A quick recap of last weeks price action on the EURUSD...

Wednesday: bulls out of steam and bearish pattern formed

The EURUSD lost vital ground on Wednesday after retesting the lows of the 2008 financial crisis. The 1.2325 area was a key area to keep an eye on as that proved to attract a lot of selling pressure. Clearly, Wednesday’s high of 1.2323 was all Euro bulls could manage last week. The session was an interesting one and price action formed a (quasi-)bearish engulfing pattern, signalling that a pullback was likely.

Thursday: some support at the 1.21

Thursday’s session found support at the 1.2160 handle. Support held, buyers were coming in to rejoin the fight and the bullish momentum carried into the early hours of Friday but was ultimately cut short.

Expect near-term weakness

Looking at the Weekly chart we can see a bearish pin bar being produced. Adding to the bearish sentiment would also be Wednesday’s engulfing pattern. These key price structures are very clear and hint at near-term weakness. The odds are that as long as 1.2325 holds as resistance, the EURUSD is likely to pull back to a level of prior support.

.png)

View larger price chart: https://www.tradingview.com/x/q8gDgAV7/

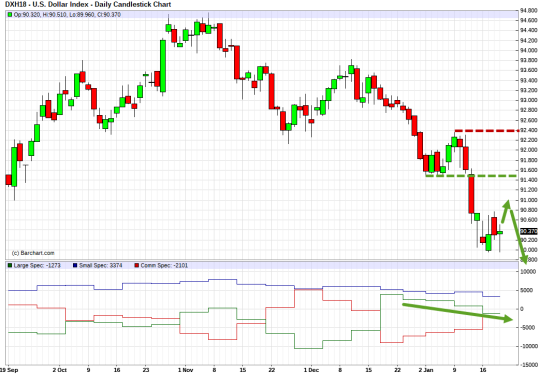

Looking at the coming trading week

Because we favour with trend trades only and the fact that the EURUSD is still in a clear uptrend (daily chart) we will be looking for long positions only. The lower the market, the more attractive risk-reward ratio will be!

Where might the EURUSD pair find support this week?

A good place to be looking for possible bullish setups would be at Thursday’s low point just above 1.2160. A close below that would expose the early January highs at 1.2070 followed by the pivot at 1.1930.

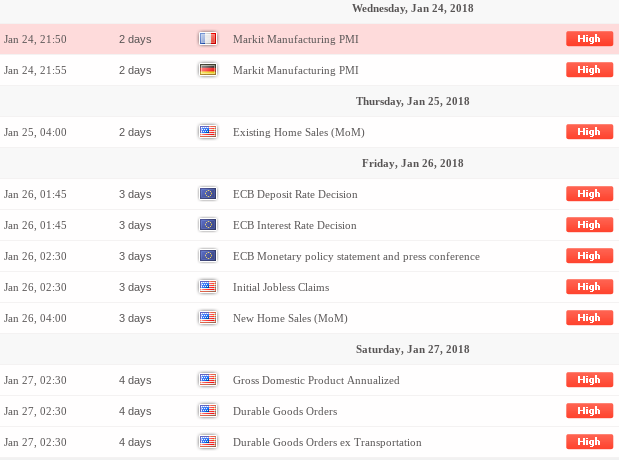

Key economic drivers this week

- The outcome of the vote in Germany (It will likely be a very active 24 hours for the Euro regardless of the outcome of that vote in Germany)

- U.S. government shut down on Saturday (this will no doubt influence the USD price)

These are the 2 major price influencers, but there are more major news events planned for this week that could have an impact on the EURUSD.

For a complete list of economic events please visit: https://www.myfxbook.com/forex-economic-calendar

Thursday’s session also promises to be an eventful one with an ECB rate decision at 7:45 am EST followed by a presser at 8:30 am EST.

As a technical trader, you want to keep an eye on these news events and how price reacts to them. The decision of whether to buy or sell will come from signals on the chart and the key levels outlined below.

.png)

For a larger chart view: https://www.tradingview.com/x/8614MP2i/

What are the big players up too?

Net EURUSD position indicator decreased but didn’t reverse and large speculators support the technical trend, which is upwards. Professionals’ opinion corresponds to the market technical picture that is bullish.

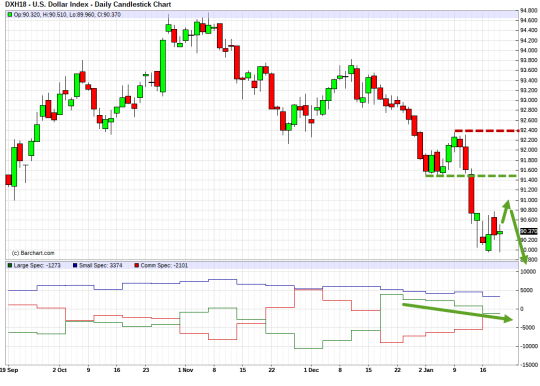

What is the sentiment on US Dollar Index (DXY)?

Hourly: Strong Buy | Daily: Strong Sell | Monthly: Strong Sell

.png)

The USD index remains in a bear trend. The market is in the correction on the Daily timeframe and a pullback selling opportunity will appear after its completion. The higher a pullback signal is formed, the more attractive risk-reward ratio will be. Short positions will remain relevant until the market is below the nearest resistance level, the highs of January 9-10.

COT net position indicator decreases along with the market and CFTC reports indicate that large speculators are actively selling USDX and hedgers are buying. The professionals’ opinion corresponds to the Daily trend direction.

New to trading and you want a good place to get started?

For new traders who want to 'get their feet wet' and try trading the Forex market, I can thoroughly recommend Etoro. Over at Etoro you can follow successful traders and copy their trades. This way you can earn money in the markets while you learn the ropes. For more info please visit: http://etoro.tw/2CUUOXs

Remember: trading involves risk, a lot of risks if you do not fully understand what it is you are doing. Please do your due-diligence before investing your hard-earned money. Before investing in anything, invest in yourself and get a good education.

Hi, I post the best forex scalping strategy in my blog, you can gain more pips by this strategy ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, I post the best forex scalping strategy in my blog, you can gain more pips by this strategy ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting! Do you also have longer term expectations? Are we going to reach 1.30 or will USD eventually get more momentum?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Long-term becomes fuzzier and harder to read. My approach is observing how price reacts at certain key daily levels - where the big buyers or sellers are likely to come into the market. From there ride the new trend if and when it is created.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good analysis, the 1.2325 is going to be a key resistance and hard to pass.

Chart H4 will give us the way forward.

good week.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 15.25% upvote from thanks to: @nzfxtrader.

thanks to: @nzfxtrader.

For more information, click here!!!!

Send minimum 0.100 SBD to bid for votes.

The Minnowhelper team is still looking for investors (Minimum 10 SP), if you are interested in this, read the conditions of how to invest click here!!!

ROI Calculator for Investors click here!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@originalworks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The @OriginalWorks bot has checked the text of this post and it appears original!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit