Poloniex, also known as Polo, has been based out of Delaware, United States, since 2014. It’s a well-known name in the industry, and it consistently boasts the highest trading volumes for altcoins.

Users who want an unparalleled selection of <rel="tooltip" title="A General name given to cryptocurrencies other than Bitcoin. For example Litecoin, Ethereum, Dash, etc.">altcoin trading pairs will enjoy Poloniex. The exchange’s setup suits more experienced cryptocurrency traders—it isn’t the place to make your first Bitcoin purchase. If you’re looking to use <rel="tooltip" title="Currency that a government has declared to be legal tender, but is not backed by a physical commodity. For example the US dollar, the Euro and almost any other country related currency you can think of.">fiatCoinbase.

Currency support

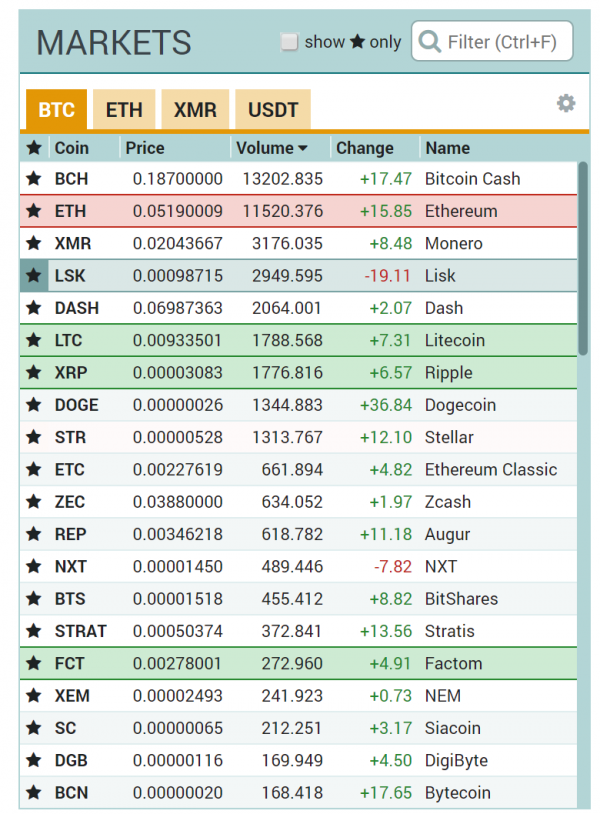

The broad range of altcoins available for trading is the resounding pull for most Polo users. However, deposits must be made in cryptocurrency. There’s no support for bank transfers or credit card transactions.

Once you’ve deposited your chosen funds, there’s an option to store value in USDT (Tether), a cryptocurrency that represents US dollars (e.g., 1 USDT should be the same as 1 USD). This is handy for those who are nervous about market volatility. While this is a useful tool, the fact that no fiat currency support exists makes it a little tricky to trade out of a cryptocurrency position because you’ll need another exchange platform.

The trading pairs on offer make Poloniex a very attractive platform, with altcoin trading options in Bitcoin, Ether, Monero, and USDT.

Country support

Although the platform is based in the United States, no real geographical restrictions exist for Poloniex customers. This in large part comes down to the pure cryptocurrency setup on the platform. It’s not currently required to conform to local banking and finance regulations because there’s no fiat currency used. It appears to be operated with particular freedom, particularly when compared to fully regulated exchanges such

Fees

Poloniex provides some of the lowest fees around, with the highest taker fee set at 0.25% when trading under 600 BTC. The maker fee starts at 0.15%, which is particularly low for trading exchanges. Working with colossal trade sizes, you can almost eliminate fees. Here’s the full fee schedule:

Security

A clear and concise layout of the exchange’s security features is a little hard to come by. Poloniex does, however, claim the following:

“The vast majority of customer deposits are stored offline in air-gapped cold storage. We only keep enough online to facilitate active trading, which greatly minimizes risk and exposure.”

Beyond this, how the platform’s security operates is a bit of a mystery. Generally, I like to know what steps are in place to protect trading accounts—if only to sleep a little easier at night.

The near-essential two-factor authentication is available to users so that at least hackers can’t access your account with just a single password. As always, try not to keep large sums in a trading exchange for lengthy periods of time. If possible, store funds in a cold hard wallet under your control. Try Ledger or Trezor for a neat, affordable solution.

Customer support

Customer support is a real bone of contention for many Poloniex customers. Many report long wait times—even up to and above 90 days. Reports across Reddit and other forums become uncomfortable to read after a while. Some users feel like they’re knocking on the door of a haunted house when trying to solve their problems.

I don’t think it’s anything malicious or scam-worthy from the customer support team, but it could be more a sign of a struggle to deal with phenomenal demand. It’s an issue for most of the industry as virtually all companies battle to keep up with incredible expansion and interest.

Public opinion/online reviews

Customer support problems combined with other issues really do leave a black mark on Poloniex. Given that it’s such a powerhouse of an exchange, it’s shocking to see such lowly opinions littering the web.

Questions about liquidity and the ability to withdraw funds are another underlying obstacle for traders. Reports of withdrawal requests “awaiting approval” for seemingly infinite periods of time account for many of the complaints.

As I mentioned earlier, the struggle to trade out of a cryptocurrency position really comes to the forefront. If you’re looking to liquidate funds after trading, a quick and painless withdrawal process is essential. Seeing your money frozen while awaiting approval could be almost ruinous. It certainly makes me think twice about regularly working with Poloniex.

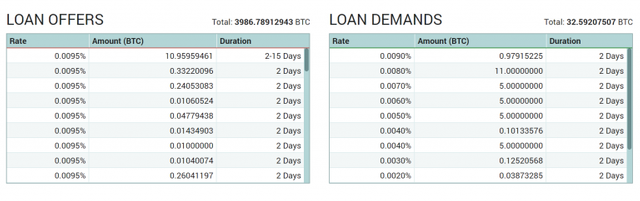

Margin trading features

One area in which Poloniex dominates the competition is the margin trading feature it offers. Users can quickly and efficiently use a peer-to-peer function to borrow funds and start margin trading. Not only can you secure trading funds, you can also take advantage of the lending feature to work with other traders. This can be particularly profitable for both parties when the market is strong and trending upward.

Conclusion: Is Poloniex a good exchange?

Poloniex’s huge trading volumes suggest that it actually operates smoothly and without problems for the majority of users. But public opinion and complaints do make me think twice about the exchange. The brilliant access to altcoins and trading pairs is a real upside, but if you can’t withdraw your funds, then it’s all a waste of time.

Perhaps Poloniex’s sheer volume and popularity are stifling its problem-solving and customer support efforts. There’s a wide range of competition now, so you may want to look at some other options—especially if you’re simply wanting to deal with major cryptocurrencies such as Bitcoin _________________________________________________________________________________________________________________________________________ # Bitcoin Wallet Copay

Warning: There is an apparent problem with Copay that has led to multiple reports of missing funds. The wallet should be considered insecure until this issue is resolved. See the end of this article for more details.

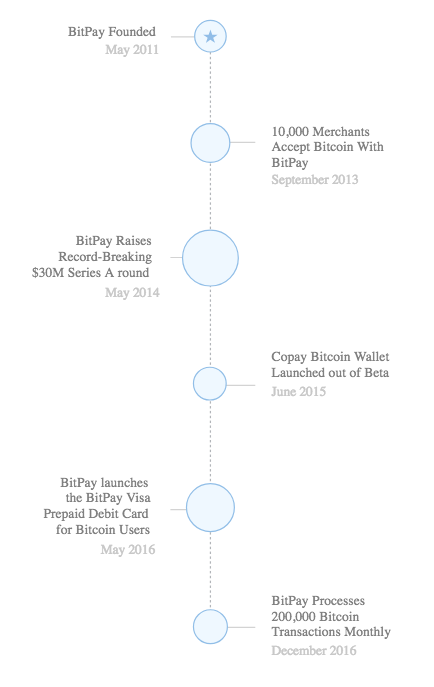

Atlanta-based BitPay was founded as a cryptocurrency payment service in 2011. At a time when many businesses were competing to be the first in their industries to implement Bitcoin—which often led to sales rushes—BitPay’s payment gateway made it easy for the service to BitPay was also among the first payment services to allow the automatic conversion of a specified percentage of received BTC into <rel="tooltip" title="Currency that a government has declared to be legal tender, but is not backed by a physical commodity. For example the US dollar, the Euro and almost any other country related currency you can think of.">fiat

BitPay’s convenience and reliability during a time when companies were keen to experiment with Bitcoin but struggling to implement it led to its becoming a popular and much-emulated service. The Bitcoin ecosystem has changed dramatically since 2011, however, and businesses that are serious about Bitcoin have largely implemented their own payment solutions (if only to save the 1% fee BitPay charges on each transaction processed over 30 per month).

The BitPay timeline

Significant events in BitPay’s history taken from the company’s About page

Absent from the timeline above are three important events:

- The phishing attack on BitPay CEO Stephen Pair in September 2015, in which 5,000 BTC was lost.

- The termination of BitPay’s prepaid debit card by Visa in January 2018. This came as a result of the credit card company’s severing of ties with WaveCrest, a banking intermediary facilitating multiple crypto-funded payment cards. who-supports-segwit2x-the-new-york-agreement-and-the-upcoming-bitcoin-fork-explained/">support for the SegWit2x <rel="tooltip" title="A radical change to the protocol that makes previously invalid blocks/transactions valid (or vice-versa), and as such requires all nodes or users to upgrade to the latest version of the protocol software. It is a permanent divergence from the previous version of the blockchain, and nodes running previous versions will no longer be accepted by the newest version.">hard fork

The BitPay/Copay wallet

BitPay launched its Copay wallet in mid-2015. It’s a light (i.e., Simple Payment Verification or <rel="tooltip" title="Simplified Payment Verification. A Bitcoin protocol feature that is usually implemented in wallets. It allow the creation of "lightweight" wallet clients - wallets that don't need to download the whole blockchain in order to operate. This makes it possible to install SPV wallets on mobile phones and other space limited devices.">SPV wallet, which means that it doesn’t download the full Bitcoin <rel="tooltip" title="The full list of mined blocks since the creation of Bitcoin. There is also a company called Blockchain.info which supplies various Bitcoin services such as a block explorer and a bitcoin wallet but they have no control or authority over Bitcoin's blockchain.">blockchain

Light wallets consume far fewer system resources, but they’re less secure (in theory) and more centralized, and they don’t help support the Bitcoin network.

Copay features

Multiple platforms

Copay is available for mobile (iOS, Android, Windows Phone) and desktop (Windows, Linux, Mac).

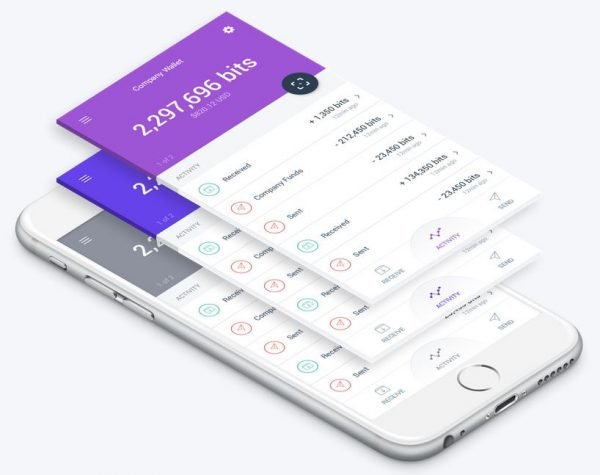

Multiple accounts

Copay allows for the creation of multiple accounts within a single wallet. You can create separate accounts for business and personal use, for example.

HD wallet

Copay is an HD (hierarchical deterministic) wallet. This is a fancy way of saying that you back up your wallet by recording and storing a random series of words known as a seed phrase. This seed phrase allows you to generate a very large amount of private keys and addresses.

This is also more convenient than backing up a digital file, as your seed phrase may be recorded in a durable physical format (such as crpytosteel-hands-on-review

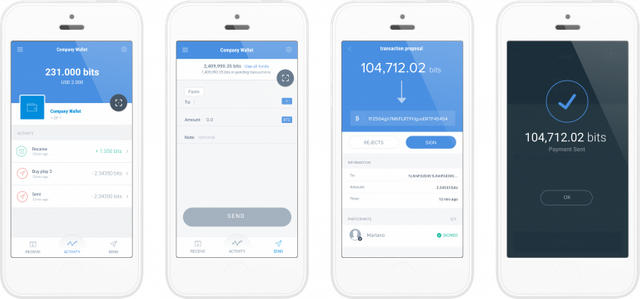

Multi-sig support

Copay allows for the creation of MULTIS accounts. Such accounts may only spend money with the approval of multiple parties. This is useful for creating the Bitcoin equivalent of joint bank accounts. Spending requires authorization from either all or a certain number of parties depending on how the wallet is configured.

Open-source project

All of Copay’s wallet and server code is public. This allows any interested party to inspect, review, and improve the code, leading to a far more trustable wallet than those that contain closed sourced code (most multi-wallets, for example).

Clean user interface

Copay has an attractive and intuitive UI. It displays prices in 150 different currencies and has support for multiple languages.

Hardware wallet support

A bitcoin wallet that uses a physical piece of hardware in order to operate and keep it more secure. Examples of hardware wallets are TREZOR, LedgerWallet and Keepkey. A hardware wallet is usually more secure since it's considered to be a form of cold storage.">hardware wallet—the most secure and convenient way to protect the private keys that control your coins.Coin support

Copay currently supports Bitcoin and Bitcoin Cash.

There are several wallets, such as electrum-wallet that have all of the above seven features and more—so what makes Copay special? Previously, we could have cited Copay’s in-wallet facility for coin purchases, but this is no longer available following Visa’s withdrawal of support. BitPay is seeking to establish a similar partnership with another payment service at the time of writing.

The Copay wallet’s integration with BitPay services is probably its main selling point. For example, the wallet will verify the address of a merchant using BitPay’s service, which can prevent misdirected payments. There are many such merchants, so this can be a useful feature for those who don’t regularly (or obsessively) check payment addresses.

Copay drawbacks

Technically and design-wise, Copay appears sound. However, BitPay’s unfortunate foray into Bitcoin politics has greatly damaged trust in its wallet. Copay was delisted from Bitcoin.org’s list of trusted wallets for endorsing the BTC1 hard fork as “the real Bitcoin.” The BTC1 hard fork eventually failed for both political and technical reasons.

That BitPay advised its wallet (server) users to switch over to rushed, untested code that ultimately failed to activate is disturbing, to say the least.

There have also been multiple reports of an issue leading to missing funds (2) (3). This is an extremely serious matter for any wallet—whose primary function it is to securely store value.

Conclusion: Is Copay a good wallet?

If we were to look only at its features, Copay would be a solid choice for a wallet. However, today there are alternatives that supply similar features without the politics that accompany Copay. Also, until the missing funds issue is resolved, it’s hard to recommend Copay as a solid choice.

Since BitPay is considered a veteran in the Bitcoin ecosystem, it will probably address these issues in the near future. Until then, use Copay cautiously and definitely not for large amounts of money.

source https://99bitcoins.com/bitpay-bitcoin-wallet-review-copay/)

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://99bitcoins.com/bitpay-bitcoin-wallet-review-copay/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit