Bitcoin is an online communication protocol that facilitates the use of a virtual currency, including electronic payments. Since its inception in 2009 by an anonymous group of developers (Nakamoto 2008), Bitcoin has served approximately 62.5 million transactions between 109 million accounts. As of March 2015, the daily transaction volume was approximately 200,000 bitcoins—roughly $50 million at market exchange rates—and the total market value of all bitcoins in circulation was $3.5 billion (Blockchain.info 2015). Table 1 summarizes Bitcoin activity to date. (We will follow the convention in the computer science literature of using capital-B Bitcoin to refer to the system, and lower-b bitcoin to refer to the unit of account.)Bitcoin’s rules were designed by engineers with no apparent influence from lawyers or regulators. Rather than store transactions on any single server or set of servers, Bitcoin is built on a transaction log that is distributed across a network of participating computers. It includes mechanisms to reward honest participation, to bootstrap acceptance by early adopters, and to guard against concentrations of power.

Bitcoin’s design allows for irreversible transactions, a prescribed path of money creation over time, and a public transaction history. Anyone can create a Bitcoin account, without charge and without any centralized vetting procedure—or even a requirement to provide a real name. Collectively, these rules yield a system that is understood to be more flexible, more private, and less amenable to regulatory oversight than other forms of payment—though as we discuss in subse-quent sections, all these benefits face important limits.

Bitcoin is of interest to economists as a virtual currency with potential to disrupt existing payment systems and perhaps even monetary systems. Even at their current early stage, such virtual currencies provide a variety of insights about market design and the behavior of buyers and sellers. This article presents the platform’s design principles and properties for a nontechnical audience; reviews its past, present, and future uses; and points out risks and regulatory issues as Bitcoin interacts with the conventional financial system and the real economy.

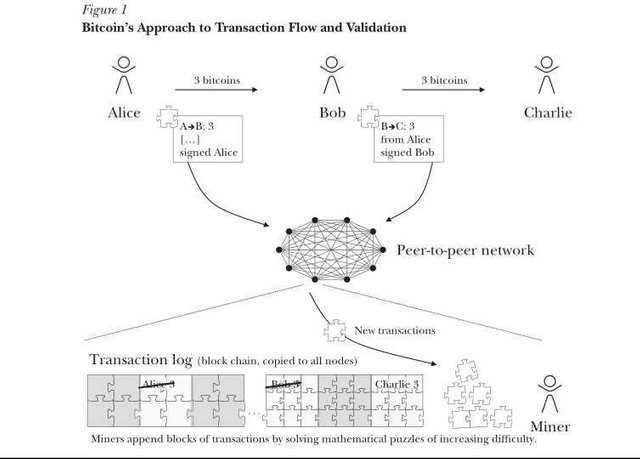

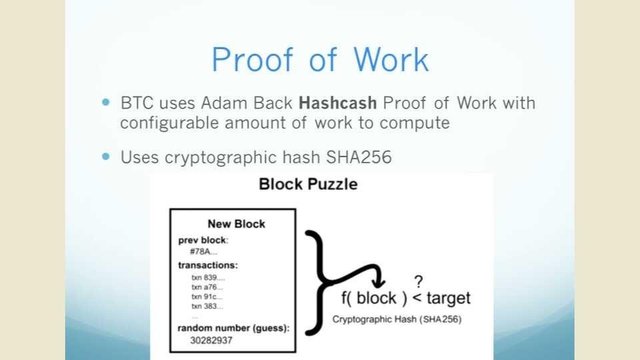

Bitcoin Design Principles Scarcity is a prerequisite for ascribing value to any form of money. At a micro level, scarcity protects against counterfeiting. More broadly, scarcity bounds the growth path of the monetary base and facilitates price stability. In modern econo-mies, where money is held in electronic forms, scarcity is preserved by legal rules ensuring the correctness of bookkeeping records: that is, electronic money involves a financial system in which transactions trigger a credit for one account and a corre-sponding debit to another. Central banks hold the power to adjust the absolute quantity of money in circulation.Against this backdrop, Bitcoin can be understood as the first widely adopted mechanism to provide absolute scarcity of a money supply. By design, Bitcoin lacks a centralized authority to distribute coins or to track who holds which coins. Conse-quently, the process of issuing currency and verifying transactions is considerably more difficult than in classic bookkeeping systems.

Meanwhile, Bitcoin issues new currency to private parties at a controlled pace in order to provide an incentive for those parties to maintain its bookkeeping system, including verifying the validity of transactions.Enabling Technologies and ProcessesThe “Bitcoin core” software can be freely downloaded at https://bitcoin.org/en/choose-your-wallet. The standard Bitcoin implementation includes a number of features. Typically, it creates a “wallet” file for the user that can store bitcoins (without giving a name or proof of identity); it creates an individual node for the user in the peer-to-peer Bitcoin network that can be used with a standard Internet connection; and it provides access to the “block chain” data structure that verifies all past Bitcoin activity...

Stay tuned for next article, I will be continue the research on cryptocurrency for my followers and I hope that you will be help me to continue

My website is here and Click this to show SteemVive inc

Twitter account is @steemvive

Linkedin account is Steemvive

Thanks for your support @jerrybanfield I always follow this awesome guy.. I also love him.. I know steemit from him.. thanks brother. good day everyone.

thanks for your support as well

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice one I followed you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for your support and staying with us..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for your support and staying with us..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good post.....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for you nice reply.. stay with us..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

excellent publication

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit