Etrade, a popular online retail trading platform, has announced it will support Cboe bitcoin futures contracts for its users. The company joins rivals Ally and TD Ameritrade in a bid to capture part of the multi billion USD cryptocurrency market.

Etrade Joins a Crowded Party

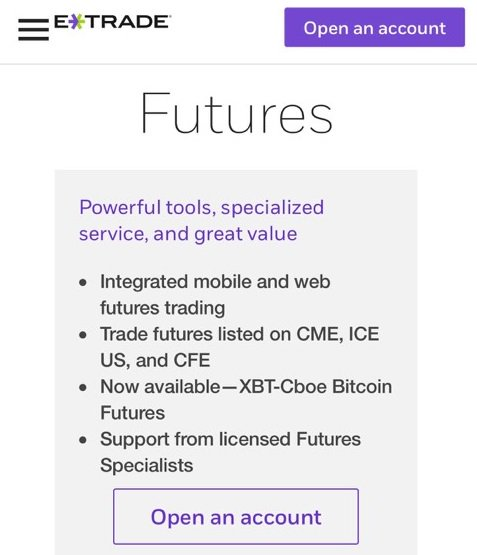

Understated, almost begrudgingly, retail online broker Etrade quietly listed the chance for its customers to choose bitcoin futures on Cboe. On the company’s Futures page, just below “Powerful tools, specialized service, and great value,” along with “Integrated mobile and web futures trading,” there it was:

“Now available—XBT-Cboe Bitcoin Futures.”

Previous Etrade pronouncements concerning the world’s most popular cryptocurrency were closer to warnings. What You Should Know About Bitcoin is their most recent missive, posted last month. Cribbed from another source, it contains all the usual scares, shifting easily from SEC cautions, to risks, speculation, and finally scams; not exactly a ringing endorsement.

Etrade largely services a US clientele, something lacking at the Cboe in terms of volume and liquidity with regard to bitcoin futures, which have initially been dominated by South Korean and Japanese traders. Etrade is a discount, do-it-yourself leader in online retail trading. It also serves as a bank with more than two dozen brick and mortar outlets. It boasts over 3 million accounts and nearly 2 billion USD in revenue.

Mainstreaming Continues

Analysts generally agree Etrade will garner more liquidity within the bitcoin ecosystem. Few were surprised by the move to Cboe. The point of a futures market is to allow retail traders bitcoin access through brokers. Mainstream investors have been skittish about cryptocurrencies, but futures are that midway step away from actually owning bitcoin while participating in price movement without bothering with wallets and keys.

So far, mainstreaming of the digital asset has been boring, especially when set against initial expectations. Futures are thought dangerous for newer investors due to their being so leveraged. Factoring in how contracts are cash-settled atop bitcoin, and soon ETFs could be settled atop futures contracts, not to mention whatever other creative financial innovations are to come, and the makings of an exciting domino effect are being potentially erected.

Bitcoin futures markets are early days, of course, having a mere couple weeks under their Cboe and CME belts. TD Ameritrade and Ally Financial have jumped in, making Etrade all but obligatory to do the same.

For its part, Etrade asks, “Why trade futures? Trade some of the most liquid contracts, in some of the world’s largest markets. Diversify into metals; Near around-the-clock trading; No pattern day trading rules; No minimum account value to trade multiple times per day; Ease of going short; No short sale restrictions or hard-to-borrow availability concerns; Capital efficiencies; Control a large amount of notional value with relatively small amount of capital,” the website argues.

What do you think about mainstreaming bitcoin?