One of the major VHCEx's stances is to remain a trader-friendly exchange. Apart from extending our fee-free trading promo till October 31st and rigorous work on our traders' requests that we receive at [email protected], we also aim at teaching the traders about basics of crypto trading in order for them to execute as deep-thought decisions as possible. Today we'll talk about depths and what they mean for a trader.

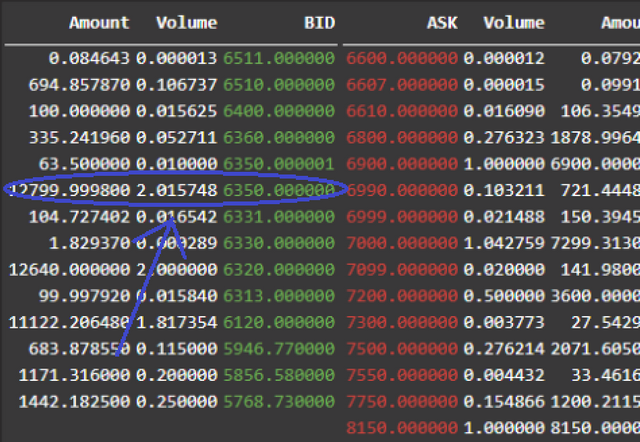

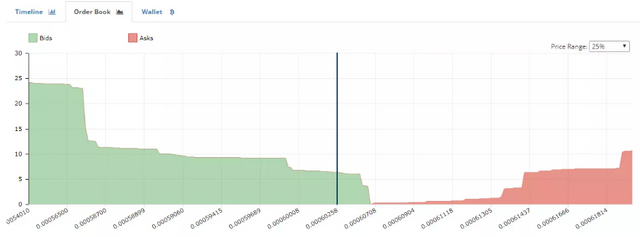

Market depth is basically a visual illustration of the order book. The order book is a list of all active buy and sell orders in a given trading pair. The orders are listed in price descending order among sell-orders and in price ascending order among buy-orders, so that a trader can see what the market sentiment is and what is the perfect price for him. We see in the example taken from VHCEx's BTC/USD trading pair that there's a steep dip in green part of the depth, meaning that there's a huge buy-order at some point down the order book.

And indeed, we see that there's actually a 2.01 BTC buy-order for the price of 6,350 USD. 2.01 is a lot in a given trading pair and that is why this order results in such a steep dip in market depth.

What it means for the trader?

The higher a given half of market depth is, the more demand for the asset there is in terms of monetary value. In other words, if a bearish trader enters the market, he'll need more of the asset to actually influence it. The other way around, if a large-holding bullish trader enters the market, he'll easily upsurge the price of the asset by executing small-value sell-orders placed in this pair.

Below is a good example of a buy wall - the one that indicates a healthy demand in the market. We see here, that the wall increases gradually, which is a good sign of the absence of fake walls in this pair.

If the wall drastically surges at some point, like in the example below, it might be a sign of the presence of a fake wall.

What is the fake wall and what it means for a trader?

If you are a day-trader, meaning that you open short-term positions mostly, it is crucial for you to understand that the exchanges are full of whales who are able to easily manipulate the market by putting their large stakes of capital to trading. They can set orders that are big enough to never actually get filled and to deter traders and trading bots from buying the asset.

If a fake wall is set, it is highly charged with a positive or negative sentiment that would lead an uninitiated trader to think that there's a confidence in the asset's future performance in the market. In fact, whales may simply remove their order outright any time they see fit.