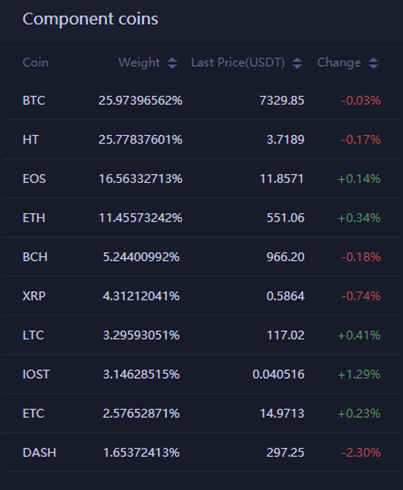

On May 23rd 2018, Huobi Pro announced the launch of “Huobi 10 Index” which is designed to track the performance of the 10 most liquid and capitalized cryptocurrencies listed on Huobi Pro and traded against Tether (USDT) in order to reflect the overall performance of the market. 8 out of 10 constituents of the new crypto index are familiar to many and are the most important assets: Bitcoin, EOS, Ethereum, Bitcoin Cash, XRP, Litecoin, Ethereum Classic, Dash. Together they account for almost 70% of the Huobi 10 Index.

The other two constituents may not be so familiar, they are “Huobi Token” (HT) and “IOST”. HTs are the native tokens of Huobi Pro Exchange (similar to Binance BNB) and they account for more than 25% of the index, while IOST offers an infrastructure for the Internet of Services. IOST proposes a sharding solution called Efficient Distrubuted Sharding (EDS) to solve the scalability issues faced by traditional POW blockchains, this solution merges EDS and a new consensus mechanism called Proof-of-Believability. Believability of a node is calculated based on contribution and behaviors.

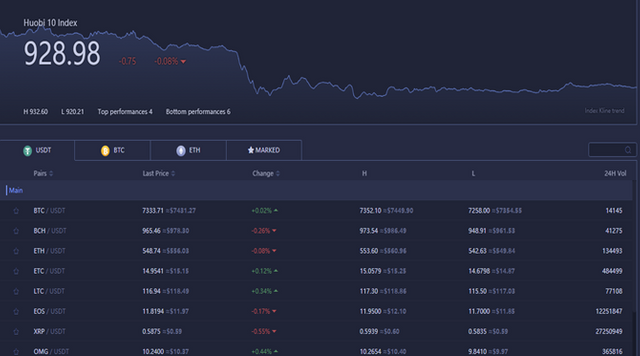

Here you can see a snapshot of the Index:

Huobi has chosen to reflect the market performance of USD Tether (USDT) pairs listed on Huobi Pro so that the value of the index is expressed and traded in clear U.S. dollar (USD) terms and therefore it can be used by institutional/professional investors as a reliable benchmark to track.

Huobi Pro is trying to follow the financial industry standards and harmonize the channels that connect the crypto-financial world with the traditional one. From their website: “On this basis, Huobi 10 Index is calculated by the formula of Pasche weighted composite price index, with the average daily trading volume of the previous quarter taken as a core index of sample selection”.

Also: "Assets will be ranked according to their turnover, and top assets of each category will be selected as index samples. After samples are selected, the sample weight will be calculated based on the daily average trading volume of the previous quarter."

The Huobi 10 Index matters because Huobi Pro ranks among the top 4 cryptocurrency exchanges by volume and others exchanges do not provide such instruments and data on their markets. According to Huobi’s official statement, the company is working with major index providers such as Bloomberg and S&P in order to see the Huobi 10 Index published by global financial communications agencies.

Huobi 10 Index has been launched with a base of 1,000 points and will enable traders to diversify their portfolios, track their trading performance (i.e. a new benchmark) and the market more efficiently, it will create new arbitrage opportunities and more liquidity as more funds will follow the index.

Huobi is now working on a June release of additional financial products such as crypto ETFs and futures contracts on its platform. More details will follow in the coming days.

Constituents Categorization.

According to the different properties of the blockchain assets, the constituents of the Huobi 10 Index can be divided into four categories: "coin", "platform", "application" and "real asset token".

“Coin" refers to blockchain native tokens (such as BTC or LTC) used mainly to make transactions and move/exchange value. In this case the value of the coins comes mostly from liquidity.

The “platform” assets refers to tokens associated with development of the underlying blockchain technology and supported by the right to use or to participate in the platform (e.g. Ethereum, NEO, EOS).

The “application” assets refers to tokens associated with a specific application scenario (e.g. OMG).

The “real asset token” refers to digital currencies that are linked to real-wolrd assets such as gold, US dollar and other actual assets (e.g. DigixDAO, where each token represents 1 gram of gold certified by the London Bullion Market Association).

This categorization helps the Index to provide a better picture of the market where every kind of blockchain idea/project is represented.

Lastly, Huobi provided data on alpha/beta performances. According to the historical data from March to May, the alpha of Huobi 10 Index compared to BTC is -0.0028, while the beta of the index based on BTC is 0.79.

Invitation link: https://www.huobi.br.com/en-us/topic/invited/?invite_code=da523 Enjoy the benefits!