At times, trading can be difficult not only in terms of keeping afloat with your traded funds but also of psychology. The process can sometimes be all-consuming, but what most behavioral scientists say is that it should not. For instance, David G. Myers, the author of the best-seller "Psychology: Ninth Edition in Modules", says that there's actually one thing your equity curve boils down to in the long-run, and it is the psychological attitude and belief in oneself.

A large number of ordinary traders tend to soak up the information that is being poured on them from newsfeed and technical analysis. The sources range from books and seminars to crypto influencers and coaches. Even VHCEx Steemit blog for that matter.

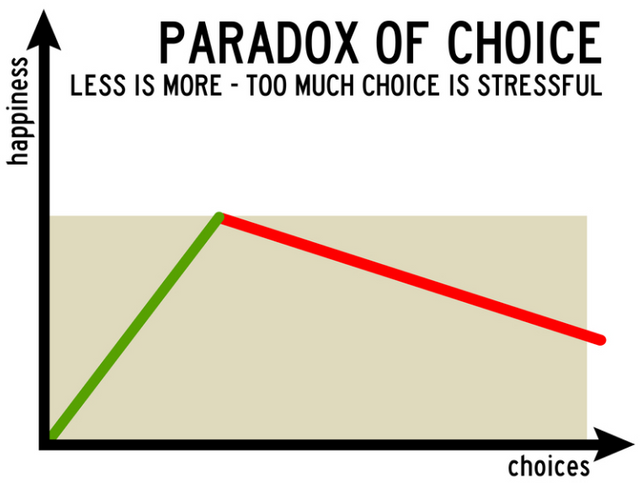

In any occupation, analysis of further actions is of paramount importance, but the truth is: not always do a lot of information equal quality of analysis. This is especially true for cryptocurrencies trading, given its tremendous volatility. When making decisions on investing in traditional stocks or indexes, there's naturally a vast field of information to analyze since economical and productional data of the underlying asset really matters. When it comes to crypto - not so much. Just remember the Ethereum Classic case. The fork (or, more precisely, the pre-fork) coin has no working team, plans or even commercial usage whatsoever. However, it didn't stop ETC from getting x50 in December 2017-January 2018. In crypto, the general market sentiment is usually what defines the trends for almost every particular coin.

So, don't go too deep into analysis of coins, as the time saved on what is set to turn out in vain, can be directed at more effective moves in the market.