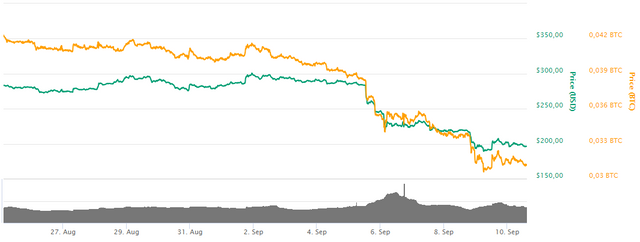

Ethereum is currently living through an unprecedented downward movement that resembles a freefall from the point of

the market chart. It happens not only in USD but also in BTC terms.

It no longer seems like a mundane rounding error or a market volatility - this gets a lot of traders whether the demand for the decentralized network has decreased or is nearing zero. Below is VHCEx analysts' view on what is actually going on and what tectonic forces drag ETH price down.

The market price of all commodities depends directly on the so-called reservation demand - the average duration of time during which an asset is held in holder's storage. For example, you have gold which is stashed in secure vaults for very long periods of time, that's because it is widely believed that it will have its high value over years and even decades. Therefore, the reservation demand is extremely high and it fosters its over-seven-trillion USD market capitalization.

The main advantage of Ethereum as both cryptocurrency and blockchain infrastructure is that it forms a decentralized economy built on the first actually Turing-complete global distributed ledger with the most game-changing feature being automatically executable smart-contracts. Cool for the reservation demand, huh? Not so much.

See, the most market-influencing smart-contracts built and executed on Ethereum blockchain are the ones used for ICOs. Those contracts reserve monetary supply in ETH to cover operational costs of ICO projects. This procedure increases the market demand during its first stage: raise of capital. However, it affects the ETH market ever more negatively during the second stage: ETH sold-out by ICO organizers.

There are two major reasons for that:

- first, ICOs tend to raise huge amounts of ETH - even a failed ICO that raises a couple of millions of Dollars, possess an extremely large amount of ETH compared even to the largest cryptoexchanges out there, and therefore, when organizers try to sell this Ether, it affects both traders who base their decisions on technical analysis and psychology and trading bots that see the enormous sell-orders and their algorythms react to that respectively by adjusting their trading behavior. The upshot: such massive sell-offs trigger a downward chain-reaction in the market.

- second, during bull dominance in the market, ICO organizers tend to hold it in expectation of rising value of their attracted funding, but in the bear-dominated market, they are eager to dump their ETH, and they tend to do it not by simply posting their ginormous sell-orders with extremely low chances of ever getting fulfilled, but rather by fulfilling buy-order going all the way down the order book. The upshot: the dip is significant.

Good post friend.Want to see more posts on future.Good luck @rdnblogs

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, @rdnblogs

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @vhcexexchange! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

WARNING - The message you received from @toyoko is a CONFIRMED SCAM!

DO NOT FOLLOW any instruction and DO NOT CLICK on any link in the comment!

For more information, read this post:

https://steemit.com/steemit/@arcange/phishing-attempts-use-images-as-comments

If you find my work to protect you and the community valuable, please consider to upvote this warning or to vote for my witness.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit