View these diagrams.

Facebook 30 Jan 2018 Crypto Ad Ban declaration chart.jpgFacebook 8 May 2019 Ad Ban unwind announcement.jpg

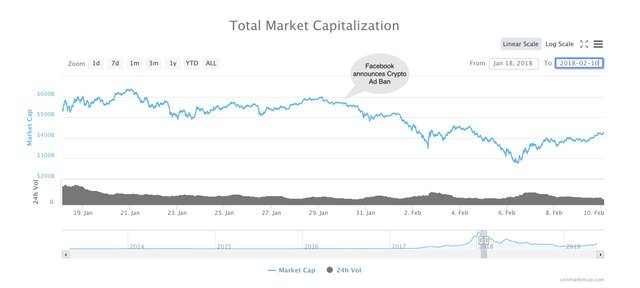

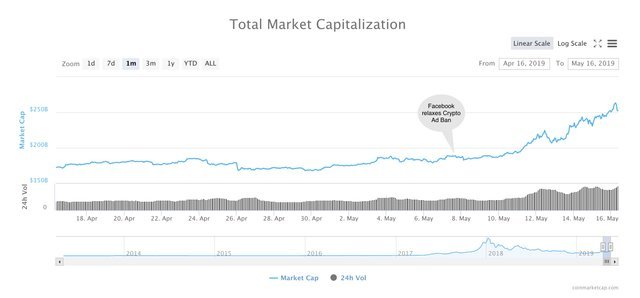

In the 7 days after Facebook reported a total restriction on all Crypto related promoting on 30 Jan 2018 crypto markets dropped by 53%.

In the 8 Days after Facebook declared a significant unwinding of this promotion boycott strategy on 8 May 2019 Crypto markets have ascended by 41%.

Effect of Ad Ban on ICOs.jpg

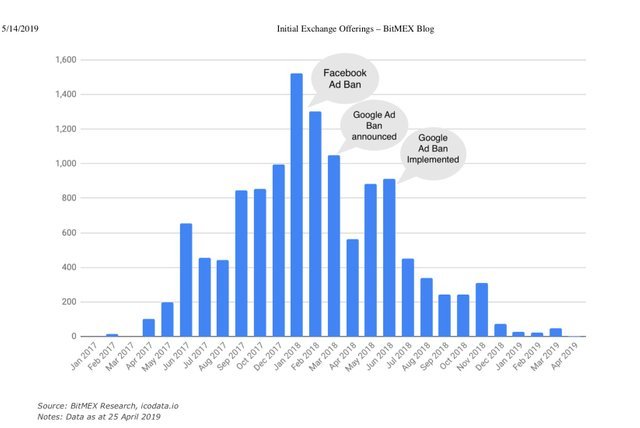

ICOs were ablaze when Facebook reported its Crypto promotion prohibition on 30 Jan 2018.

You can perceive how the sums raised dropped by right around 66% in the accompanying 3 months with Google's 15 March 2018 Ad boycott declaration turning the screws.

But since Google's execution of the boycott was postponed until June, there was some achievement of final desperate attempts of ICOs to raise utilizing Google adwords before Crypto ventures were closed out of it too in June 2018. After that the ICO showcase totally passed on as every single plausible strategy for promoting had been cut off.

Presently while these diagrams demonstrate a solid connection between's Facebook and Google's activities and the mid 2018 accident and current recuperation of the Crypto advertises just as the breakdown of the ICO showcase, the facts demonstrate that relationship is no causation.

Be that as it may, the causation contention is solid and straightforward.

Facebook and Google consolidated authority over 66% of the internet publicizing market. Facebook alone controls 84% of the online networking promoting market, which was the primary spot Crypto ventures publicized for clients and financial specialists before the boycott.

The whole reason for promoting is to invigorate request and the whole multi-trillion dollar publicizing industry is based on the way that publicizing does for sure drastically influence interest for an item.

Subsequently when Facebook prohibited Crypto advertisements it devastatingly affected interest for digital forms of money and the capacity of Crypto ventures to draw in new clients and financial specialists.

ICOs began bombing and after that evaporated.

The cost of any cash is resolved just by free market activity. Cut interest while keeping supply consistent and value drops. It is Economics 101!

Along these lines both observational proof of connection and monetary hypothesis of causation coordinate.

The legal claim against Facebook and Google which JPB Liberty is sorting out for the Crypto business depends on the solid lawful case that Facebook and Google's Crypto Ad Ban was unlawful under Australian law and the solid proof that the misfortunes brought about by this illicit activity include:

speculator misfortunes from the $300 Billion (Facebook) and $100 Billion (Google) drops in Crypto markets;

several billions in crypto venture misfortunes and disappointments from the breakdown of the ICO advertise;

many billions of misfortunes in cryptographic money trade incomes due to significantly bring down costs and volumes.