What is the MakerDao?

MakerDao

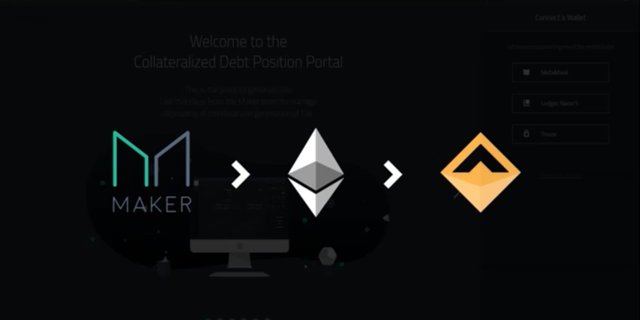

The MakerDAO is a complex computer software application, which has two or more very complicated computer programs inside it called #Smart #Contracts, which dictate or determine how it functions. There are certain parameters of these applications and program which can be adjusted or modified. The decision to make these adjustments is determined by a group of investors who provided the financial backing or money for this application to conduct business. Their influence or control over these software programs is called #Governance. Because these investors can live all over the world and conduct meetings to discus decision making and they all have a vote in all decisions, this type of control or governance is called a DAO.

DAO

DAO stands for Decentralized Autonomous Organization. The word Decentralized means that the people in control of the business are not in a central location, they are instead spread out, or #distributed all over a country and all over the world. The word Autonomous refers to these people acting or functioning independently of any government rules or regulations, specifically with regard to their business and how it runs. Because the business doesn’t exist in a physical location in one country, and the owners are all over the world, they act as if they are not governed by the government or regulators of any one country. Additionally each investor is free to vote as they wish on each issue or rule. They are not governed by anyone else and are independent or autonomous. The last word, Organization refers to the fact that they are all part of the group which controls or governs the adjustable parameters of this business enterprise.

Tradition Business Leadership Model

The DAO is a type of governance or control of a business is very different from the #traditional business governance structure of an Owner, a President, a Vice President and/or a Treasurer, who live in close proximity and/or work in one location. And who also make all the decisions for the business organization within their job description, without conferring or discussion with each other. The traditional structure is in this way more centralized, as in the power or control is in the hands of one person or a few persons. This concentrated or centralized decision process regarding the running the business is called centralized leadership or governance. This traditional leadership is also typically accompanied by all the leaders living in the same city or small geographic location and working in the same physical location or building. This increases the centralization aspects of this leadership or governance model. and makes them more easily subject to control from outside their business by government officials, regulators and rules.

Leadership Model

Finally, with a traditional business leadership model, the leaders are chosen by a single person or small group of persons. Which is further centralization or concentration of power in the hand of a single person or a small group of people. In contrast in a DAO the people who are members select themselves by investing in the company by purchasing the company’s cryptocurrency token called Maker or abbreviated MKR. Thus a larger and self selecting group of people choose to be active participants in the Decentralized Autonomous Organization, the controls or governs the MakerDao. The project was started in 2015 and did not conduct an initial coin offering, or ICO, instead choosing to privately sell MKR tokens to fund development over time. The MakerDao’s DAO decided to create the Maker’s DAI stable coin at the start of 2018

What does the application or platform called the MakerDao do?

The MakerDao functions like a bank of the future.

The #MakerDAO is an computer software program, which provides some of the same financial services that a bank provides. It acts as and is referred to, as a #Credit-Debt-Facility. It provides credit and the creation of #debt #obligations which are similar to #loans. However the #loans provided by the #MakerDao and all similar computer software credit debt facilities are called #Credit #Debt #Products or #CDPs. Additionally while the traditional #loans, issued by traditional #banks, charge you a fee for the loan called an #interest #rate which is the amount of money you need to pay the bank in addition to the amount of the loan. The computer software applications called #Credit #Debt #Facilities charge you a fee for borrowing money that is called a #stability #fee. This stability fee plus the amount you borrowed is the total amount you pay back to the Credit Debt Facility for the Credit Debt Product.

Special Features

The MakerDao initially only accepted Ethereum as collateral for it’s loans. Thus all loans or CDPS were backed by Ethereum and all are over-Collateralized, meaning the value of the collateral exceeds the amounts of all loans. A very safe, stable and secure banking frame work which almost guarantees the success and growth of the #bank or #credit #debt #facility. The loans are paid to borrowers in Dai. The MakerDao issues new Dai to fund each loan. Each Dai is worth one dollar USD. The stability fee or interest rate is raised to reduce selling pressure on the Dai and help keep it pegged to the dollar and vice versa. The DAI stability fee or interest rates for borrowers was 1%, but later the stability fee increased from 1% to 3.5%.

What does the MakerDao do and why are there so many transactions?

The MakerDao provides loans in Dai, against assets, mainly Ethereum and in some instances Bitcoin held by Bitgo.

New Vocabulary and Concepts

In order to understand the way the MakerDao functions you need a new vocabulary. So I will introduce and define some new terms and explain the concepts behind the MakerDao.

Terms

#Bank , a business that makes money providing credit.

#Credit, means credit cards and loans like those used to buy cars and homes.

#Interest, the fee or money you pay the bank for borrowing money in the form of credit cards or loans.

#Stability fee is the same as interest.

#Default, you are in default if you don’t pay your credit card bill or loan payments for two or more months. Aldo if the value of your asset falls below a predetermined value.

#Default fee: extra money you pay the bank on top of your loan balance if you default.

#Liquidate: if you default on your loan used to buy your car or home the bank takes your car or house and sells it to pay off your loan.

#Liquidation fee is the same as a default fee.

#Debt: money you owe the bank for credit card balances or loans.

#Credit Facility, is another name for a bank on a blockchain like the MakerDao

#Collateralized Debt product, is another name for a loan granted you in exchange for the title or ownership papers of your collateral.

#Collateral, an asset like a car, home or cryptocurrency, whose ownership papers are held by a bank or credit facility when you borrow money and use the asset as security for the loan.

#Agree with liquidation. If you offer an asset as security for a loan, you agree the bank or credit facility can sell your asset if you default on your loan or the value of your collateral falls below a certain dollar value.

#Ownership papers: For a car it’s the title and for cryptocurrency it’s your keys.

Concepts

#Loans are a Debt

#Loans are a Product created by a bank or a credit debt facilities.

#Loans are secured or Collateralized.

#Collateralized Debt Products, in a Credit Debt Facility platform or application like the MakerDao, loans are called “Collateralized Loan Products“ and also are also called by their abbreviation “CDPs”.

#CDP, collateralized debt product

#Loan to Value Ratio

Traditionally, a bank doesn’t loan you 100% of the value of an asset. It loans you a percentage. If the bank loans you 50% of the assets value, the loan to value ratio is 50%.

#Collateralization Ratio

Credit Debt Facilities don’t use a loan to value ratio, they use something called a Collateralization Ratio. It is the inverse or opposite of a loan to value ratio. In a loan to value ratio you create a fraction with the loan value on top (numerator) and asset value on the bottom. (denominator). In a Collateralization ratio the value of the asset is on top, and the loan is on the bottom. If the asset is worth two dollars and the loan one dollar the collateralization ratio is 2:1 or 200%.

#Liquidation

If you don’t pay your loan, the bank sells your asset, the car or your home you pledged as security or collateral and sells it to get back the money it loaned you. This process is called repossession in America in the case of a car or foreclosure in America the case of your home. In the world of decentralized finance the bank or “credit debt facility” will also liquidate your assets if your collateralization ratio drops below a pre-agreed upon number.

#Vault: the name for your account at a “credit debt facility” or Bank on the blockchain.

#Competitive suction.

If you default on your collateralized debt product, the credit debt facility will sell your asset. To lessen the downward selling pressure on the value of the asset, the asset is not sold on an exchange. Instead it’s sold in an auction where people make bids and the highest bid wins.

#Over capitalization of CDP, the value of your asset in the vault collateralizing your loan or CDP is above the collateralization ratio number which triggers liquidation of your assets. This is a good.

#Under capitalization of CDP, this is the opposite of over capitalization, as the value of your asset means your collateralization ratio is “at or below” the number which triggers liquidation of your assets. This is bad.

#Decentralized finance profit motive for CDP or collateralized debt products.

Investors take out loans on cryptocurrency they are holding long term so they can earn money from the appreciation of the cryptocurrency asset and use the loan funds to invest in another asset that generates an additional return on capitol. This means multiple streams of income from the original capitol investment and an increased return on investment.

#Tokenization: the representation of a physical asset Ads digital token.

#Fractional ownership, After a physical asset is tokenized investors can buy very small portions of an investment and these small ownership portions are called fractions.

The Profit Motive on the MakerDao

For Example**

If you deposit one Ethereum worth $150 USD in the MakerDao you can ask for a 50 Dai loan and 50 Dai is worth 50 dollars USD. Your asset, the Ethereum, is held as collateral and you get it back when you repay the loan. This process of depositing your Ethereum as collateral and getting a loan is known as collateralization.

The ratio of collateral to loan is $150/$50 or 3:1. This is called your collateralization ratio. The minimum ratio is 1.5. If the price of Ethereum falls, your ratio will fall. Once the dollar value ration of your Ethereum collateral gets to 1.5 your Ethereum collateral will be liquidated or sold to pay back your loan.

Why Collateralize your Ethereum

As an investor your rate of return on Ethereum is variable, for example if the price for Ethereum increased 5% in one month your ROI was 5%.

If you owned $100 worth of Ethereum your 5% ROI was worth $5 USD. But what if you owned 10 times as much Ethereum? $1000 worth of Ethereum at a 5% ROI would mean $50 USD. If you had 100 times as much Ethereum your 5% ROI would be worth $500 USD. So to make more money, you need to buy more Ethereum. But with collateralization you can buy more Ethereum without having more money.

For Example.

You buy and hodle one Ethereum worth $150 USD. In one month if your ROI was 5%.

150/100 =1.5 x5 = $7.5 USD

But if You deposit your $150 worth of Ethereum in the MakerDao, you can borrow 75 Dai, using your $150 worth of Ethereum as collateral. You then exchange 75 Dai for $75 USD on the exchange and buy $75 dollars worth of additional Ethereum. Now you own $225 dollars worth of Ethereum. So if in one month you get a 5% ROI on $225 USD or 225/100=2.25x5=11.25$.

So by using the MakerDao you were able to increase the amount of Ethereum your hodling from $150 to $225, a 50% increase, but without investing any additional capitol. While you pay 3.5% interest on the additional $75 worth of Ethereum you still get 1.5% ROI without increasing your capitol invested.

Discussion

You didn’t use any additional capitol to increase your ROI, you used a “Credit Facility”, which is called MakerDao. This allowed you to earn money from the appreciation of your asset and to borrow against your asset to buy more asset and earn more money. That’s why this is popular and that’s why the MakerDao has increasing volumes as more people collateralize their assets to make more money. In some ways, this is a win-win situation as the MakerDao gains 3.5% stabilization fee and the borrower gains addition ROI.

But there’s more.

Bitgo is currently offering a service which allows people to Tokenize their Bitcoin and get Ethereum. Then those Bitcoin owners can deposit their “Ethereum loans” at the MakerDao and borrow against it. Then they can earn off the appreciation of Ethereum and the appreciation of their Bitcoin.

And even more

You can also deposit the Ethereum you bought with your MakerDao loan in the MakerDao to increase both the amount deposited and the amount you can borrow. So if you deposited $300 worth of Ethereum and borrowed $100 in Dai, which you changed to dollars and bought Ethereum. You could deposit this additional $100 worth of Ethereum in the MakerDao for a total of $400 dollars worth of Ethereum in your account. Now you could borrow an additional $100 to bring your total borrowing to $200 and use this second $100 loan to buy $100 worth of Ethereum and deposit this also, for a total of $500 of Ethereum deposited and $200 borrowed.

Now your $300 worth of Ethereum has grown to $500 worth of Ethereum using the MskerDao credit facility and your collateralization ration is 500/200 or 2.5, well above the 1.5 liquidation market and requiring a 40% drop in the Ethereum Price

Are losses possible?

Certainly. But they are very similar to your possible losses HODLing Ethereum.

Example

You buy and hodle $150 worth of Ethereum. In one month it drops 50%. Now the value of your $150 has fallen to $75. You lost 50%. If you sell now, you get $75.00.

If you take the same $150 USD investment, deposit it in the MakerDao and borrow 75$ ( 75 Dai, exchange for $75 dollars, but $75 dollars worth of Ethereum and now hodle 225$ worth of Ethereum for one month. If Ethereum falls in value 50%, your Ethereum collateral deposited in the MakerDao will be liquidated or sold for 75 dollars to pay back your loan. You are left with the $75.00 worth of Ethereum you bought using the loan. Basically the same position you would have been in, if you had just hodled your original $150 worth of Ethereum.

So technically there are losses, but in reality your ROI is zero in both scenarios.

Decentralized Finance

The MakerDao doesn’t care about your race, religion, sex or country of origin. There are no financial qualifications other then having Ethereum. This is permission-less, as in you don’t need anyone’s permission to do this. It is also trust-less by design as the smart contract locks up your Ethereum when you enter the agreement and releases your Ethereum when you repay the loan.

This is the #Makerdao, this is #Decentralized #Finance, this is where #Finance meets #Technology and creates something new called #FinTech...this is the future where finance and technology are meet.

@shortsegments