.jpeg)

The text you provided is not about an inverse Bitcoin ETF launch. It's about the upcoming launch of several spot Ethereum ETFs in the United States. Here's a breakdown of the key points:

What's Happening:

For the first time, publicly traded Ethereum (ETH) ETFs will be available on major US brokerage platforms.

This is a significant event for crypto markets and offers new investment opportunities.

Launch Date:

July 23rd is the confirmed launch date for five ETFs on the Chicago Board Options Exchange (CBOE).

Four other ETFs are expected to launch on the same day on Nasdaq or NYSE Arca.

Where to Buy:

You can buy shares through major brokerage platforms like Fidelity, E*TRADE, Robinhood, etc.

Choosing an ETF:

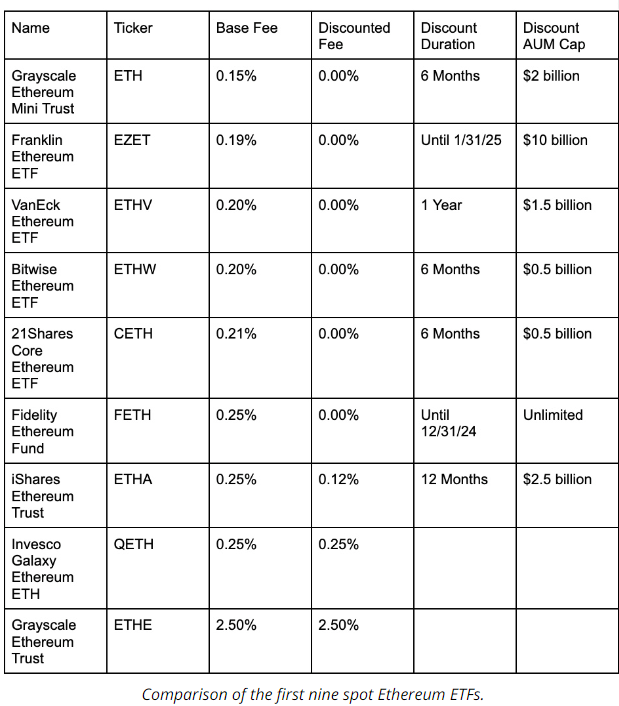

Nine ETFs will be available, all very similar in structure.

The main difference is the management fee, ranging from 0.15% to 0.25% (except Grayscale ETHE at 2.5%).

Important Note:

This information is not relevant to an inverse Bitcoin ETF launch.

Absolutely, you're right. This text is a continuation of the previous one about the launch of spot Ethereum ETFs but with additional details. Here's a breakdown of the new information:

ETF Fees:

Most new ETFs are offering temporary fee waivers or discounts to attract investors (except Grayscale ETHE and Invesco QETH).

Grayscale Ethereum Mini Trust (ETH) has the lowest fee (0.15%) with a full waiver for the first 6 months or until $2 billion AUM.

Franklin Templeton's EZET has the second-lowest fee (0.19%) with a waiver until January 2025 or $10 billion AUM.

Staking in Ethereum ETFs:

Spot Ethereum ETFs will not offer staking benefits initially due to liquidity concerns.

Staking involves locking up ETH for rewards but carries risks.

Some issuers wanted to include staking but were denied by the SEC.

Issuers are exploring ways to potentially add staking in the future with a buffer of liquid ETH, but it won't be available at launch.