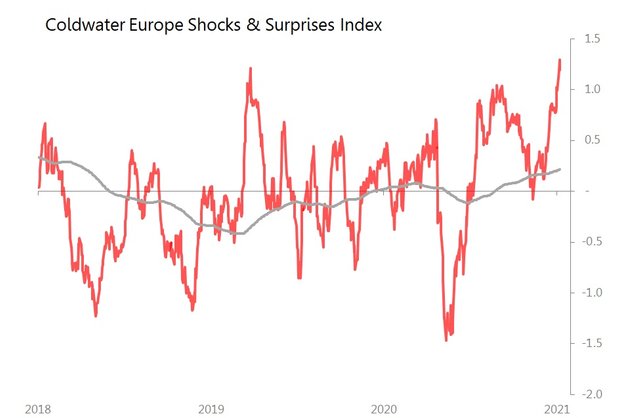

Most of the economic data coming from Europe is recording for posterity what happened in November, before the new round of Covid-lockdowns really kicked in. And November turned out to be a much stronger month that consensus expected, pushing Coldwater's Europe shocks & surprises index up to the highest since 4Q16.

But today we had the EU's largest and most comprehensive set of confidence indicators, with surveys taking place in the second half of December. This is our first best chance to see what damage Round 2 of the pandemic is doing to the EU economy. The results were surprisingly good: the growth-tracking Economic Sentiment Index rose 2/4pts to 90.4, the Employment Environment index rose 1.4pts to 88.3, and the Industrial Confidence index rose 2.9pts to minus 7.2. Whilst none of these managed to beat normal expectations, they were all clustered towards the top end of where you'd expect them to be. Only the Services Confidence index dipped, down 0.3pts to minus 17.4, as both Germany and France soured, whilst others survived or improved.

Maybe there's worse to come (watch for France's Nov consumer spending tomorrow!). But on the face of it, the combination of massive monetary stimulus and a dramatic easing of fiscal corsets in Germany and France, look to be working better than expected.