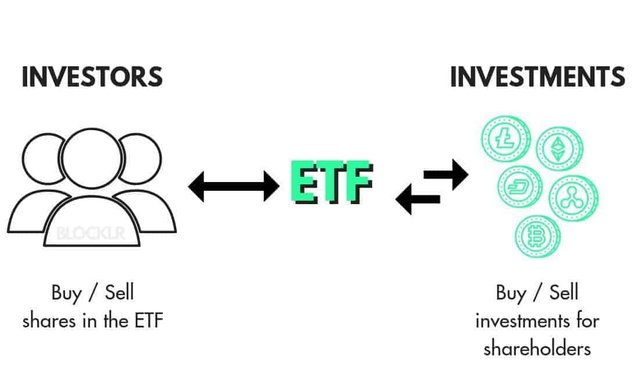

pooled investment security called an exchange-traded fund (ETF) functions very similarly to a mutual fund. ETFs often follow a certain sector, index, commodity, or other asset, but unlike mutual funds, they can be bought or sold on a stock exchange just like normal stocks can. Anything from the price of a single commodity to a sizable and varied group of securities can be tracked by an ETF. ETFs may even be designed to follow particular investment strategies.

Learning about Exchange-Traded Funds (ETFs)

Because it is exchanged on an exchange like stocks are, an ETF is also known as an exchange-traded fund. As shares of an ETF are purchased and sold on the market throughout the trading day, the price of the shares will fluctuate. Contrary to mutual funds, which only trade once daily after the markets close and are not traded on an exchange, this is the case. In comparison to mutual funds, ETFs are typically cheaper and more liquid.