The Ethereum Merge has been trending on social media throughout August. In the meantime, the US sanction against Tornado Cash has also sparked heated discussions, and the two incidents are linked together by discussions about decentralized products and centralized censorship and sanctions in the crypto market.

On August 8, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) added Tornado Cash to its list of Specially Designated Nationals (SDN), including the 45 Ethereum wallet addresses related to the company. Subsequently, dYdX and Pocket Network blocked the Tornado-related accounts, and Aave banned the addresses that had participated in Tornado Cash mining altogether (the ban has now been lifted).

Later on, users on social media started to discuss how the Ethereum community would react if regulators were to censor the validator nodes of certain protocols (e.g. Lido, Coinbase, etc.). Ethereum founder Vitalik replied that he would consider the censorship an attack on Ethereum and burn their stake via social consensus.

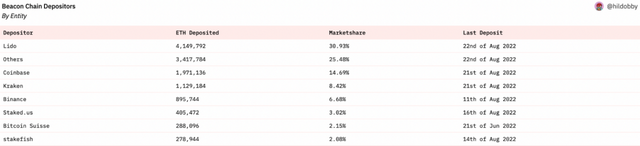

It should be noted that the post-merge Ethereum will use PoS instead of PoW, and investors must stake ETH on the chain if they wish to mine ETH. At the moment, 74.5% of the staked ETH on the Beacon Chain is controlled by the staking service operators, which means that all information and assets have become “centralized”. In light of this, once regulators decide to target Ethereum, and if service providers obey that decision, the whole Ethereum ecosystem would face a lethal blow.

Although Vitalik has publicly stated his opposition to censorship, whether that statement also applies to the entire Ethereum community depends on the stance of the relevant operators. According to Dune, 30.9% of the total ETH staked comes from Lido Finance, 14.7% from Coinbase, 8.4% from Kraken, 6.7% from Binance, and 3.02% from Staked.us.

On August 18, Coinbase CEO Brian Armstrong tweeted that the company would shut down its Ethereum staking services to preserve the blockchain network’s integrity if regulators were to ask the platform to censor the validators of Ethereum-powered protocols. He also added that “Got to focus on the bigger picture. There may be some better option (C) or a legal challenge as well that could help reach a better outcome.”

On August 19, Ethereum staking service provider Lido Finance, which now controls the largest market share, said that “Lido’s mission is to make staking simple + secure and to keep Ethereum (and other PoS networks) decentralized and censorship-resistant.”

Other service providers have not commented on this matter, as of this writing. Meanwhile, according to community news, Ethermine, the biggest mining pool on Ethereum, rejected to pack the transfers dealing with Tornado Cash into blocks last week.

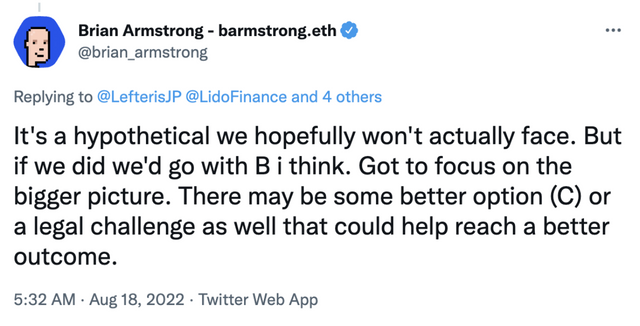

For investors, both upgrades and censorship have to do with “asset security”, which has always been a major concern. In the event of a hack or address ban, all profits would disappear no matter how successful your investments were. According to incomplete statistics, to date, there have been 811 crypto hacks in the world, including 104 security incidents that involved exchanges, with a total loss of about $10.3 billion.

Safe, convenient exchanges are rare in the crypto market, and CoinEx is one of them. According to public information, CoinEx is a world-renowned crypto exchange established by ViaBTC Group in 2017. Protected by multiple security strategies, the exchange promises that all crypto assets are 100% reserved and has never suffered any security breach since its inception.

In addition to enhanced security, CoinEx also features simple web pages and easy, user-friendly operations. Recently, the number of cryptos listed on the exchange has exceeded 600. Through comparison, we can tell that coins listed on CoinEx are all premium assets that have gone through rigorous listing procedures. Apart from that, CoinEx is one of the few crypto exchanges that’s willing to share profits with users, which generates win-win results. For instance, it recently introduced CoinEx Ambassador (Futures Special Program), which offers 60% referral commissions on fees to applicants who attract futures traders to the exchange. With the program, you can receive steady returns from CoinEx even in today’s bearish market conditions. Click the link to sign up for the program now: https://www.coinex.com/activity/ambassador

Disclaimer: This article offers no investment advice, and all statistics mentioned herein are for reference only. The information provided herein may not be relied upon for investment decisions, for which you will be fully liable.

Your post was upvoted and reshared on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thx!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit