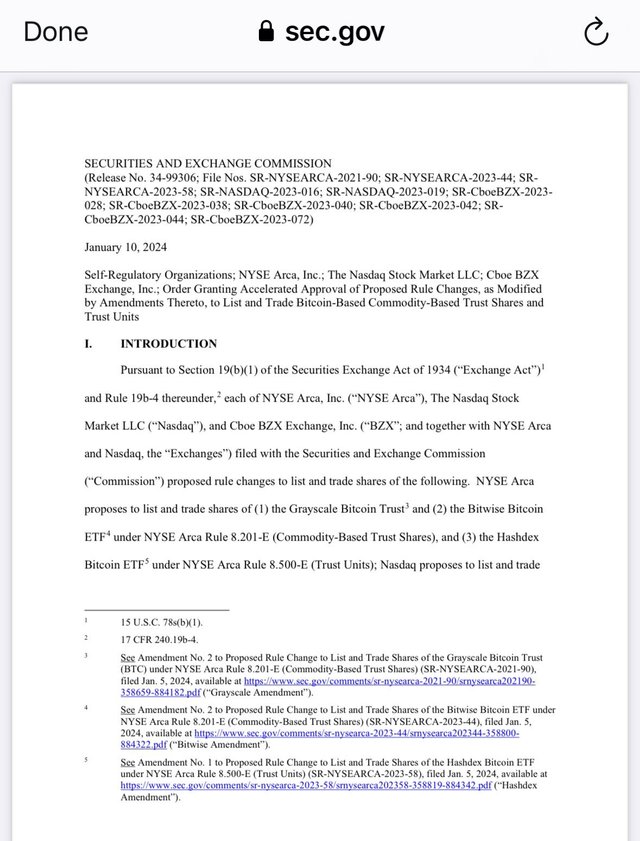

In a groundbreaking move, the Securities and Exchange Commission (SEC) has approved the listing of 11 spot Bitcoin exchange-traded funds (ETFs), heralding a new era for cryptocurrency adoption in traditional financial markets.

The Genesis: Understanding ETFs and Bitcoin

Imagine a bridge spanning the worlds of traditional finance and digital assets—a bridge built by ETFs. Exchange-traded funds are investment funds traded on stock exchanges, mirroring the performance of a specific index, commodity, or, in this case, Bitcoin. These funds provide investors with a regulated and convenient way to dip their toes into the exciting but volatile waters of the cryptocurrency market.

The Cast of Characters: 11 ETFs Ready to Shine

VanEck Bitcoin Trust (VBT): Stepping onto the stage, VBT promises investors a secure and regulated pathway to engage with Bitcoin's unpredictable dance.

ProShares Bitcoin Strategy ETF (BITO): With a strategic approach, BITO tracks Bitcoin futures contracts, offering a distinctive angle for those seeking exposure to the cryptocurrency.

Winklevoss Bitcoin Trust: The Winklevoss twins, known for their early Bitcoin involvement, introduce a trust that encapsulates their vision for a seamless Bitcoin investment experience.

Grayscale Bitcoin Trust (GBTC): Grayscale, a familiar name in the crypto space, now enters the ETF scene, extending its offerings to a broader audience.

Fidelity Bitcoin ETF: Fidelity, a financial giant, embraces the digital revolution by providing a platform for investors to seamlessly include Bitcoin in their diversified portfolios.

NYSE Bitcoin ETF: The New York Stock Exchange joins the party, adding legitimacy to the cryptocurrency market and attracting a wave of institutional interest.

WisdomTree Bitcoin Trust: With wisdom at its core, this trust brings a fresh perspective to the Bitcoin ETF landscape, offering unique features to attract diverse investors.

CoinShares Bitcoin ETF: CoinShares, a digital asset investment firm, amplifies its presence by introducing an ETF, providing investors with yet another avenue for Bitcoin exposure.

Global X Bitcoin Trust: Global X contributes to the global reach of Bitcoin investments, opening doors for investors from various corners of the world.

Bitwise Bitcoin ETF: Bitwise brings innovation with a focus on diversification, allowing investors to navigate the dynamic cryptocurrency market with confidence.

ARK Bitcoin ETF: ARK Invest steps into the ETF arena, offering an actively managed approach to Bitcoin investments, capturing opportunities in this ever-evolving market.

The Unveiling: When Will the Curtains Rise?

The excitement builds as investors eagerly await the debut of these 11 Bitcoin ETFs. The launch dates are expected to unfold gradually over the upcoming months. Each ETF will navigate regulatory processes and market dynamics before making its grand entrance.

Conclusion: A Symphony of Innovation

The SEC's approval of these 11 spot Bitcoin ETFs marks a harmonious convergence of traditional finance and the digital frontier. The stage is set for a symphony of innovation, inviting investors to participate in the cryptocurrency market with a newfound sense of security and accessibility. As the curtain rises on this transformative moment, the spotlight shines on a future where Bitcoin and ETFs dance together, forging a path towards mainstream acceptance and integration.