Looking at the bigger picture

If we take a look at the NFT market today we can see that there are two main niches that gained most of the traction and are the main drivers of growth: Gaming and Art.

We could say that both niches satisfy different user needs and each one is quite different in the way collectors perceive the properties that give value to those assets.

For example, in gaming we have more utility attached to those assets while in art the assets are closely linked to the brand that the artist has created for himself. But even with utility, we are still left with a lot of intrinsic value that is derived from the sole perception of the buyer over the actual price and scarcity plays a big part in both niches that makes an objective valuation even more difficult compared to fungible tokens.

Looking at the market in terms of adoption, we can immediately notice that there will always be a big diversity of asset types and a big influx of new projects launching and testing new ideas and with the barrier to entry getting even lower, we can only estimate that the volume of new projects and ideas will increase in the future.

Taking this context into consideration, let's see what role will automation play in the NFT lending space.

ETNA Lending and Borrowing Functions

The trading platform that also includes lending and borrowing sequences is named ETNA. This dedicated platform runs on the tenets of the Binance Smart Chain and aims to support the adoption of the DeFi technologies. ETNA's adoption of the DeFi technology is done to deliver customer-centric solutions.

Lending and Borrowing on ETNA is programmed to be simpler and supports a larger extent of use cases. On ETNA, the users can secure a loan against NFTs as a collateral. So, any NFT owner can provide their NFT to the lenders and get a loan. For users staking the native ETNA tokens as collateral for the loans, no interest rates are charged.

When it comes to the DeFi-oriented aspects of the platform, users can now lend and borrow, transact in the marketplace, and engage in regular contests to earn rewards.

Comprehensive Market-Ready Functions

The marketplace proffered by the platform represents a mix of DEX trading and Broker-Buyer functions which is an improvement from the existing system with a similar approach. The marketplace, which is also called a Hephaestus workshop, works as a comprehensive marketplace.

The Hybrid Marketplace has integrated gateways and can be used to trade products. These multiple gateways will allow the users to transact in different cryptocurrencies. The payment gateways are built in a manner that any user can make payments without owning multiple payment wallets.

ETNA Tokenomics

The total supply of ETNA tokens is 100 million. The entire token supply is divided into various aspects that include staking, the marketplace, presale, liquidity, partnership, development fund, team, and foundational. The team allocation, partnership & development funds, plus the foundational allocation fund, is locked for a fixed period. For the presale, it is scheduled to happen on the 21st of March, 2021.

How to buy an ETNA token?

ETNA symbol comes through a skilled decentralized principle which usually works out relating to the BSC project — Pancake Trade.

Buy link: https://exchange.pancakeswap.finance/#/swap?outputCurrency=0x51f35073ff7cf54c9e86b7042e59a8cc9709fc46

Contract address to add to your wallet MetaMask, TrustWallet, etc

0x51f35073ff7cf54c9e86b7042e59a8cc9709fc46

Utilization of the ETNA Tokens

The ETNA tokens are native to the financial platform. It has four central use cases, which includes Lending transactions, NFT Market transactions, BBT Marketplace, and Game Asset Value.

For the lending transactions, the ETNA tokens can be used to submit the collateral and get interest-free loans. ETNA tokens will be the preferred currency in the NFT market and required to gain its membership.

Since the marketplace works on a hybrid model, the brokers need to become a member for facilitating the transactions. The membership fee has to be paid in ETNA tokens. The last use case of ETNA is with reference to the Game Asset valuation, where the token is used as a store of value for buying the game-related assets.

OxBull's Role in the Partnership

Oxbull is an incubator helping platforms like ETNA gain awareness, attention, customer base, and market.

About ETNA

ETNA's reward-generation features and functions lets the users engage with the platform in multiple ways. The users can get a loan based on some collateral from the lenders who are also present on the same platform.

By keeping the ETNA coins as collateral, the users can get interest-free loans and others can get lower-interest loans.

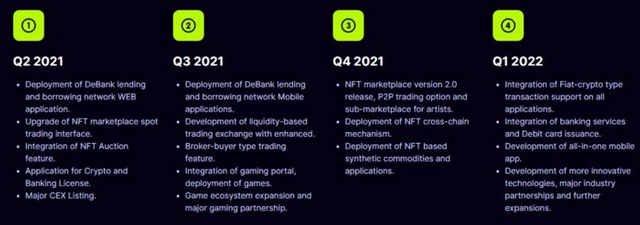

ROADMAP

In conclusion

At ETNA,we believe that NFTs are here to stay and offering users the option to leverage their assets without selling them will bring a new wave of innovation in the space.

As we are getting closer to mainnet launch, we are preparing to bring new upgrades to our core product and make fast loans and pool lending a reality for our users.

Thanks for reading and stay tuned for more updates! Don’t forget to stay in touch, check out our Website and follow us on Twitter, Telegram and Discord.

The official resources of the project etna.network:

Website: https://www.etna.network/

Whitepaper: https://www.etna.network/assets/ETNA.pdf

Twitter: https://twitter.com/EtnaNetwork

Telegram group: https://t.me/EtnaNetwork

Telegram channel: https://t.me/EtnaChannel

Discord: https://discord.com/invite/dbuEXdm

Youtube: https://www.youtube.com/channel/UCgkP_qjdYSZ8iesrz5kK0YQ

Author

Forum Username: milagros12

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=2745921

BEP-20 Wallet Address: 0x4e4907E686D697C43ADc18c32Be41A3453913878