Currently, centralized exchanges are in charge of deciding what coins deserve to be listed and what coins do not. Digital exchanges are not obliged to list every coin, but I already can see that many high-quality projects cannot get listing on liquid platforms due to many variables. It usually includes: overloaded legal department of digital exchange, subjective opinion of exchange’s managers, lack of interest from investors, and so on. Decentralized exchanges should solve this problem once and for all. Of course, shitty coins will be barely traded, but high-quality projects will get a fair valuation if decentralized exchanges gain enough liquidity and are easy to use.

But what about listed coins? Why do digital exchanges like Poloniex or Bittrex start delisting quite popular coins? In this presentation I covered every single reason exchange can use to delist cryptocurrency.

So, here I will cover:

- General reasons coins get delisted

- BITTREX Removal policy

- Examples of delisted coins and why they were delisted

- The consequences of delisting for coins

First reason is the most popular among exchanges, low trade volume.

Usually, centralized digital exchanges have certain trade volume thresholds that must be exceeded by CryptoCurrencies for a certain period of time not to get delisted. It is either calculated in bitcoins or USD. Why do exchanges do that? They simply get rid of the coins that are not popular among traders and investors. BITTREX has a very detailed policy on that, I will show you this on the next slide.

Second most popular reason is technical problems.

What should technically happen to Coin to get delisted?

• If blockchain had a fork and didn’t even notify the exchange. It is funny, but there are such cases in BITTREX and POLONIEX history

• If there is some sort of disruption of blockchain and nothing is done about it. Developers do not seem to work hard to solve the problem

• If there is no sight of development. Especially, if the cryptocurrency’s site is dead and nobody replies to you on coin’s social networks. This is why it is important to be public about your cryptocurrency development

• If there are serious technical problems that obstruct the digital exchange business. For example, problems with the cryptocurrency wallets, block times, and low hashrate

Third reason, Howey test. In my humble opinion, soon we will hear more cases about coins that get delisted from exchanges due to the fact that they are deemed to be securities. Maybe, at some point, this reason will become the most talked about.

What is Howey test? It is means for SEC to determine if cryptocurrency is indeed financial security. This ICO project is security If there is a capital raising entity, investment of money, reasonable expectation of profit, and managerial efforts of others. If you want the details, just check my big blog post on SEC DAO report here or my youtube video here .

Finally, other reasons.

• Founders of the project can ask digital exchange to delist their tokens. Recent example is Monaco asked Gatecoin to be delisted

• Weak blockchain security. For example, it is easy to attack network when the hashrate is too low

• Projects’ actions violate exchanges’ policies

• Team doesn’t seem to be alive and there are no updates

• Founders start to artificially pump their coins

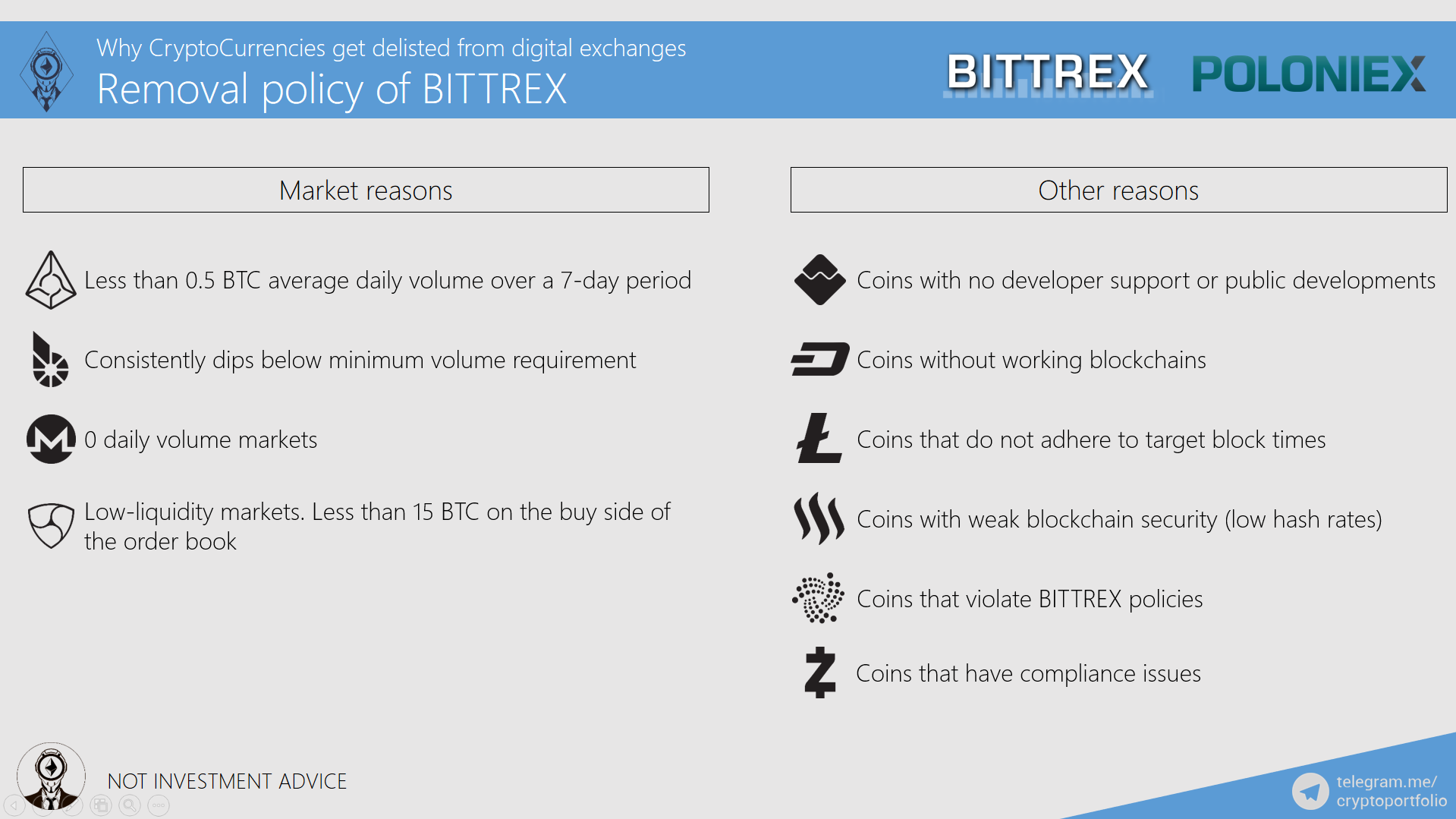

Let’s now take a look at Removal policy of BITTREX. If you want details, I will leave a link here

There are Market reasons for removal of a coin and other reasons.

Market Reasons:

• Less than 0.5 BTC average daily volume over a 7-day period

• Consistently dips below minimum volume requirement

• 0 daily volume markets

• Low-liquidity markets. Less than 15 BTC on the buy side of the order book

Other Reasons:

• Coins with no developer support or public developments

• Coins without working blockchains

• Coins that do not adhere to target block times

• Coins with weak blockchain security (low hash rates)

• Coins that violate BITTREX policies

• Coins that have compliance issues

On this slide, I would like to show you examples of delisted coins. I will explain why cryptocurrency was delisted and when.

Hacker Gold was delisted on 1.09.2017 due to disappeared team. It is the first example of the project that spent all the ethers and simply disappeared. It is such an interesting case that I think of making a separate video/blog post about this.

BTS was announced to be delisted on 13.10.2017. Reasons unknown, but it seems that there was some kind of a software problem. It looks like developers of BTS could reach BITTREX and fix the problems, so the tokens will not be delisted.

BTA was delisted on 13.10.2017. Reasons unknown. Possibly, trade volume was too low

NAUT was delisted on 25.08.2017. Core dev passed away in May and there is no development.

There were a lot of delisted coins in April on Poloniex. I looked at the coins and trade volume seems to be the main reason the cryptocurrencies were delisted.

Here is the most interesting case. After the compliance review by Gatecoin legal department, digital exchange delisted TenX, DGD, MCO, and ICN. All of them were deemed to be securities. I think that this will soon happen to other coins on different exchanges when SEC will have a more detailed position on initial coin offerings.

What does delisting leads to for coins?

First of all, lower liquidity. Usually, coins are delisted from big exchanges which leads to lower amount of buyers and sellers that can trade this coin.

Then, there is a problem of lower price. A lot of investors into ICOs like to dream about their tokens being listed on Poloniex or BITTREX. That usually leads to price pumps.

Community anger is next. Investors are displeased when their coin is delisted. Anger is either directed at exchange or developers. Usually, tokenholders will be angry at both parties at the same time.

Finally, delisted coins have bad news coverage, which decreases the price.

Very good post.

I personnaly lived the Poloniex delist (purge!) in April. And yes, people were angry! Some accused Poloniex of trying to make money by delisting.

Same with Bittrex, I saw someone claiming Bittrex would not delist BTS in the end (apparently this point was right). According to this person, Bittrex announced BTS delist just to buy a huge amount of them at cheap price...

What do you think about this possibility ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If ya'll want a strong investment plan visit https://bitpetite.com/?aff=kipparinga (bitpetite) Its a bittumbler that privatizes btc transactions using other currencies. You as an investor get paid dividends from fees they charge people to use their service.

You can invest your BTC, ETH, LTC and or XMR into bitpetite for either;

6 weeks - 4.5% daily and 1 % on weekends. Total return - 147% (47%, 100% being your original investment)

9 weeks - 3.6% daily 1% on weekends. Total return - 180% (80%, 100% being your original investment)

They recently updated their server to allow almost instantaneous withdrawals - you get paid hourly through dividends and can withdraw on demand. (within the minimum amount which is less than 5 dollars)

I would deem it low - medium risk as of now -

Good luck and happy investing :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit