Foreword: This article proposes that not all economic bandwidth is of equal importance from the perspective of open finance development. Among them, ETH and BTC are economic bandwidths that are completely trustless. They have trustless issuance and trustless settlement.

According to the two dimensions of issuance and trust, the other three different quadrants of assets can also be distinguished: bearer trust assets, legal trust assets, and national trust assets. But, in the end, the best match for open finance is the completely trustless assets, which is why ETH is irreplaceable. The authors of this article are Ryan Sean Adams and Lucas Campbell, translated by "An" from the "Blue Fox Notes" community.

Economic bandwidth is the fuel that enables open and decentralized financial applications. In ETH2, economic bandwidth is also used to ensure that Ethereum acts as a global settlement layer. The more economic bandwidth on the network, the greater the capacity of its financial applications, and the higher the security of its network.

In order to promote a decentralized, permissionless financial economy, Ethereum will need trillions of dollars in economic bandwidth. But where does it come from? Yes, economic bandwidth comes from the total value of network assets. However, we need more specific refinement...because not all economic bandwidths are created equal.

Trust-free economic bandwidth Today, the native token of Ethereum, Ether (ETH), has become the main reserve asset, which provides economic bandwidth for its currency protocols and financial applications. Importantly, ETH provides the most valuable form of bandwidth-economic bandwidth without trust. ETH is trustless value, it provides economic bandwidth for Ethereum's permissionless currency protocol. In order to build a trustless economy, trustless value is needed. Imagine that USDC is the main reserve asset of Ethereum.

The entire system will be limited by the ideas of Coinbase, Silvergate, and the Federal Reserve. Not decentralized enough, the same as existing systems. Only through fully decentralized on-chain settlement of encrypted native assets (such as BTC and ETH without centralized support) can the trustless value be realized. The total flow value of trustless assets on the network is the trustless economic bandwidth of the network. The total trustless economic bandwidth of Ethereum denominated in USD is the liquid market value of trustless assets of its network, that is, the market value of ETH. But can Ethereum tokens also become a source of untrustworthy economic bandwidth?

Tokenized assets as economic bandwidth Although tokenized assets on Ethereum provide economic bandwidth, it is not necessarily trustless economic bandwidth. Example: Synthetix is a synthetic asset issuance protocol. It is built on Ethereum and has a value accrual asset SNX. Although Synthetix introduces ETH-based collateral, this move will greatly increase the economic bandwidth of synthetic assets, but now, its synthetic assets are basically completely dependent on the economic bandwidth provided by SNX.

Can other DeFi protocols use SNX as economic bandwidth? Yes, but they must trust Synthetix. Even though SNX has proven itself to be a form of economic bandwidth in the Synthetix ecosystem, it lacks the most important feature when it comes to broader economic bandwidth without permission: it is not trustless. When SNX is settled on the chain, the Synthetix team has sufficient control to supplement its issuance. SNX has trustless settlement because it is carried out on Ethereum, but its token issuance is not trustless because its supply may be manipulated by a selfish third party. SNX does not need to be trusted if it does not reach the level of ETH. It seems that there is a variable range of trust between the axis of issuance and settlement. Can we apply it to broader asset classifications?

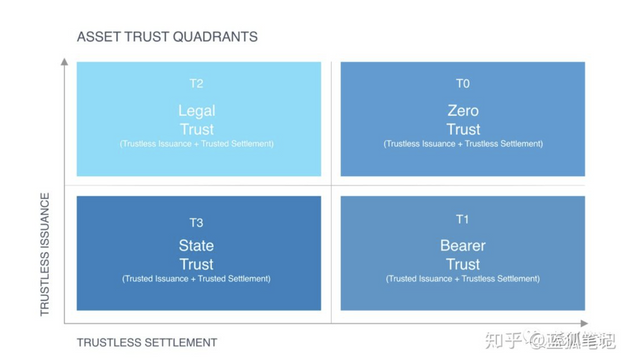

Let us define the degree of trust related to assets through the following two parts: trustless issuance and trustless settlement.

Trustless issuance means that the asset issuance policy is not dependent on and cannot be manipulated by a selfish third party.

Trustless settlement means that the finality of asset transactions does not depend on and cannot be manipulated by a selfish third party.

At the same time, having trustless issuance and trustless settlement of assets is the best form of economic bandwidth for a decentralized system. Zero trust assets (assets that do not require trust at all) are assets in the upper right quadrant.

Zero Trust Assets (T0): Trust-free issuance & Trust-free settlement

Bearer Trusted Assets (T1): Trusted Issuance & Trustless Settlement

Legal trust assets (T2): Trustless issuance & trustworthy settlement

National Trust Assets (T3): Must be credible issuance & must be credible settlement

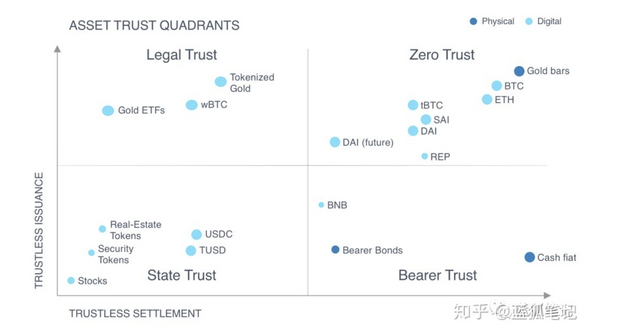

In today's world, ETH, BTC, and gold are the three least trustworthy forms of economic bandwidth. Unfortunately, because gold's trustlessness is limited to its physical form, it has less bandwidth available in the digital native economy. This is how we map these assets:

Let's take a look at the reasoning process: the first asset that does not require trust at all:

BTC: A completely trustless asset settled on the Bitcoin network

ETH: Similar to BTC, but the trustlessness of issuance & settlement is slightly lower than that of BTC

DAI: Supported by ETH, but its oracle & governance make it unnecessary to trust lower than ETH

DAI (Future): If trustworthy assets are added to DAI's collateral type, then DAI will move to the left