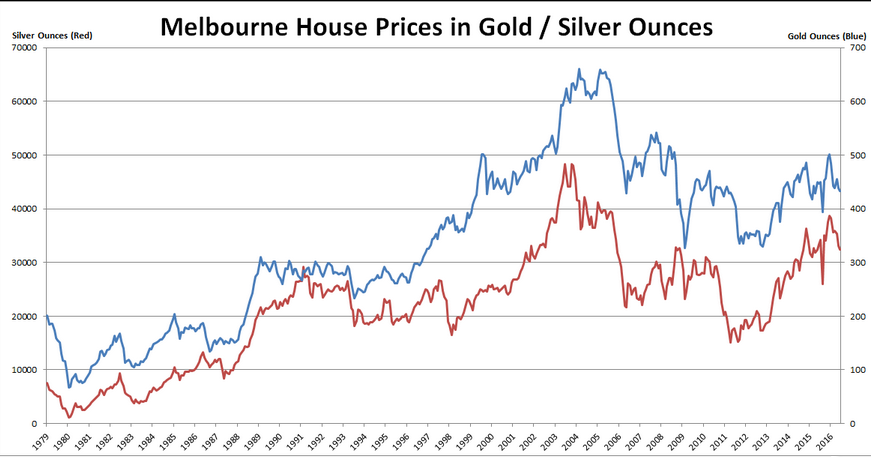

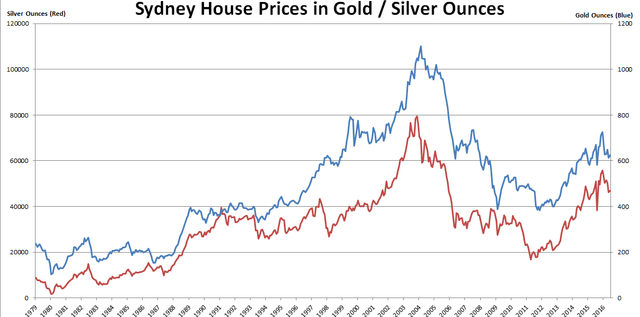

Below are current ratios in the two major cities, Melbourne and Sydney.

Melbourne (Ounces to buy a house)

Precious Metals Peak (January 1980): 67oz Gold, 1181oz Silver

Housing Peak Against Gold (February 2004): 661oz Gold

Based on Current Spot Price: 417oz Gold, 27,519oz Silver

Sydney (Ounces to buy a house)

Precious Metals Peak (January 1980): 103oz Gold, 1811oz Silver

Housing Peak Against Gold (February 2004): 1100oz Gold

Based on Current Spot Price: 603oz Gold, 39,741oz Silver

I think the top is near in housing vs Gold/Silver, and a resumption of Gold/Silver going alot higher vs housing will surpass many expectations, perhaps come close to the 1980 peak (see figures above). I am always reminded by the bulls 'i have heard it all before' ' The government will never allow it' or 'property never goes down'. Just remember the only thing that has inflated the market is not only the willingness of the banks to give money to anyone but as the debt has grown, interest rates have been lowered thus only materially impacting monthly repayments. Rising rates will crush household income and debt markets. Banks willingness to lend just like in the GFC will be non existent. A cash market will mean a 50%+ drop.

I personally am buying bullion as part of this gameplan, as it is outside the banking system and no one elses liability.

What to look for? Gold the anti-economic growth and hedge against central banks, is still in a triangle wedge formation.

The apex of the triangle breaks in Q1 2018 and either it goes to 971usd an ounce or it breaks to the upside with targets of 2400usd+ and beyond. I believe this is the best way to play the game.

Below are my thoughts only, do your own research. Note: i didn't even bother mentioning the China factor of them buying up and rising prices, because they too have the same coming issues. Thank you for reading.

can you hear that hissing noise. I can

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What's driving the market, gold and silver have different motivations, housing is due for a significant correction, anyway most Victorians are moving north for some warmth and cropping up on the Goldie and Brisvegas, which explains the Victorian oversupply. Heck, four seasons in one day, why wouldn't you?

China factor, new overseas money controls, no Aussie bank lending and now the drop from $2m to $750k property tax issues from the ATO, Chinese are not a factor, Sunland etc are going to suffer with their China marketing, so high density sales will cool in QLD.

Gold and Silver will be stable for a while now that France is pro Euro and only the Germans to vote later in the year. No money movement is now towards Crypto not Gold and Silver and yes we just shifted oz into BTC

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit