There are many factors and characteristics to consider when choosing to use cryptocurrency exchange. Some beginners’ digital asset users and investors know nothing about how to start trading and buying virtual currency.

Therefore, for novices and experienced investors, it is very important to ask before continuing. Here are some key factors to consider when choosing a digital currency exchange:

- Location and restrictions

The population of most cryptocurrency exchanges is geographically narrow. Therefore, investors must ensure that they are easily accessible (and legal) from their home country before registering the cryptocurrency exchange. - Authenticity, security, anonymity and support

You should conduct thorough research to ensure that you choose a real, legal, secure and reliable platform.

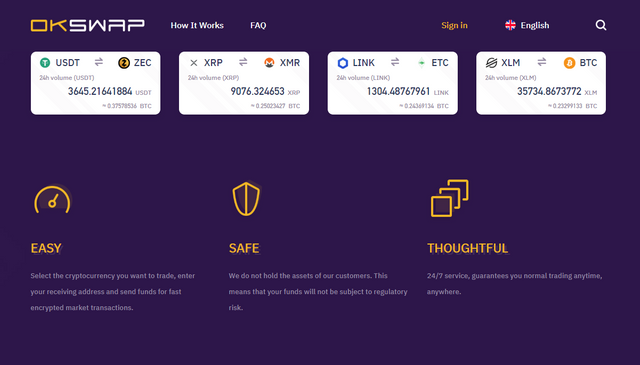

Example: OKSwap does not add extra fees, hidden fees or other ancillary fees. OKSwap only finds the best deal in one of the integrated exchanges, processes the trade, and then sends the exchange’s currency to your wallet. It is worth noting that there is no limit to the number of users that can be completed.

- Purchase method

There are several ways to use cryptocurrency exchanges when purchasing digital assets. Some platforms require deposits through bank transfers, while other platforms prefer credit and debit cards, PayPal, while other platforms use only cryptocurrencies for purchases and acquisitions.

So if you don’t have cryptocurrencies and want to join the market and industry, then it’s best to look for legal (traditional) currencies (such as US dollars, Euros, British pounds, Renminbi, etc. Always know how long it takes to complete the purchase — some Exchanges can execute trades immediately, while some trades take days or weeks. - Supported tokens

There is no doubt — 99% of the exchanges support Bitcoin (BTC) and Ethereum (ETH). However, different platforms support different digital assets, for example,OKSwap trades multiple digital currencies, such as DASH, ETC, LINK, LTC, etc., to see the currency you want to exchange and then trade. - Expense structure

Various exchanges have different transaction costs and fee structures, which are very important when choosing. Some platforms can reduce costs, but this happens when trading on the exchange’s own token. - User interface, user experience and customer support

The user interface and functionality are key features of a cryptocurrency investor, trader or first time purchaser. A spontaneous interface and a good user experience make user activity on the platform more effective and highly knowledgeable. However, different users will enjoy different interfaces because the user experience is subjective and skewed. In the future, any cryptocurrency exchange with a good user experience will certainly achieve a significant increase in transaction volume.

When choosing the standard for cryptocurrency exchanges, you should definitely consider security, commission size, number of pairs, and other indicators. I hope the above factors will help you.