The world's top VCs are deploying applications on Ethereum

A16z, which has invested in Mystery Cat, Polychain Capital of Nervos and Nucypher, Danhua Capital of Ontology and Liquid Network, Digital Currency Capital, Bain Capital Ventures of Tendermint, and Y Combinator, the originator of Internet angel round investment.

Investment institutions for projects that are familiar to these industries are all paying attention to the second and third layer applications on Ethereum. Especially the two hottest tracks on DeFi: lending applications and prediction markets.

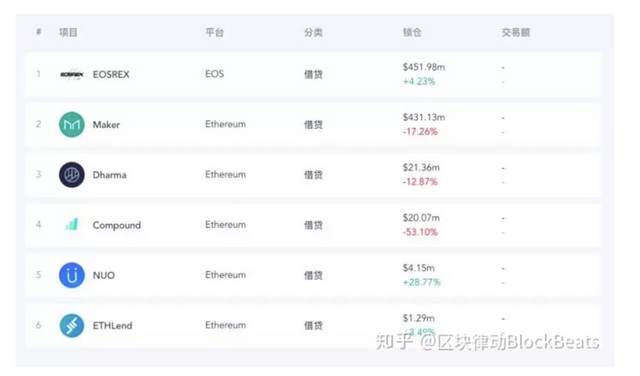

Among the top 6 lending apps, there are 5 in Ethereum

What is the market for lending?

According to data from the National Bureau of Statistics, in 2017, personal short-term borrowing amounted to RMB 6.8 trillion, and long-term borrowing reached RMB 24.7 trillion. The chain growth rate for several consecutive years has been above 15%. For domestic bank loans, in April this year, the total amount of bank loans exceeded RMB 14 trillion. Private lending is even more popular, especially P2P online lending. At its peak, 2017, the domestic P2P scale reached 702.9 billion RMB. This is only domestic data.

Before the advent of P2P, people who were unable to obtain bank loans could only find private loans, but the risks of private loans were extremely high and there was no security guarantee. As a result, P2P platforms came into being, which are much higher than private lending in terms of yield and risk. Since 2007, P2P lending has developed rapidly for 10 years. However, as more and more P2P companies are experiencing thunderstorms and running away, last year it became a turning point in the P2P lending industry, and the state began to control it.

The significance of decentralized lending is that it treats everyone indiscriminately, so that everyone who holds digital assets can get reasonable treatment. Although traditional private lending has been regulated, the demand for borrowing has not decreased. Decentralized lending minimizes the cost of trust, as long as you trust the code, you can complete the lending.

Lending and lending applications on the blockchain have become commonplace. BM, the founder of EOS, the third largest public chain, has publicly been optimistic about the DeFi field just a few days ago, saying that EOS is the future in this part of the decentralized finance market. There are already RAM leases, REX resource leases, and domain name transactions. Ethereum has failed.

These financial applications on EOS are all launched by the EOS system itself, or are official. Few independent teams do financial applications on EOS.

In contrast, on Ethereum, project teams such as MakerDao, Compound, Dharma, and dydx, the lending ecology on Ethereum is already very rich.

MakerDao, the earliest lending application on Ethereum, has received investments from SNZ Holding, Distributed Capital Partners, and Ledong Capital.

Compound, the first project to receive investment from Coinbase Ventures, allows users to deposit coins on the exchange to receive interest, and also received investment from a16z, Polychain Capital, Bain Capital Ventures, and Danhua Capital.

Dharma, which allows users to borrow and lend directly in their wallets, has received investments from Polychain Capital, Y Combinator, Coinbase Ventures, and Passport Capital.

dydx, the first decentralized financial derivatives exchange, received venture capital from a16z, Polychain Capital, and Bain Capital Ventures.

Not just at home, people all over the world will have borrowing needs. However, not everyone can meet the requirements and conditions of bank lending, and the trust cost of private lending is getting higher and higher, which will make decentralized lending a trend. The vision of these top VCs has already explained the reason.

The ecology based on Augur is already more prosperous than most public chain ecology

Predicting the market is a very interesting direction. Simple understanding can be understood as gambling. For example, if you are optimistic that the Warriors can win this year and buy the Warriors to win, this is an act of predicting the market. According to the predictions of gaming giants such as Playtech PLC and Paddy Power Betfair PLC, the size of the online legal gaming market will reach 96.8 billion U.S. dollars.

You can also interpret some of the products of the prediction market as futures. For example, if you are optimistic about Bitcoin, when someone asks you if Bitcoin will rise to 20,000 USD, you choose yes. It is equivalent to looking at more bitcoins. This is the thinking of futures in financial derivatives. It is estimated that the global financial derivatives market has now exceeded USD 1.2 trillion.

In the 1970s and 1980s, prediction markets actually appeared, and of course they were all centralized. The problem was obvious. It was difficult to prove themselves. Users must believe that the database was not tampered with. The decentralized prediction market has not nearly reduced the cost of trust and the cost of entry. Anyone can make market predictions on the blockchain.

In terms of the prediction market, Augur is already the most well-known project on Ethereum. It has just been upgraded to a new version recently, which solved some problems of the previous version, and made improvements in the introduction of stablecoins and invalid market orders.

But perhaps even the Augur team did not expect that predicting the market has become a new direction. This time, many project teams that have received financing from well-known investment institutions have begun to develop new Layer 3 products based on Layer 2's Augur protocol. Augur has become the "Ethereum" in the prediction market.

Veil, with the investment of Paradigm and Sequoia Capital, can now make predictions for the 2020 US election, and users can participate with the stable currency DAI.

Flux, another product of the founding team of EveryDApp, on Flux, users can make transactions by predicting the development schedule of start-ups, which may include product launches, investment rounds, and progress.

BlitzPredict, a sports event prediction product, can provide users with the highest odds.

Defisurance, this is the latest Augur-based application, a new application developed by a Stanford graduate who used to work at Y Combinator to provide insurance for financial contract users who were hacked.

There is a view that the prediction market will be the first large-scale application on the blockchain. On Ethereum, the prediction market already has its own scale. These Layer 3 applications, with Augur and the second-layer lending protocol as the bottom layer, have attracted top VCs of these magnitudes. The major premise for this to happen is that all application development teams and all venture capitalists believe in the bottom-level foundation-Ethereum.

And other chains have no clear direction

When Ethereum Layer3 applications are beginning to attract capital, the focus of public chains such as EOS and Tron seems to be still on DApps.

Take EOS as an example. During the period when DApps broke out, the concurrent volume of DApps was indeed higher than that of Ethereum. The maximum daily activity reached 40,000, which was 10 times higher than that of Ethereum.

But the value of EOS has not changed because of the explosion of DApp.

In fact, well-known DApp teams still choose Ethereum when they release new games. The Dapper Labs team, which developed Mystery Cat, launched Cheeze Wizards on Ethereum on May 18, and did not choose to use other faster chains.

Not to mention the security issues of DApps on EOS. Until this year, gambling DApps on EOS were still unsafe. On April 29th, 3 EOS gambling DApps were attacked by a new type of transaction memo, resulting in a total loss of 12,883 EOS. This rarely happens on Ethereum.

Of all the ecological public chains, only Ethereum has a clear vision of the future. Decentralized finance, or more directly, DeFi, is the purpose of Ethereum becoming the world's computer, the second value discovery. For public chains such as EOS and Tron, there are still various games without traffic and various coin-issuing games on the chain.

Although there are community applications like HashBaby, there is no clear positioning for the public chain community, the development team, or the developers on the chain. This is true for EOS, which has raised $4 billion in financing, not to mention other small chain projects.