In the summer of 2020, DeFi initially demonstrated its manic energy. In the next 6 to 12 months, the power demonstrated by Bitcoin and ETH2.0 may far exceed the magnitude of DeFi. Blue Fox Notes has also published many topics in this area before: "Encryption Cycle and Value Flow", "BTC's Halving Effect: How to include the price? ", "Bitcoin Halving Effect", "ETH 2.0: Moving by the Wind", "Why is ETH Silent in the DeFi Carnival?" ", "10 Signs of ETH's Upward Development", "Seven Reasons Why ETH2.0 Will Create Economic Transformation".

Bitcoin's halving effect

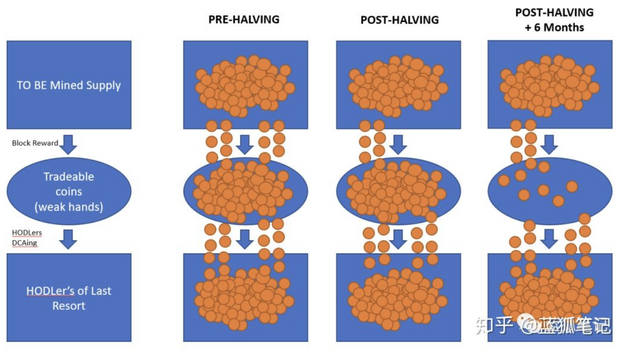

When Bitcoin halved in May of this year, everyone was very excited. But Bitcoin's halving is not an immediate effect. The Bitcoin halving will gradually show up over time. The reason is simple. With the halving of block rewards, the demand for Bitcoin has not decreased (or even increased), and the supply has become less and less. There will be no obvious impact at the time of the halving, but after a few months to a year, the halving effect will gradually become prominent.

The picture below is from MoonCapital, which shows the halving effect of Bitcoin very vividly. Only time can make it ferment.

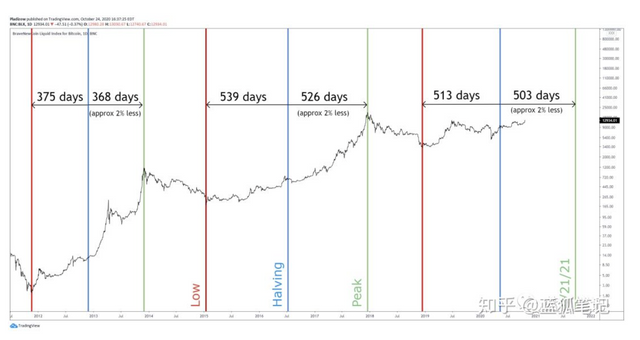

If we look at pure price dynamics, Bitcoin in history has shown us the following state, what will happen in the future? No one knows, but we can look at the evolution of history. If it still matches this time, then Bitcoin will enter the stage of self-prediction in the future. Because it will only lead to more and more "strong players" (hoarders).

The power of ETH2.0

From the perspective of ETH supply and demand, the influence of ETH2.0 is undoubtedly the largest in the history of Ethereum. It will exceed the impact of the previous 1CO and DeFi periods on ETH.

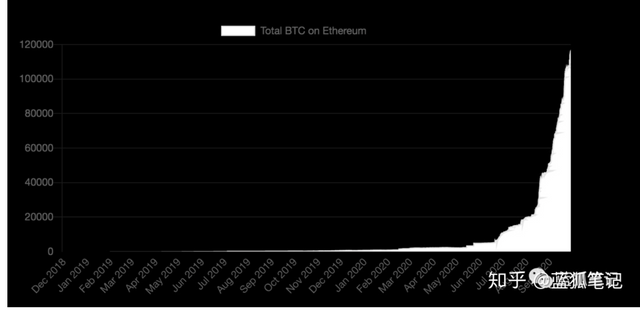

The first is that the PoS pledge mechanism generates a huge demand for ETH. At present, the ETH pledged on DeFi is about 8%, and the gray scale is about 2%. In the future, the ETH pledge of ETH2.0 is expected to reach about 30%. This will result in a significant reduction in ETH in circulation.

And we have to consider a situation is that about 60% of the ETH has been lying in the wallet for a year without moving. This means that within a period of time, the actual circulation of ETH will drop substantially.

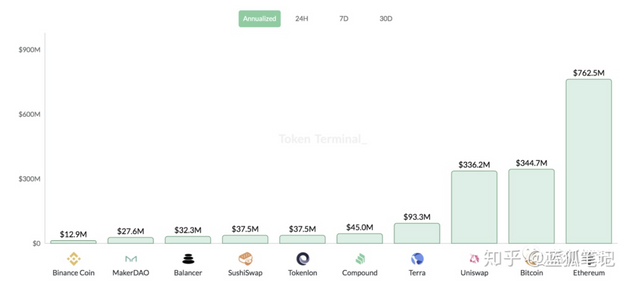

Second, Ethereum's EIP-1559 can capture value. The core of EIP-1559 is to destroy the basic transaction fees. At present, the transaction cost of Ethereum has surpassed BTC to become the largest value capture place in the encryption field. As of the writing of Blue Fox Notes, its annualized income fee income can reach 760 million U.S. dollars, about twice that of Bitcoin or Uniswap. .

For the EIP-1559 proposal, please refer to the previous article "Ethereum EIP-1559 and ETH Value Capture" by Blue Fox Notes.

(As of Blue Fox Note's annualized revenue ranking of encrypted projects at the time of writing, Soure: tokenterminal)

Even if the capture of basic fees is lower than the total amount of fees captured by the current bidding model, if the scale of Ethereum transactions continues to grow, then ETH can capture more basic fees. If the scale reaches a certain level, it may even cause deflation of Ethereum (in reality, it is unlikely in the short term, but this possibility cannot be ruled out). Once ETH enters deflation, this will lead to a cycle that will further promote the reduction of ETH circulation.

In addition, the current total amount of BTC is constant and Bitcoin is not deflationary. If ETH can enter deflation, it may cause ETH to strengthen its position as a store of value.

Before, people regarded BTC as digital gold, and its value storage position was unshakable. But if ETH enters a state of deflation, ETH may also compete with BTC in the position of value storage.

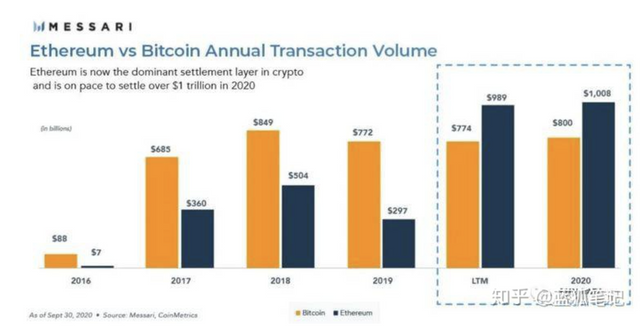

In terms of value settlement, Ethereum has become the first public chain with an annual transaction volume of more than one trillion US dollars, surpassing BTC. Ethereum surpassed Bitcoin to become the largest encrypted settlement layer. As shown below:

(Ethereum surpasses Bitcoin to become the largest settlement layer, Soure: MESSARI)

DeFi continues

A lot of the DeFi mining bubble in the summer of 2020 has been eliminated, but DeFi will continue, which is different from the crowdfunding boom in 2017. The current DeFi has actual product landings in terms of transactions, lending, derivatives, insurance, oracles, aggregators, and stablecoins, especially in the fields of transactions and lending and aggregators. The scale of its revenue has been in the entire encryption field. At the forefront.

When the BTC and ETH bubbles push up, DeFi may be relatively squeezed, but in the end people will find that BTC and ETH are too expensive, and then there are opportunities for DeFi who have actual products to land. Their product development and value capture will support them to move forward.

As long as there are truly solid products, agreements, and value capture capabilities, what should come will definitely come, may be late, but will not be absent.