I've been paying close attention to crypto for 6 months, and to be completely honest, i am JUST BARELY beginning to understand the price movements after being wildly confused for months. I have been making mental bets for some time, though. My mental bets are consistently wrong, and i have been trying to figure out why. I realized why - it's because i'm viewing crypto investing through the same lens as stock investing. Huge mistake.

Nonetheless, i dipped my toes in crypto anyway, with the idea that i'd build a diversified portfolio that emulated my favorite stock-based investment - the index fund. Why? because i understand that i don't know what i'm doing, and i don't believe anyone else does, either.

I took one good stock mentality with me into crypto land... i consistently hold, think mid to long term, and have only switched positions twice in 6 months. I always think of my portfolio's value as a whole and never freak out about one particular coin. I never buy into an investment for a short term reason. I never try to time the market - although i tend to buy during price corrections. This has worked for me very well.

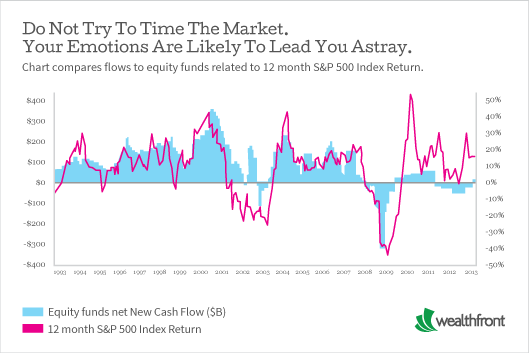

And just like with stocks... I have watched others try to time the market over short periods of time and lose money as a result. It seems like the more emotion there is, the more bad decisions are made.

So even my stupid strategy of usually buying at the wrong times and holding has worked out great for me. But i'm still left wondering how my strategy could improve, and it struck me today.

I have noticed is that the thinking patterns of traditional fiat currency / stock based investors and crypto investors are COMPLETE OPPOSITES. If you apply stock-based thinking while making crypto bets, you will make the wrong bet ~80% of the time. It seems that a majority of crypto investors are contrarians by nature. Thus, price movements are often the opposite of what you would expect from a stock/fiat based mindset.

You could say that crypto investors' contrarian bets are foolish... however, these people also determine how this game works. This is bizarro world.. so when in Rome, do as the Romans do.

Allow me to give you a couple examples of what i mean.

Stock world:

Tesla releases 3rd quarter financials and shows it's bleeding even more money. Investors sell, price goes down. ( makes sense to me, even though this is short sighted. I will be a contrarian and buy, since i am in tesla long term. )

Amazon buys whole foods, stock price shoots up 10% shortly after ( also makes sense - they're about to make more money and amazon has a great track record. )

Crypto world:

Bitcoin futures launches. Bitcoin futures website chokes from being overloaded. Bitcoin's competitor, ethereum, shoots up 15%, and many other competing cryptocurrencies jolt upwards even more. Bitcoin's price is extremely stable at +0.25% over 24 hours ( this makes no sense to me, given that i expect futures trading will accelerate the price growth of bitcoin, and so does everyone else. If i was an active trader, i would have traded my other coins for crypto, and made a huge mistake that day. Good thing i'm not! )

An ethereum wallet, parity, causes hundreds of millions of dollars worth of Ethereum to vanish, due to a developer error. Ethereum's price had been steady for months, but starts climbing at this point. By the end of the month, it is up 70% after remaining stagnant ( a stock trader would have sold, not bought! but those contrarians.. ). A month later, there is still no fix, and the people who are affected by the parity hack are still out of luck.

Now the one time i made a good bet on ethereum is when there were rumors of Vitalik's death. I made a contrarian bet and invested my first $250. It was my best bet!

So if you want to win with crypto investing.. i believe the recipe of success is thus:

HODL and don't actively trade. Change your positioning as infrequently as possible. Fully research something before you buy it so that your position is solid in the first place.

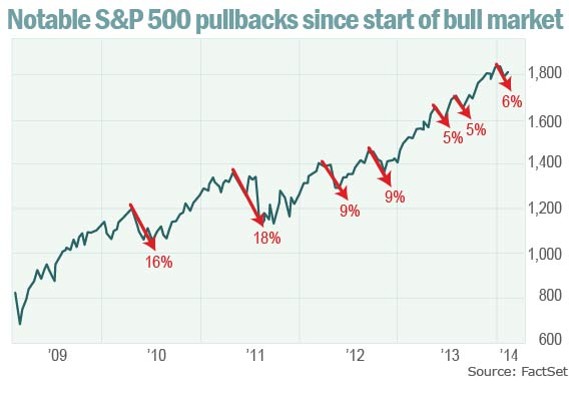

When you make bets, make contrarian bets because the price is based on the thinking and actions of people who are mostly contrarians. Try to buy during corrections and not rallies. Peak rally prices rarely hold. Conversely, corrections rarely signal further drops in price. The same thing is true of every time that the stock market is not in a recession.

- Do not let your emotions get the best of you. Crypto investing is speculative and high risk. People are constantly posting FUD all over the internet in attempt to raise or lower the price. Do not pay too much attention to this noise, or you'll go crazy. Make a bet and stick to it. If you cannot handle this, try a safer and lower risk investment, such as a S&P 500 index fund.. which, by the way, has returned 20% this year. No shame in that game.

Hope you enjoyed this article. If you want to learn more about the mentality approach i take, google 'bogleheads' and read some writings by Peter Lynch and Warren Buffet about what it takes to be a successful investor.

-Silverman

Congratulations @neptronix! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit