The Bancor Protocol Ecosystem

Different parties can take on different roles in the Bancor network ecosystem. The primary forms of participation are as follows:

● End-Users can receive, hold, transfer, request, purchase and liquidate smart tokens.

● Smart Token Creators can issue new, always liquid smart tokens, that may be used for trading, token changing, as token baskets or as network tokens.

● Asset Tokenizers (e.g. Tether-USD, Digix-Gold) can issue ERC20 tokens representing external assets, thus enabling smart tokens to use these assets as reserve tokens. (Existing crypto-exchanges that operate under their local KYC regulations are well positioned to provide asset tokenization services.)

● Arbitrageurs are organically incentivized to constantly reduce gaps between prices on crypto-exchanges and the Bancor network. Smart tokens work similarly to exchanges in that purchasing them increases their price and selling them decreases it, so that the same arbitrage mechanics and incentives apply.

Bancor Network Token (BNT)

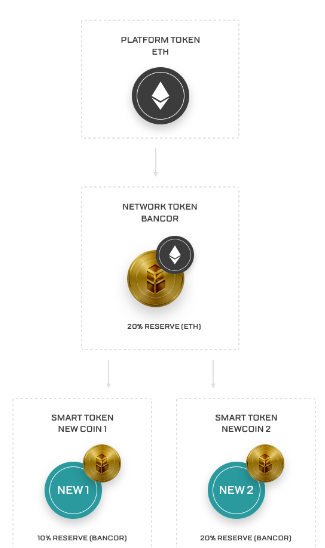

The First Smart Token The BNT will hold a single reserve in Ether. Other smart tokens, by using BNT as (one of) their reserve(s), connect to the BNT network using the price discovery method outlined in this paper. The BNT network will include user-generated smart tokens, token changers (forming a global decentralized, highly liquid exchange), decentralized token baskets as well as subnetworks.

Smart Token Transaction Flows

In this example, a crowdsale for a new token (BNT) has collected 300,000 ETH.

300,000 BNT are issued at a 1:1 ratio and transferred to the crowdsale participants. 240,000 ETH were directed towards funding the BNT project’s development and 60,000 (20% CRR) were kept in the BNT smart contract as a reserve.

● Purchasing and liquidating BNT becomes possible as soon as the crowdsale is completed. The opening price is the last crowdsale price, in this example 1 ETH for the first BNT.

● BNT liquidators get ETH from the reserve of BNT, the liquidated BNT are destroyed, and the BNT price decreases respectively.

● BNT buyers get newly minted BNT, their payment in ETH is added to the smart contract reserve and the BNT price increases. The ETH reserve always remains 20% of the BNT market cap.

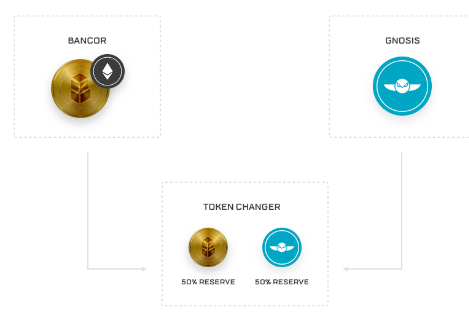

Token Changer Transaction Flows

In this example, a “BNTGNO” smart token is created to function as a token changer between BNT and GNO (Gnosis), holding both in reserve with a 50% CRR each, for a total of a 100% CRR.

Assuming a current market price of 1 BNT = 2 GNO, the contract can define the initial prices as 1 BNT = 2 GNO = 1 BNTGNO and in this example, 10,000 BNTGNO are issued to the depositors of the initial reserves.

● The opening prices are 1 BNTGNO = 1 BNT = 2 GNO as was set in the contract.

● The BNTGNO can be purchased with BNT or GNO. The BNTGNO price will increase for the reserve token it was purchased with (BNT or GNO), and decrease in the uninvolved reserve token (due to the increase in the BNTGNO supply).

● BNTGNO can be liquidated back to BNT or GNO, decreasing the BNTGNO price in the liquidated reserve token, and increasing it in the uninvolved reserve token. This scenario demonstrates how a 100% backed smart token with two 50% CRR reserve tokens can function as a decentralized token changer, open for anyone to use, with its prices organically balanced by arbitrageurs. Both the token changer and the token basket automatically maintain their CRR ratios.

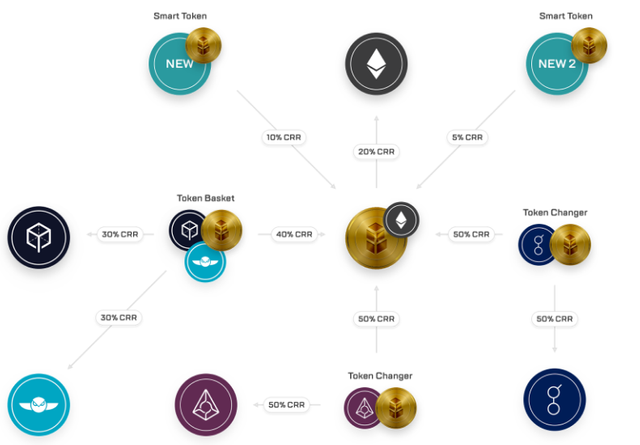

Illustrative Map of a Potential Bancor Network

● BNT - The BNT, backed by Ether

● ETH, DGD, DGX, REP and GNT are standard Ethereum-tokens

● NEW - New smart tokens created (e.g. crowdfunding campaign, a community currency, etc.)

● Smart tokens hold reserves (arrows point to the reserve tokens)

● Token changers are 100% backed, and hold two or more reserves

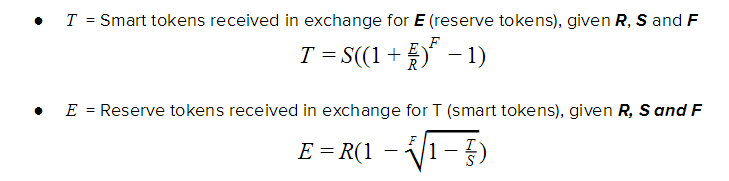

Price Calculation Per Transaction The actual price of a smart token is calculated as a function of the transaction size.

R - Reserve Token Balance

S - Smart Token Supply

F - Constant Reserve Ratio (CRR)

Summary

The Bancor protocol standardizes smart tokens, enabling asynchronous price discovery and continuous liquidity for cryptocurrencies using constant ratios of reserve tokens held through smart contracts, acting as automated market makers. The Bancor protocol enables the creation of hierarchical monetary systems with no liquidity risk. The BNT will be used to establish the first decentralized interconnected currency exchange system which does not rely on matching bid and ask orders, thus remaining liquid irrespective of its trading volume. This system proposes the first technological solution for the Coincidence of Wants Problem in asset exchange, enabling the long tail of user-generated currencies to emerge.

Nice blog. Interesting to see I'm not the only one that is thinking about this. The decision to buy a coin should be based on real analysis of the coin. I found that people keep buying coins without have any knowledge of them. This is considered high risk. An interesting website I found: https://www.coincheckup.com I don't know any other site that gives such good inisghts in the team, the product, advisors, community, the business and the business model, etc. Check for example: https://www.coincheckup.com/coins/Bancor#analysis For a complete Bancor Investment research report.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit