Gold is trading in its highest level in seven months.

Don't get overly bullish yet. What we're waiting for is the "all clear" signal, which is just 3% or so away from us.

What Portfolio Wealth Global is also keeping an eye on is the sentiment. If gold's price is rising while demand is soaring, then the banking giants smack the price around and scare off the weak hands, but this isn't happening now.

The best time to enter a position is when the elements are aligned.

Remember these three elements that I'm about to show you and stick to them—don't ever deviate from them.

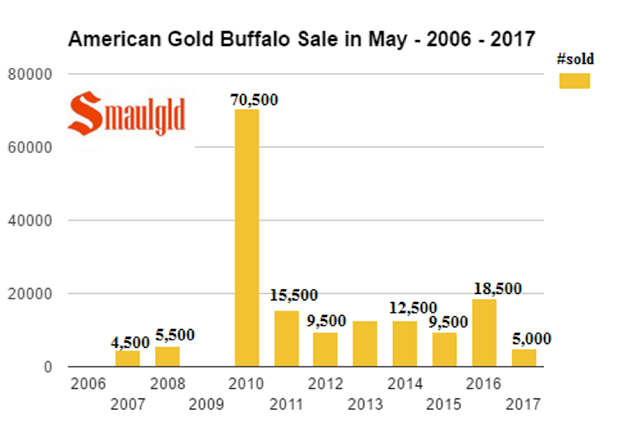

For an investment opportunity in commodities to work out for you in the most profitable way, you must be ready when an asset is hated, cheap, and in an uptrend.1. Hated: Middle-class America has abandoned gold and silver. Not only are the sales severely down, but on Google Trends, Bitcoin and Ethereum have surpassed the search quantity of the metals.

In fact, bond investors are betting on low interest rates at a record pace. This is a deflationary theme, and we all know that investor sentiment is a brilliant contrarian indicator.

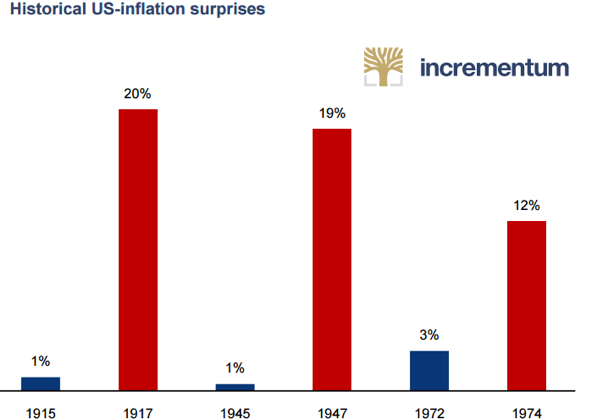

Inflation is here and banks will be on the run and run on.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.wealthresearchgroup.com/gold-verge-tearing-resistance/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Love that site. Nice.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit