Introduction

Decentralized Finance (DeFi) is a financial plan that is not controlled by any system. DeFi is the key technology behind bitcoin and other similar crypto assets. In a DeFi system, multiple people can keep transaction records. On the one hand, DeFi is an extension of blockchain technology because it opens the door to future DeFi products, not just value transfer.

DeFi is generally faster than a centralized system because no one has to operate it. No central system approval is required when transacting with DeFi.

What is the Future of Defi: NFT and Flash Loans?

DeFi had a slow start, and it took society a few years to realize the potential of such a sophisticated system. It's nothing new that DeFi will eventually replace many of the financial software we use today. Later, if DeFi takes over the market, it is estimated that the total price of goods and services will also change in the coming years. Many projects are already implementing the DeFi protocol and are ready to take over the market. For example, we are starting to see growth in NFT and flash loans (Non Non-Fungible Tokens). An article published on CoinTelegraph shows the impact of the DeFi revival on banking.

What are Flash Loans?

Flash loans are one of the best use cases of the DeFi space and an extension of blockchain technology. They are basically loans that require no collateral. You don't even have to pass a credit check or perform the steps you normally take when taking a regular loan. The only condition for flash loans is that you have to repay the loan in the same transaction.

The ethereum blockchain makes the whole concept possible. Flash Loans basically depends on the flexibility of ethereum and smart contracts. Think of ethereum as a platform if you will – a “programmable money” platform. The ethereum blockchain makes the whole concept possible. Flash loans basically depend on the flexibility of ethereum and smart contracts. Think of ethereum as a platform if you will – a “programmable money” platform.

Why Choose DeFi Flash Loans over Traditional Bank Loans?

There are many reasons why you would prefer DeFi flash loans over traditional bank loans. If you need a bank loan, you may have to submit collateral or maintain a decent credit score. DeFi flash loans don't require anything like that. The only thing DeFi demands is that you can pay on the same transaction.

For example, if you take a flash loan and return it, you can pay it back in the same transaction as ETH. If you don't pay the loan, your transaction will be rejected, and the sender will get the money back. This rule is also referred to as the DeFi protocol. You can't do anything arbitrarily and therefore security can be guaranteed.

A Growing Trend in DeFi is NFT

NFTs are a different type of digital asset compared to crypto assets like bitcoin and ETH. The difference between exchangeable and non-exchangeable tokens is simple.

Let's assume that you lend your friend Nate a dollar. Now, Nate can spend this money as he pleases. The end goal is that he can return the money that has been used, the amount does not have to be the same as the money he borrowed from you, but you need to know that the value does not change with the serial number, as long as it is a whole banknote.

Now, let's assume that you give your friend Nate a very rare Michael Jordan NBA card. In this case, Nate must return the same card you gave him as the value changes depending on the rarity. He can't just give you Michael Jordan's regular NBA card. In this case, the cards are not interchangeable.

What NFT Has DeFi Unlocked?

DeFi has unlocked many NFTs from collectibles to games, art and real estate. The card collection is also a great example. For example, today's Devin Booker card is worth $74,500. Prices may increase over time. With DeFi, card collection can be much more lucrative.

NFT Game More Explosive Year 2021

NFT is already starting to take off and is expected to be a hit in gaming in the years to come. Games are really the right space to implement NFT. The gaming industry is expected to be worth $138 billion by 2021 where most of the revenue streams are from gamers to companies.

In-game NFT refers to a more financially savvy way for gamers to exchange items. Imagine being the real owner of an in-game item, ETNA brings a new way of facilitating a gaming ecosystem leveraging the NFT assets and conventional games onto the blockchain platform. As a DeFi project amalgamating the functions of yield farming and NFTs, Etna now ventures into Lending and borrowing via cryptocurrency networks.

ETNA Lending and Borrowing Functions

The trading platform that also includes lending and borrowing sequences is named ETNA. This dedicated platform runs on the tenets of the Binance Smart Chain and aims to support the adoption of the DeFi technologies. ETNA's adoption of the DeFi technology is done to deliver customer-centric solutions.

Lending and Borrowing on ETNA is programmed to be simpler and supports a larger extent of use cases. On ETNA, the users can secure a loan against NFTs as a collateral. So, any NFT owner can provide their NFT to the lenders and get a loan. For users staking the native ETNA tokens as collateral for the loans, no interest rates are charged.

When it comes to the DeFi-oriented aspects of the platform, users can now lend and borrow, transact in the marketplace, and engage in regular contests to earn rewards.

Comprehensive Market-Ready Functions

The marketplace proffered by the platform represents a mix of DEX trading and Broker-Buyer functions which is an improvement from the existing system with a similar approach. The marketplace, which is also called a Hephaestus workshop, works as a comprehensive marketplace.

The Hybrid Marketplace has integrated gateways and can be used to trade products. These multiple gateways will allow the users to transact in different cryptocurrencies. The payment gateways are built in a manner that any user can make payments without owning multiple payment wallets.

ETNA Tokenomics

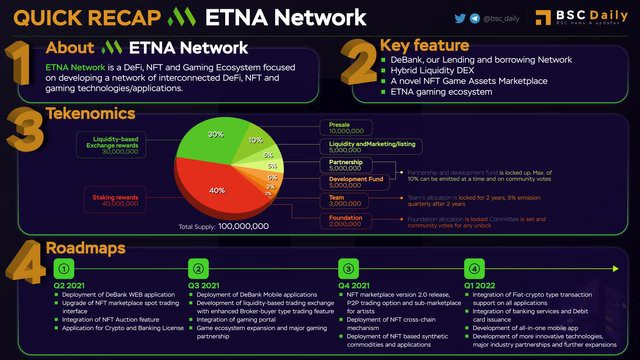

The total supply of ETNA tokens is 100 million. The entire token supply is divided into various aspects that include staking, the marketplace, presale, liquidity, partnership, development fund, team, and foundational. The team allocation, partnership & development funds, plus the foundational allocation fund, is locked for a fixed period. For the presale, it is scheduled to happen on the 21st of March, 2021.

Utilization of the ETNA Tokens

The ETNA tokens are native to the financial platform. It has four central use cases, which includes Lending transactions, NFT Market transactions, BBT Marketplace, and Game Asset Value.

For the lending transactions, the ETNA tokens can be used to submit the collateral and get interest-free loans. ETNA tokens will be the preferred currency in the NFT market and required to gain its membership.

Since the marketplace works on a hybrid model, the brokers need to become a member for facilitating the transactions. The membership fee has to be paid in ETNA tokens. The last use case of ETNA is with reference to the Game Asset valuation, where the token is used as a store of value for buying the game-related assets.

OxBull's Role in the Partnership

Oxbull is an incubator helping platforms like ETNA gain awareness, attention, customer base, and market.

About ETNA

ETNA's reward-generation features and functions lets the users engage with the platform in multiple ways. The users can get a loan based on some collateral from the lenders who are also present on the same platform.

By keeping the ETNA coins as collateral, the users can get interest-free loans and others can get lower-interest loans.

Useful links to the project

WEB: https://www.etna.network/

TWITTER: https://twitter.com/EtnaNetwork

TELEGRAM: https://t.me/EtnaNetwork

AUTHOR

bitcointalk username: blachken

Link BTT: https://bitcointalk.org/index.php?action=profile;u=2763530

BEP-20 Wallet Address:0xC240B3cc47b1907aB814Ae9C585b29f4CdfF9756