Weekly euro fundamental forecast

News rules financial markets. After a source familiar with the matter informed Bloomberg that the ECB could immediately raise the deposit rate by half a point, and Reuters received information from trusted people about the resumption of Nord Stream from July 21, EURUSD bulls went ahead. The major currency pair hit a two-week high despite being close to a crash a bit earlier.

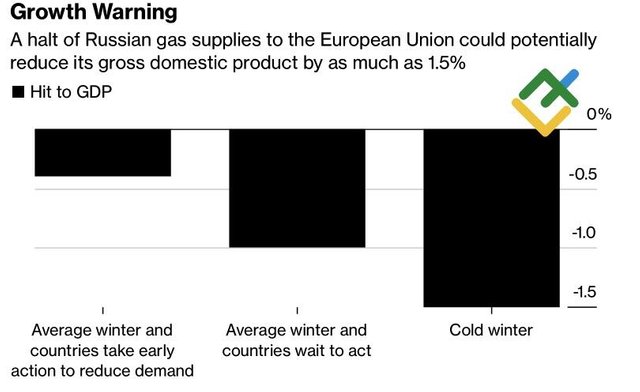

The anticipation of death is worse than death itself. The European Union was tired of waiting for the complete shutdown of Russian gas and accepted this scenario as a base one. According to the forecasts of the European Commission, a severe winter will deduct 1.5 percentage points from the EU GDP, a moderate one - 0.6-1 percentage point. If all the planned measures can be implemented, the losses may even be reduced to 0.4 percentage points. It means maximizing the import of liquefied natural gas, restoring coal capacity, and other measures. According to Wood Mackenzie, if the winter turns out to be colder than average in recent years, Europe will have to ration only 7% of the gas demand.

Losses EU GDP in case of complete shutdown of Russian gas

Read more on LiteForex site

https://www.litefinance.com/blog/analysts-opinions/euro-stays-close-to-a-crash-forecast-as-of-20072022/?uid=285861726&cid=58534