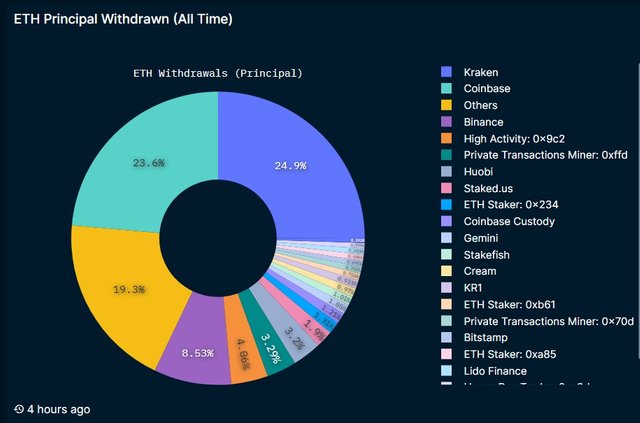

In early 2023, SEC Chairman Gary Gensler said that passive income generation may be subject to federal securities regulations and issued a pre-trial complaint to crypto-exchanges demanding they cease their staking operations. Some of them (like Kraken) have agreed to voluntarily exit the programme as soon as the long-awaited Shanghai hard fork releases the frozen funds. Coinbase, on the other hand, went to court to challenge the claim. Nevertheless, both American crypto-exchanges became leaders in the outflow of funds from staking, taking a 48.5% share.

Including staking fees, Kraken has withdrawn 730,000 ETH in less than three months. Coinbase has withdrawn 747 ETH. ETH. At current prices, this amounts to $2.9bn.

Image source: nansen.ai

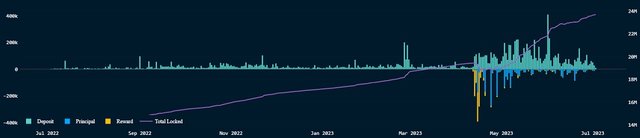

However, fears of an investor exodus did not materialise; on the contrary, the April hard fork attracted cautious market participants. As a result, the influx of new investors more than covered the outflow of deposits: since April 12, the total amount frozen in staking has increased by 22% to 23.7m ETH ($46bn).

Image source: nansen.ai

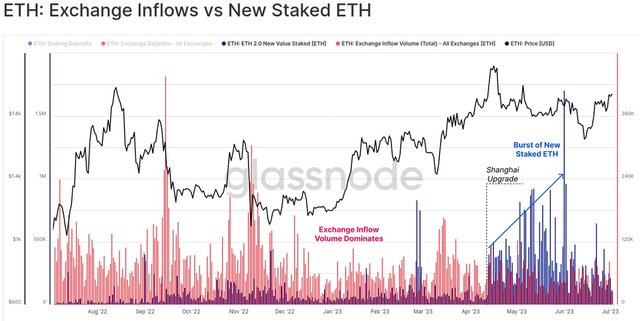

In addition, more ETH is being sent to staking than to cryptocurrency exchanges, a clear signal of its transformation from a speculative asset to an investment asset. And this trend has only gained momentum since the Shanghai hard fork.

Image source: glassnode.com

If Bitcoin has cemented its status as a "store of value", Ethereum could well become an advanced investment asset. The current yield on staking is 4.6%, and on some days in May it was as high as 8.6% due to increased network load.

Image source: beaconcha.in

The only factor standing in the way of further growth is the SEC's stance. In 2023, Ethereum is second to Bitcoin in dynamics solely due to complaints about staking and the regulator's desire to class the coin as a security.

Image source: StormGain.com

However, unlike a number of coins that have been classed as securities in previous lawsuits, interventions against Ethereum remain verbal – for now. If the SEC pulls back and recognises Ethereum as a commodity alongside Bitcoin, we will see a significant rise in interest in the second-largest crypto asset by capitalisation.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)