In the ever-expanding world of cryptocurrency, Bitcoin and Ethereum stand as two of the most prominent players. While both are digital currencies built on blockchain technology, they have significant differences in their mining processes. Let’s explore their similarities, differences, and what you need to know as an aspiring miner or curious enthusiast.

Bitcoin Mining: Pioneering the Proof of Work Consensus

Bitcoin, the original cryptocurrency created by Satoshi Nakamoto, introduced the world to the concept of mining as a means of verifying transactions and minting new coins.

Bitcoin mining operates on a Proof of Work (PoW) consensus mechanism, where miners compete to solve complex mathematical puzzles to add new blocks to the blockchain.

This process requires specialised hardware known as ASICs (Application-Specific Integrated Circuits) and consumes substantial amounts of energy. Bitcoin mining rewards miners with newly minted Bitcoins and transaction fees, incentivizing them to contribute their computational power to the network.

Ethereum Mining: Innovating with Smart Contracts

In contrast to Bitcoin, Ethereum takes a more versatile approach to blockchain technology, introducing smart contracts and decentralised applications (DApps) to its platform.

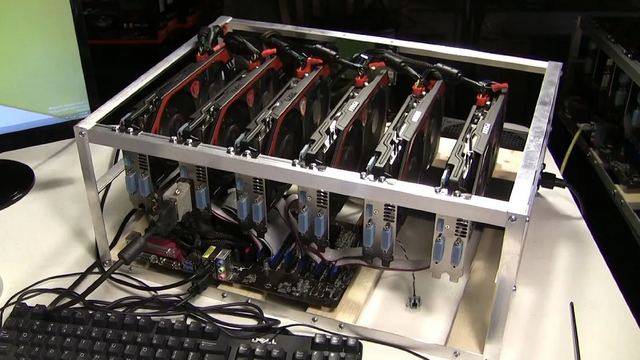

Ethereum mining also relies on a Proof of Work consensus mechanism, but with a different hashing algorithm called Ethash. This algorithm is designed to be memory-intensive, making it resistant to ASIC mining and more accessible to individual miners using GPUs (Graphics Processing Units).

Ethereum miners validate transactions and execute smart contracts on the Ethereum blockchain, earning rewards in Ether (ETH) for their efforts.

Differences: Bitcoin vs. Ethereum Mining

While Bitcoin and Ethereum mining share some similarities, they also have distinct differences that set them apart. Bitcoin mining is more centralised, with large mining pools and mining farms dominating the landscape due to the specialised nature of ASIC mining.

In contrast, Ethereum mining is more decentralised, thanks to its GPU-friendly algorithm and the prevalence of smaller mining operations.

While Bitcoin mining paved the way for decentralised digital currencies, Ethereum mining has pushed the boundaries of blockchain technology with its smart contracts and DApps.

Is Cloud Mining Bitcoin and Ethereum Possible?

Cloud mining for both Bitcoin and Ethereum is possible and has become a popular option for people looking to participate in cryptocurrency mining without the need to maintain their own hardware infrastructure. Cloud mining allows users to lease hashing power from remote data centers, where mining operations are managed by third-party providers.

In the case of Bitcoin and Ethereum cloud mining, users can buy mining contracts from reputable providers such as Luxor Mining, which allocates a portion of the provider’s mining resources to the user.

These contracts come with fixed terms, including the duration of the contract and the amount of hashing power allocated to the user. Users pay upfront or ongoing fees for these contracts, which cover the cost of hardware, maintenance, electricity, and other operational expenses.

Cloud mining offers several advantages for users, including:

- Accessibility: Cloud mining allows users to participate in cryptocurrency mining without the need to purchase and set up their own mining hardware, making it accessible to people with limited technical knowledge or resources.

- Convenience: Cloud miningremoves the stress of hardware maintenance, cooling, and electricity management, as these tasks are handled by the cloud mining provider.

- Scalability: Cloud mining contracts often offer flexible options, allowing users to scale their mining operations up or down depending on their budget and mining goals.

Summarily, cloud mining for Bitcoin and Ethereum offers an accessible option for people looking to participate in cryptocurrency mining without the complexities of hardware setup and maintenance. With reputable providers like Luxor Mining, users can leverage cloud mining contracts to earn rewards from Bitcoin and Ethereum mining operations, contributing to the decentralisation of these blockchain networks.