Weekly euro fundamental forecast

Are financial markets wrong dreaming of the impossible? The S&P 500 rose 9.1% in July, its best performance since November 2020. Stocks and bonds are reassessing the Fed’s monetary policy outlook. Just a week ago, the chances of a 50-basis-point federal funds rate hike in September were 44%, but now they have jumped to 82%. In addition to a drop in Treasury yields, this encourages the EURUSD bulls, but the growth potential looks limited.

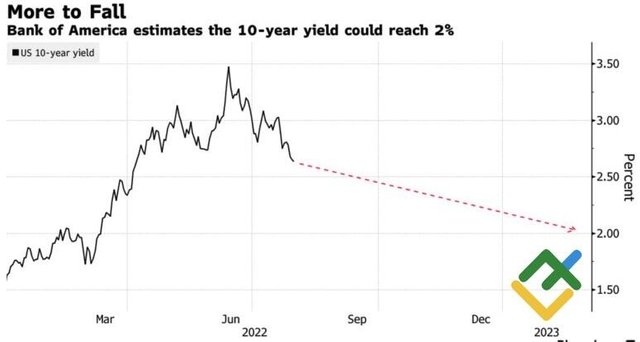

The greenback’s safe-haven status and the Fed’s aggressive monetary tightening are the major bullish drivers for the dollar that allowed the USD hit its 20-year high. When both stocks and bonds fall, causing the latter to rise in yield, there is no alternative to the US dollar. However, fears of a recession have lured investors back to Treasuries. Treasury yields went down, depriving the greenback of an important benefit. Bank of America forecasts 10-year yields to drop to 2%. Even if the Fed manages to make a soft landing, market fears of a recession will still have a significant impact.

Dynamics of 10-year Treasury yield

For more information follow the link to the website of the LiteForex

https://www.litefinance.com/blog/analysts-opinions/eurusd-dreams-of-impossible-forecast-as-of-02082022/?uid=285861726&cid=58534