For the first time in human history, finance became fair and borderless, giving everyone on this planet equal opportunity by lending value on the blockchain. - Sergej Stein, Financial Advisor at ETHLend

In the following article, we are going to guide our fellow ETHLend users on the best practices of successful lending on our decentralized application. First, we will briefly introduce you to ETHLend. The second part deals with reputation-based lending and finally we will show some examples on how to identify creditworthy borrowers.

Our goal is to provide you with the greatest experience and to show you how to profit most from lending on ETHLend.

Part 1: Introduction to ETHLend

What is ETHLend?

ETHLend is a new decentralized p2p-lending application on the Ethereum Blockchain, that has already a proven platform and an international team working eager on making finance more fair and accessible to everyone in the world today. We are bringing democracy to lending, erasing interest rate differences and creating a trusted lending network, without the need for banks and governments. Someone from Tokyo can lend to someone from Delhi instantaneously, making lending borderless.

How does lending on ETHLend works?

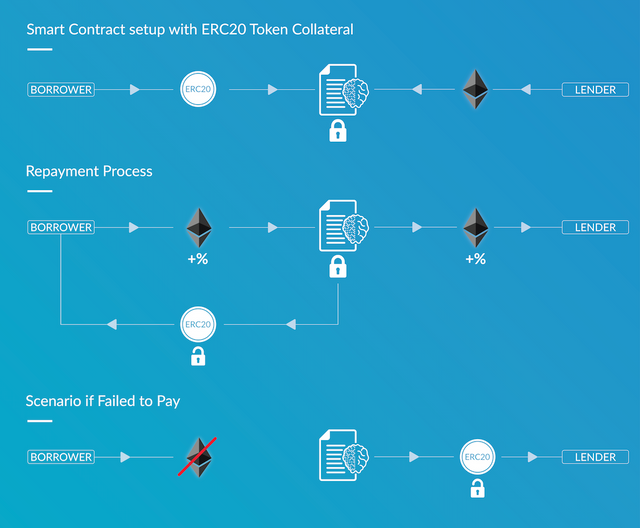

There are two ways, on how a borrower can set a loan request on the ETHLend DApp.

The first is based on secured lending, where the borrower pledges ECR-20 Tokens or ENS-domains as collaterals to place a loan request. The second one is reputation-based (unsecured) lending, where a borrower can request collateral free loans based on his lending history.

In both cases, the borrower has the decision power over the collaterals amount and premium payment, which gives him the responsibility for placing loan requests that are attractive to the lender. Also, the borrower can cancel his request if he does not find a lender and if the borrower does not repay the amount (default), the tokens are automatically transferred to the lender.

Part 2: Reputation-based lending

In order to allow lending on the blockchain without the need for fully collateralize funds, as known from conventional banking in the fiat world, we need to introduce a mechanism that creates trust based on measurable variables, such as the payment behaviour of the borrower. This in fact is challenging on the Ethereum Blockchain since we are working with pseudo-anonymous addresses and irreversible transactions.

Our primary goal is to stay loyal to our decentralized vision of finance, meaning that all possible solutions that come to our mind need to be “on-chain”.

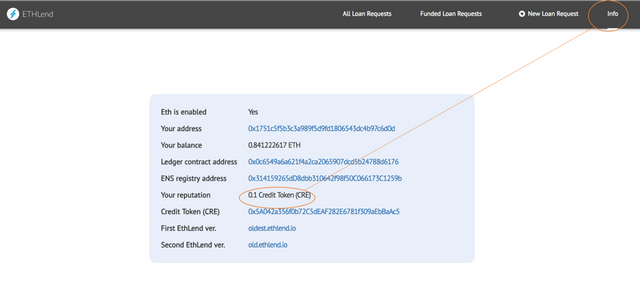

Thereby, we have introduced reputation-based lending with our native ERC-20 compatible Credit Tokens (short: CRE) for non-collateralized loans. Every time the borrower repays the loans successfully, he will be rewarded with CRE. More precisely, on each 1 ETH loan repayment, there will be 0.1 CRE minted.

Each 0.1 CRE allows to lend 0.1 ETH collateral free. When the borrower does not repay one of his loans, CRE will be burned and the reputation is destroyed permanently. Furthermore, CRE has no monetary value and cannot be transferred. That way, we have a reputation that encourages responsible behaviour.

Part 3: Due Diligence on Loan Request

The freedom that is brought by decentralization comes with a cost: responsibility.

Loan requests require due diligence by the lender, specifically non-collateralized. This would be the best practice similarly as it is done on a centralized lending platform.

This is easier said than done due to the anonymity on the Ethereum Blockchain and the lack of information that gives insights about the default risk of a borrower. This problem might be relieved as soon as some identity is introduced to the platform (e.g. uPort). Also, plans of prediction markets might help in advancing the risk assessment. In the near future, we will implement AI such as robo advisors, that will calculate the default risk in real time directly from the blockchain.

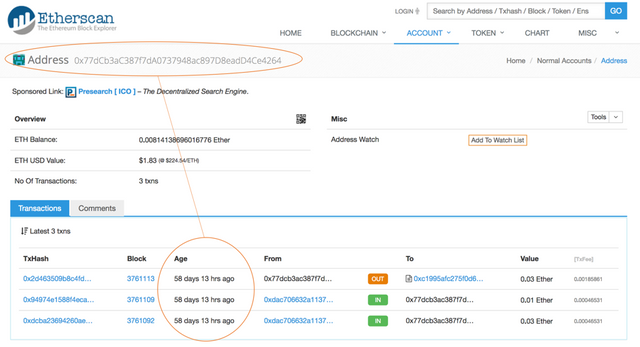

One possibility assessing risk is to view the previous loans of the borrower and if there are not any, then to view the borrower’s Ethereum address on Etherscan.

Here are some points that you as a lender could review:

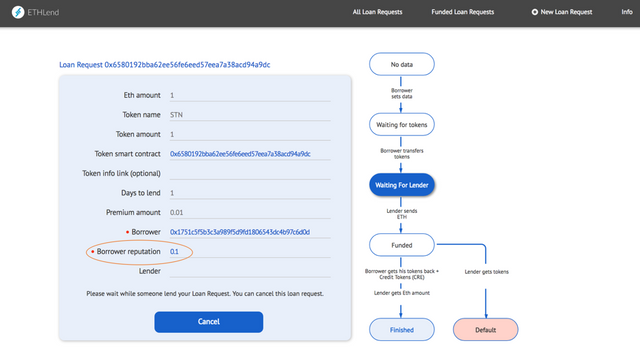

- Loan history: how many reputation points (CRE) have been accumulated?

- Transaction history: how old is the address? how many transactions?

- Balance: what is the monthly average balance of the borrower?

- Other information: does he/she possess ERC-20 Tokens, ENS domains?

Loan history

In part 2 of our guide we showed you where to find the Credit Tokens on your account. You can review also the amount of Credit Tokens by the borrower. Since on each successful repayment 0.1 CRE are rewarded, an amount of 1 CRE would mean, that the borrower has already 10 successful loan repayments.

However, in order to obtain more security from misuse, CRE should not be the only factor that is considered.

Imagine a borrower that has 100 small successful loan repayments, each that have a loan value of 0.01 ETH summing up to a total of 1 ETH. Those 100 transaction would give the borrower a reputation of 10 CRE.

10 CRE in turn, allow him to borrow 10 ETH collateral free.

If his average balance is 0.1 ETH on his Ethereum address and the age of the address is six weeks, is it a good idea to lend him 10 ETH collateral free? Most likely not. The risk of misuse is high when the difference between monthly balance and amount of a loan request is so huge.

Transaction History

Another point we might be interested in is the age of the Ethereum address as well as the number of transactions.

The question is, whether the age of an address is truly conclusive. For most addresses, the age and the number of transactions do show an average Ethereum user with no bad intention at all. However, a scammer might wait long enough and build a history of transactions, in order to default on a loan. The trick is to get a feeling of how an average Ethereum address looks like versus one that is solely created for misuse.

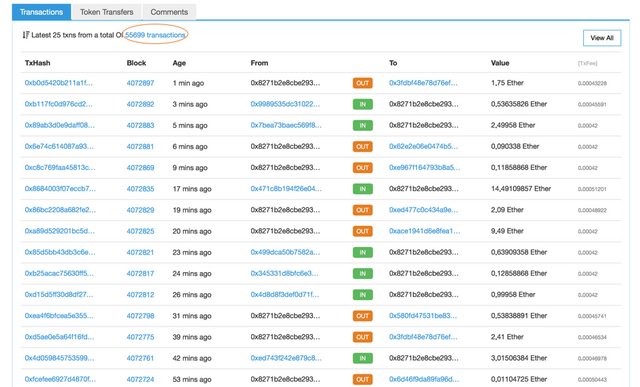

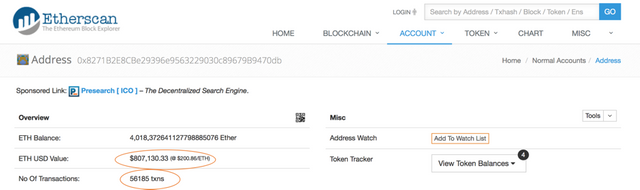

In this example you see a highly used account with more than 50,000 transactions and most transaction within a short time frame. The balance of this account (not shown here) amounts to roughly 4,000 ETH ($800,000). Although those transactions suggest that this account is backed somehow by an automated trading system, this would be a liquid user with a long history of transactions.

Balance

As just mentioned, the balance might be a good indicator whether the borrower has available funds for repaying the loan at all. The golden rule is to have someone that has on average at least 50% of borrowed funds available over a period of at least 6 months.

Coming back to our heavy user, this is definitely a liquid user with a long account history. So if he would borrow 1,000 ETH, his account would cover the loan by a factor of 4, which is seemingly sufficient. If he now borrows 5,000 ETH, his account would cover 80% of the loan. Giving that all other factors are satisfying including payment history, he would a be a liquid user and the loan amount legit.

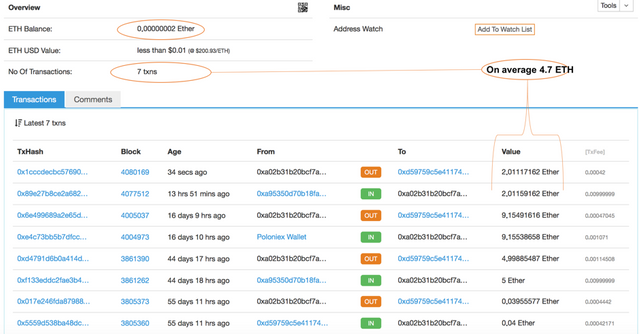

In this second example, we would have a user that might seek micro loans.

Let us briefly evaluate this account:

- Nr. of transactions are low, but an average user who simply invests occasionally will most likely have an address looking like this.

- Age of the address is roughly 2 months, not really old, but simply can be a sign of a newcomer. So this should not be the ultimate reason for declining a loan.

- Balance is almost zero, which would not allow him to borrow, since the loan minimum is 0.01 ETH. However, assuming his balance will regain at some point, we can derive from his past transaction an average balance of 4.7 ETH. Applying the same rule as above, he could borrow 6 ETH with an average account suggesting a liquid user.

Other Information

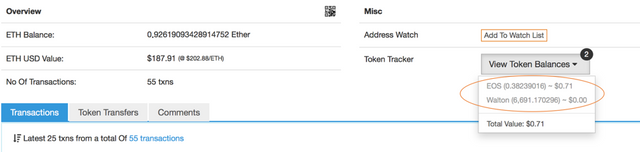

Finally, we might seek for some further information such as the possession of ECR-20 compatible tokens or ENS domains. We find further tokens under “View Tokens Balance” as you can see here:

The token balance is important since the user could be simply invested into ECR-20 tokens instead of Ether.

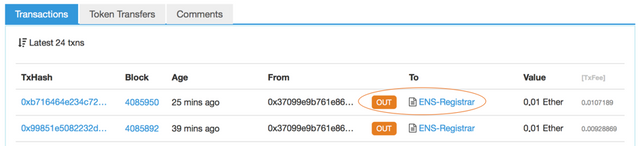

ENS domains can be an indication for the liquidity of the user since it is simply Ether that is locked up for a certain time. Here is an example of someone who transferred 0.01 ETH to the ENS-Registrar:

For more information about ETHLend, read the White Paper here.

Author: @sergej.stein

Follow us also on our other social media channels:

Homepage: http://about.ethlend.io

Facebook: https://www.facebook.com/EthLend-1848586068794685/

Twitter: https://twitter.com/ethlend1

Medium: https://medium.com/@ethlend1

Youtube: https://www.youtube.com/channel/UCZUFYgrvO7xpxzMjijgqWyQ/videos

Slack: https://join.slack.com/ETHLend/shared_invite/MjAzMTM0MzEyNzA3LTE0OTg0MDk0NDItOGY0MTlkMTlmZA

Reddit: https://www.reddit.com/r/ETHLend/

Telegram: https://t.me/joinchat/FWu2CQ0ZRCeWfey4eP8VhQ

--------------------------------------------------------------------------------------------

Disclaimer

Our content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our Website and wish to rely upon, whether for the purpose of making an investment decision or otherwise.

Accordingly, we will not be liable, whether in contract, tort (including negligence) or otherwise, in respect of any damage, expense or other loss you may suffer arising out of such information or any reliance you may place upon such information. Any arrangements between you and any third party contacted via the EthLend are at your sole risk.