In 2017, the top movers in the industry were ICOs — Initial Coin Offerings. What is next?

2017 was a big year for the crypto community, entrepreneurs and startups in the new industry. Cryptocurrency prices were rising, blockchain network traffic and usage increased, media all over the world extensively covered Bitcoin, Ethereum and crypto startup projects. One of the top movers in the industry were ICOs — Initial Coin Offerings. Startup ideas that were funded by contributors in this new landscape. What is next?

First, a little about ICOs

Initial Coin Offering (or ICO) projects are backed by founders’ promise and an idea for the development of a product, explained in a whitepaper. The backers were not VCs (venture capitalists) as in ordinary startups, but contributors, ordinary people with small amount to participate with.

To ensure the widest spread of news and engagement, ICOs had to build a strong community not only by numbers, but also a community, where members talk to each other, help each other and support the common goal of the project. In our experience, every successful community also had (and still has) a certain share of members who are actively participating in the conversation, proactively empowering the cause of the community and behaving almost like smart shareholders.

Source: https://www.ccn.com/op-ed-a-beginners-guide-to-the-economics-behind-security-token-offerings/

So, what happened after?

The goal of every ICO project should of course be the development of the idea proposed and within the whitepaper. In order to get there, ICOs pursued a monetary goal and usually raised theirfunds through Token Generation Event (TGE or Crowdsale). Then, they had to assemble the right team, generate and share the tokens among their contributors for them to use on the developed platform and also develop a witty strategy to make the tokens a desirable asset to be traded on exchanges. A chain of events with a lot at stake.

The Road to Security Tokens

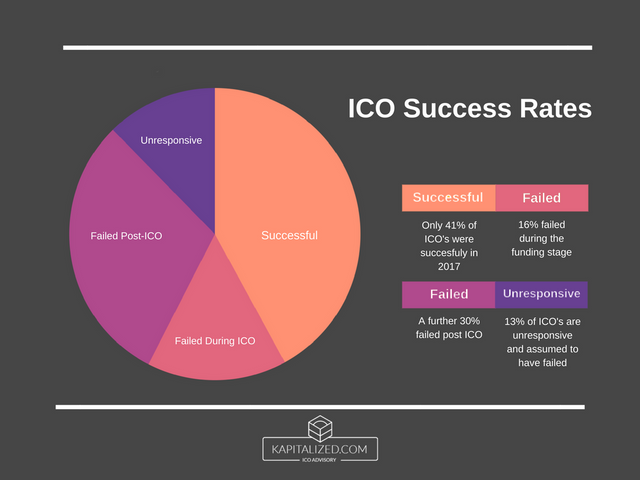

But not all was good in the crypto land. A lot of ICOs were scams, teams fell apart, ideas broke and since cryptocurrency prices fell, tokens followed. And, at the moment, very few ICOs are proving to be on the road to success.

The ones who are among the few, are proving to be on the right path with an active community, following the roadmap and having strong development. They are connecting with other successful enterprises and groups of interest, with a goal to lift the blockchain industry to the next level in the eyes of business, economy and regulation.

Source: https://kapitalized.com/blog/why-most-initial-coin-offerings-in-2017-failed

However, although the tokenization hype is calming down, the development of new projects in 2018 didn’t stop. In fact, it actually continued and in the first half of this year, already surpassed the amount of funds gathered in 2017. (“Initial coin offerings (ICOs) raised more money in the first three months of 2018 than the whole of 2017, according to data collected by CoinDesk.”)

With the maturation of the industry and wider adoption, responsibility follows. And even though the industry aims to self-regulate, the official regulators joined forces to establish transparent rules and clear guidelines. This is how the security tokens were defined.

Namely, to address the irregularities in ICO projects, the industry and regulators created the solution in a new concept, called an STO — Security Token Offering. The STO models after the IPO* in traditional financing and adapts the concept to fit the cryptocurrency industry.

Initial public offering (IPO) or stock market launch is a type of public offering in which shares of a company are sold to institutional investors and usually also retail (individual) investors…*

The Concept of Security Token Offerings

Security Token Offerings, or STO, could very well fulfill the promise of ICO. In ICO, contributors don’t hold any value beyond tokens, which are dependent on what the potential project worth. In other words, ICO holders do not have any tangible value, no company share, and are also not protected in case of misbehavior of owners of the project or project fail. And since we know, a vast share of ICO project fail, either because project isn’t feasible, market conditions don’t support the current value, or are plain scams; ICO holders don’t have it easy.

STOs might change that. The relationship between project team and contributors gets on a whole new level with security tokens, especially concerning the responsibility of founders to their investors. Owning an security token also could mean a fractional ownership of the company you’ve invested in and having a voice beyond just hoping the project will succeed.

Security tokens accelerate the democratization of venture capital.

Security tokens also hold the following characteristics:

- First, those who put their trust and money into the project, are no longer contributors, but investors. With that the project owners have a lot more responsibilities towards their investors that in ICO case.

- Securities are regulated financial securities. That means SEC and other regulators have oversight and investors are more protected from scams or other ill intended manipulations form the company they’re investing in.

- “Distributed ledgers enable the tokenization of otherwise illiquid assets, such as real estate and fine art. Security tokens allow fractional ownership, and the issuer determines how fractional that ownership is.” (a quote form the article)

What defines the security token? The Howey Test.

In order to categorize a token as a security and not a utility token, SEC regulators needed to define it. Investopedia has an abstract:

Put simply, the Howey Test asks whether the value of a transaction for one of its participants is dependent upon the other’s work. Specifically, the Howey Test determines that a transaction represents an investment contract if “a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party.”

The future of token economy

US regulators are clear on tokens — they’re all securities. In other economies, most utility tokens might need to converts to securities. Some might stay utilities, if their usage is indeed needed for the network their project is building.

It is still too early to tell how do STOs actually work, if even, as VentureBeat article “The era of security tokens has begun” recognizes, continuing: The very first exchanges specializing in STOs are just starting to go live. Companies […] are busy developing standard restrictions for tokenized assets and security tokens. For now, the industry awaits for the first successful STO projects. But, if we take into account at least the efforts to make cryptoasset business more transparent, safe and secure, we are on good way to build the new kind of economy.

Is your company exploring the possibilities for starting STO project? Request our services on the link below.

https://www.netis.si/en/#contact

Check our website Netis.si and follow our updates on LinkedIn and Twitter. For regular blog updates follow this Steemit blog or Medium space.