Bitgrail, an exchange whose primary purpose was to facilitate the trading of nano, has folded after ‘losing’ 17 million XRB, valued at around $170 million. The Italian exchange had been offline for weeks, and its customers feared the worst. Today, its operator “Francesco The Bomber” confirmed the bad news, which gained short shrift from the Nano community. Many believe Bitgrail’s owner to have exit scammed, taking with him almost 13% of the total circulating supply.

A Big Heist for Tiny Nano

Cryptocurrency Exchange Bitgrail Closes After ‘Losing’ $170 Million of NanoUp until December of last year, nano – then going under the name of raiblocks – was little more than another aspiring altcoin hoping to make it to the big league. Its promise of fast transactions and zero fees had some of the more diligent Twitter traders interested, but even they were astonished by the moon mission XRB suddenly embarked on. At the start of December, 1 XRB could be bought for $0.20. One month later, 1 XRB had soared to $35 after gaining 17,500%, making it 2017’s biggest gainer and putting the likes of bitcoin, litecoin and ripple in the shade.

For most of last year, Bitgrail – the ‘rai’ in its name derived from raiblocks – was one of the only places where XRB could be bought. The exchange was clunky and erratic, like most small crypto exchanges, but it worked. Most of the time. It also supported other cryptocurrencies, but the volume was laughably low. Bitgrail was the place to go for raiblocks and nothing else. 99% of the time, altcoins that begin life on micro-exchanges stay there. But every once in a while, an outlier makes it to the big league. Raiblocks did just that in December, gravitating to larger exchanges and rocketing in price.

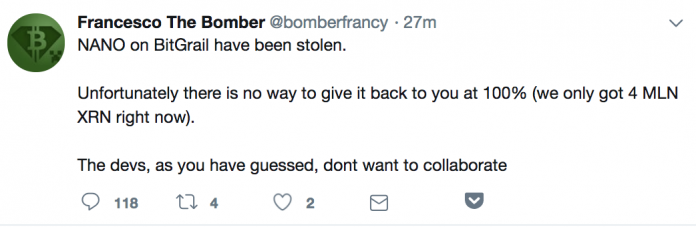

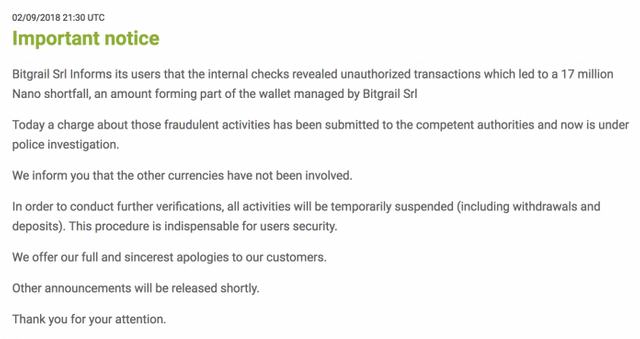

Bitgrail, previously just another minnow in a sea of competing exchanges, suddenly found itself in the custody of assets worth hundreds of millions of dollars. The temptation to take the money and run may have been too much for the site’s operator to take. It’s unclear at this stage exactly what happened. On January 28, the exchange tweeted: “XRB deposits and withdrawals currently suspended for internal system optimization. Thanks for understanding.” Then, on February 9, it posted the following notice:

Hack or Exit Scam?

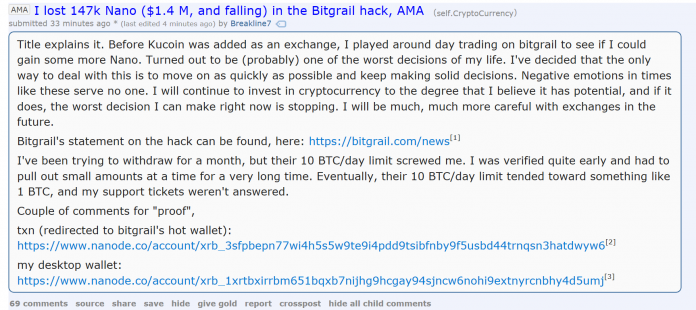

While many users are adamant that Bitgrail has exit scammed, Francesco maintains the site was hacked. It has been alleged that the stolen XRB has been gradually transferred from this Bitgrail wallet to Mercatox and getting dumped for months. There are also rumors that Bitgrail became insolvent following a withdrawal bug that was discovered by some users and then shared in Discord and other chat groups, causing the wallet balance to gradually diminish. One user explained: “There was a bug on Bitgrail where if you placed two orders you got double balance added to your account. You could then withdraw while the orders were up and steal the coins. You had negative balance in the end but you could just make a new account.”

In a statement published on February 9, the Nano team wrote: “We now have sufficient reason to believe that Firano has been misleading the Nano Core Team and the community regarding the solvency of the BitGrail exchange for a significant period of time.” Whatever the truth, Bitgrail users have zero chance of getting their crypto back.

It’s a suckerpunch for hodlers who’d had the acuity to buy raiblocks when it was dirt cheap and had then seen their little turned into a lot. By mid-December they should have taken their coins off Bitgrail and into a personal wallet, or at least to a more reputable exchange, but that’s easy to say in hindsight. The Nano team have sensibly refused Bitgrail’s entreaties to alter its code to isolate the stolen XRB.

Only a week ago, Binance added nano to its exchange. In the wake of the Bitgrail incident, Binance’s CEO tweeted “We are in contact with Nano team (re: Bitgrail) and will freeze deposits from identified addresses as we receive them. This is one reason we require coin CEO/founder to submit listing requests. Binance will assist where we can. We need to work together to protect users.” In monetary terms, the $170 million hack is less than half the previous record, set just a fortnight ago, when $400 million of NEM were stolen from Coincheck. But at 12.7% of the total supply, the XRB theft is bigger than NEM and bigger than the the 800,000 BTC that caused the collapse of Mt Gox.