Weekly euro fundamental forecast

Investors are confident that Jerome Powell’s speech at Jackson Hole will cause a real shock in the financial markets. For a long time, markets have been trading on expectations, and they are waiting for the facts now. One should not go against the Fed, and the Fed’s plan should not change, supporting the EURUSD bears.

Whatever extremes CME derivatives go to, either lowering the likelihood of a 75-basis-point hike in the federal funds rate in September from 70% to 40%, then again raising the odds above 50%, the Fed’s final verdict will depend on the inflation report for August. Jerome Powell doesn’t know where consumer prices will go, so he can’t provide any clues on the Fed’s next moves.

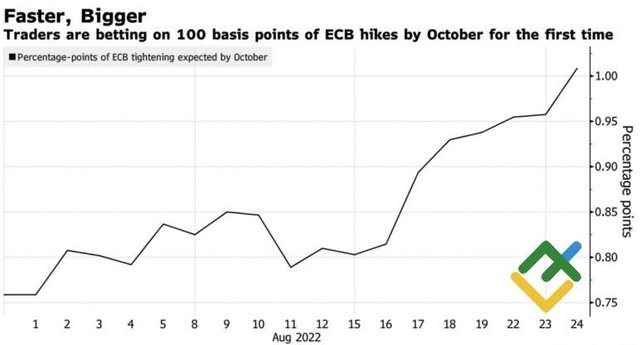

Dynamics of expected growth of ECB rate

For more information follow the link to the website of the LiteForex

https://www.litefinance.com/blog/analysts-opinions/euro-is-reckless-forecast-as-of-25082022/?uid=285861726&cid=58534