Ethereum's price has been rising for the past few days, and the altcoin even touches the $ 2,000 mark for a short time before falling back below. While ETH appears to grow exponentially in the second half of 2020 and throughout 2021, it will be interesting to see DeFi as the key factor behind the growth of ETH in 2021.

↘️Ethereum and Interesting DeFi Relationship

Compared to ETH's price point at the beginning of the year, the altcoin has grown by over 180 percent in just three months. While it could be argued that this is due to the increase in popularity of the DeFi ecosystem, it is important to note that ETH has a rather interesting love-hate relationship with the field.

In the summer of last year's DeFi, TVL locked on DeFi rose 13 times from one billion. At the time of writing, data from DefiPulse highlighted TVL to be around $ 45.45 billion, a staggering increase. In the same timeframe in 2020, ETH witnessed an increase in user activity and interest, both of which translated well on their price charts.

However, the same interest in #DeFi has raised questions about the sustainability of Ethereum as a platform. With the growing interest in DeFi, transaction fees and Gas fees on Ethereum soared, the same situation prompted further criticism of the platform.

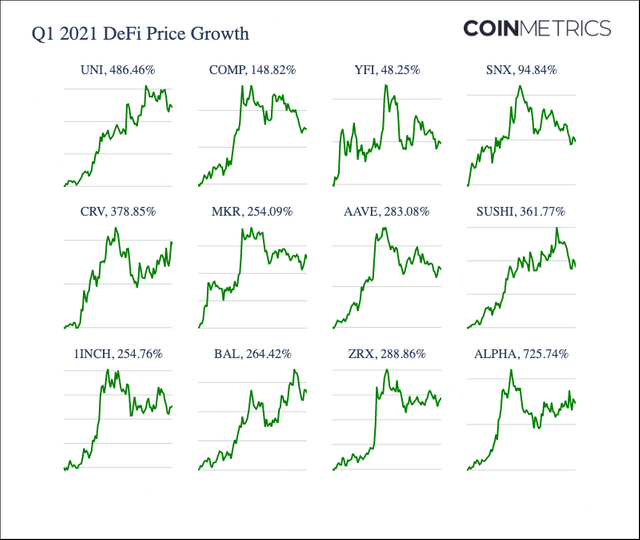

A recent report from #CoinMetrics highlighted how 2021 is different from the previous year when looking at this issue. The report highlighted that “Decentralized finance (DeFi) is back on the agenda in early 2021, following its first rise in the summer of 2020. All major DeFi tokens had a great first quarter, most of which increased by at least 100%. ” emphasizing.

In addition, the increase in the demand, awareness, and popularity of NFTs may also have played an important role in driving adoption and the value of ETH in recent months. The report points to the following important truth regarding the issue:

“But Ethereum's biggest Q1 story was undoubtedly an explosion of immutable tokens (NFT). Ethereum has impacted mainstream media more than ever, thanks to massive crypto product sales led by Beeple's Christie's auction, the attention of celebrities from Mark Cuban, Elon Musk and others, and the explosion of digital collectibles such as CryptoPunks and Hashmasks. “

↘️DeFi Tokens

#DeFi tokens have seen enormous gains in their price charts this year. Uniswap (UNI), UNI has recorded gains of up to 486% since the beginning of the year. Other DEX tokens such as SUSHI, CRV, BAL, 1INCH and ZRX also saw significant gains in the first quarter and have risen at least 250% since the beginning of the year.

While DeFi tokens are on the rise and NFTs are promising, 2021 remains truly an extremely effective year for the field.

It can be argued that this translates well for Ethereum as well, and the recent price increases are due not only to the fundamentals but also to the growth of DeFi.

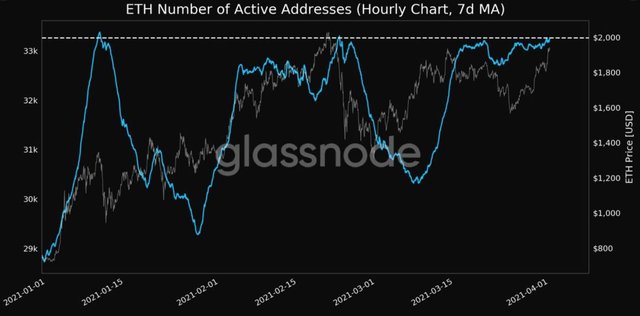

Interestingly, these developments reflect well on Ethereum's market fundamentals. According to the data provided, there are about 800,000 more addresses with at least 0.1 ETH compared to the beginning of the year. Glassnode also reported that the number of active addresses (7-day MA) climbed to a 1-month high of 33,257,149.

Such an increase in activity is a positive sign for ETH in the long run, but there are also a few concerns for cryptocurrencies in the short term. The report includes these concerns as follows:

“Ethereum transaction fees reached new heights in early 2021. For context, at the peak of the 2017/2018 bull run, the average Ethereum transaction fee reached $ 5.70. The Ethereum average transaction fee has been more than $ 5.70 each day since January 18, 2021. The average transaction fee is over $ 10 for most of the year. ”

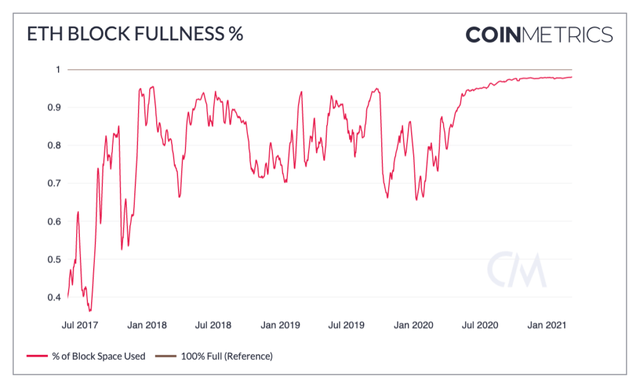

What's more, since the rise of DeFi in the summer of 2020, the blocks have consistently been nearly 95% full or more. According to data provided by CoinMetrics, blocks were 97% - 98% full on average in March 2021. Complete blocks cause network congestion and result in high gas charges. This is an issue Ethereum has faced in the past, and it continues to be so now. While DeFi is a major catalyst for the growth of ETH in the long run, it has posed challenges for the network in the short term. That was the case in 2020, and with regard to sustainability, a lot needs to be changed for 2021.