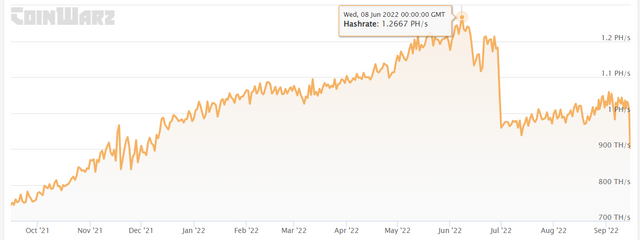

On 15 September, Ethereum shifted away from miners' services as validators are responsible for assembling blocks on the network. The altcoin ranked first in terms of mining profitability, which resulted in the network's total computing power growing until the announcement of Ethereum's Merge date. A maximum of 1.27 PH/s was delivered in June, which is the rough equivalent of 22 million 3060 Ti graphics cards with a capacity of 58 MH/s.

Image source: coinwarz.com

On 15 September, Ethereum shifted away from miners' services as validators are responsible for assembling blocks on the network. The altcoin ranked first in terms of mining profitability, which resulted in the network's total computing power growing until the announcement of Ethereum's Merge date. A maximum of 1.27 PH/s was delivered in June, which is the rough equivalent of 22 million 3060 Ti graphics cards with a capacity of 58 MH/s.

Image source: coinwarz.com

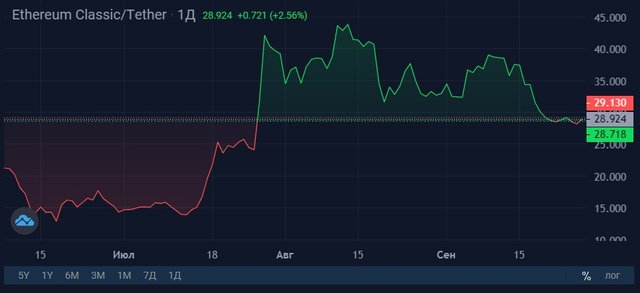

Despite the network's increased security, the coin's value didn't increase proportionally. ETC's price has moved upward since its Merge was announced. However, since then, it's been trading in the red since the date of the actual transition. A classic example of the approach is "buy the rumour, sell the news".

Image source: StormGain.com

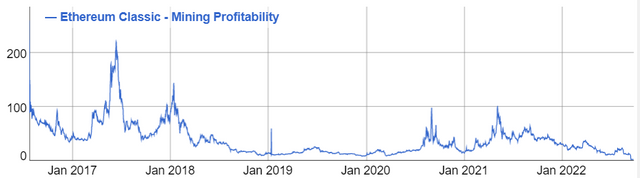

Due to the influx of miners, the mining difficulty has increased, which, while maintaining a low price, has led to a more than three-field decrease in mining profitability from $9.70 to $2.90 per GH/s per day. This is a low for Ethereum Classic and another test of miners' perseverance.

Image source: bitinfocharts.com

However, low performance is not a reason to put an end to the network's future. Ethereum has rightly been criticised for increased centralisation and risking having its transactions censored. On the day of the merger, SEC Chairman Gary Gensler announced that the regulator could possibly recognise PoS coins as securities.

Image source: defillama.com

The risks that have arisen with Ethereum are leading to a revival of the community around ETC. Thus, the volume of funds staked in DeFi gas increased from $93,000 in July to the current $607,000. This is a drop in the ocean compared to Ethereum's $31 billion. Nevertheless, a positive trend can be seen, and if the above risks materialise, interest in ETC will increase many times over.

StormGain analytics team

(cryptocurrency trading, exchange and storage platform)